4 Gray Areas of Crypto Taxation in the US: How to Navigate Them?

Despite best efforts from the IRS, we still have many gray areas of crypto taxation in the US that demand more clarity. These include liquidity pool taxes, staking reward taxes, whether NFTs are treated as property or collectible, and if the wash sale rule applies to crypto.

Since March 2014, when the IRS issued its first notice on the tax treatment of cryptocurrencies, the regulations around crypto taxes in the US have made tremendous progress. But due to the complex nature of crypto and blockchain technology, along with constant innovations in the industry, the existing guidelines fail to address or fairly tax certain crypto activities.

In this guide, we will shed light on these and help you equip yourself with a better understanding of the underlying mechanism and best strategies to report your taxes.

The Basics of Crypto Taxes in the US

The IRS treats crypto as property for tax purposes. Furthermore, crypto taxes in the US can be categorized into – capital gains taxes and income taxes, depending on the nature of the transaction.

Capital Gains Taxes

Whenever you sell, spend, swap or dispose of your crypto and realize a capital gain (capital gain), you become liable to capital gains taxes.

Short-term capital gains (gains from selling within a year of purchase) range from 10-37%, while long-term capital gains (gains from selling after a year of purchase) range from 0-20%.

If you have losses from crypto, you can deduct them from your gains for the current or future years. And if you don’t have any gains to offset, you can use your crypto losses to reduce your taxable income by up to $3,000.

Income Taxes

If you receive crypto as income or salary, it is subjected to income tax rates, meaning any time you sell products, provide services, or complete tasks to earn crypto, you become liable for income taxes. This includes airdrops, hard forks, rewards from play-to-earn crypto games, mining, and staking (more on this later).

Income tax rates in the US range from 10% to 37%, depending on the income bracket an individual falls under.

Now that we know the basics. Let’s see how this tax framework, although impressive, fails to address the complexities and nuances of specific crypto activities, creating gray areas of crypto taxation in the US.

1. Liquidity Pool Taxes

Most decentralized exchanges (DEXs) rely on automated market makers and liquidity pools filled by liquidity providers to facilitate trades. When users trade on DEXs, they pay a transaction fee, which is then proportionally distributed to the liquidity providers.

This concept gave rise to activities such as yield farming and liquidity mining, where investors receive rewards for their contributions to these pools

In most platforms, investors receive tokens that represent their contributed funds. In theory, when you fill a liquidity pool, you still retain ownership of your underlying digital assets. But due to receiving tokens in exchange for your liquidity, the IRS may view it as a swap—a disposal event that triggers capital gain taxes.

When you decide to withdraw from the liquidity pool, the tokens you received are exchanged back for an equivalent amount of your invested capital, and those tokens are burned. Yet, the tax implications can vary depending on the platform mechanics, and this is where the waters become murky.

Some platforms increase the value of the token representing your investment as a reward. For example, when you contribute liquidity in Compound, a liquidity pool platform, you receive cTokens to represent your investment. And as you receive a portion of the transaction fees, the value of cTokens increases.

So, when you later sell or swap the tokens back for your underlying assets, you might be subject to capital gain taxes.

Conversely, other platforms provide rewards by issuing tokens at a 1:1 ratio to the underlying asset you invested. As you receive a portion of the transaction fees as rewards, you receive more tokens instead of seeing an increase in the token’s price. In this scenario, you may find yourself subject to income taxes.

As of now, the IRS lacks clear guidelines regarding how liquidity pools, investments and rewards are treated for tax purposes. However, some tax experts suggest that all rewards, whether represented as an increase in value or volume, will likely be subject to income taxes.

Navigating the gray areas of crypto taxation in the US, especially with liquidity pools, requires careful consideration and understanding of the different mechanisms employed by platforms. It’s best to consult a tax professional to avoid confusion.

2. Are NFTs Treated as Collectibles or Property?

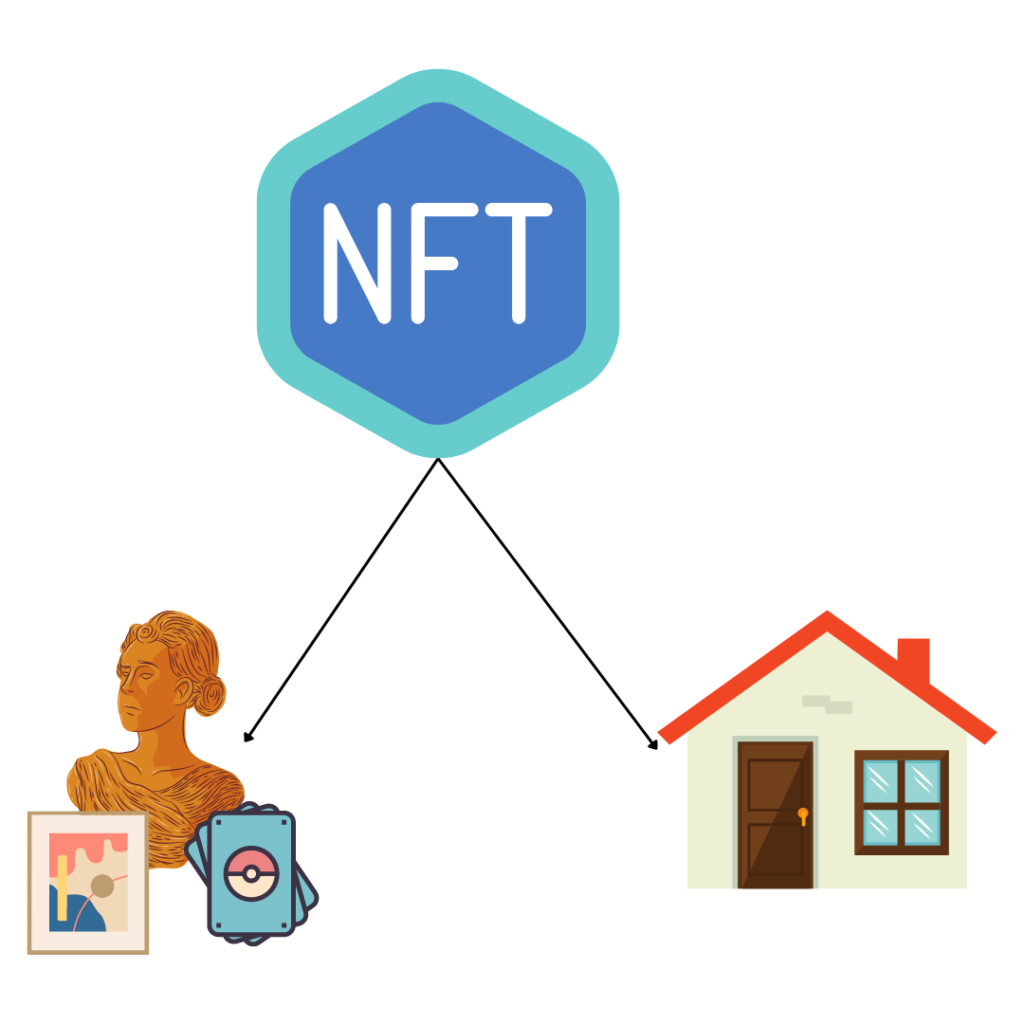

In the world of digital assets, non-fungible tokens (NFTs) have garnered significant attention, representing ownership or proof of authenticity for unique items or pieces of content, like artwork, music, or videos.

NFTs gained immense popularity, particularly in the art world, during the peak of 2020. They provided artists with a platform to sell their digital creations directly to buyers while maintaining control over their work. The market may be experiencing a temporary slump right now but the future of NFTs still holds great promise.

Now, coming back to taxes, according to the IRS, NFTs are classified as digital assets and are treated similarly to cryptocurrencies – as property. Therefore, the same tax laws that apply to cryptocurrencies also apply to NFTs.

Or not?

We also know that the IRS categorizes art, stamps, coins, cards, comics, rare items, and antiques as collectibles, subjecting them to slightly different taxes than property.

Some argue that certain NFTs can also be considered artwork and should be treated as such. This distinction is crucial because collectibles can be subject to higher tax rates, reaching up to 28%, whereas property is taxed at 0% to 20%.

Fortunately, the IRS recently released a notice addressing the tax treatment of specific NFTs as collectibles, bringing clarity to this gray area of crypto taxation in the US.

Here’s the gist of it:

NFTs encompass a broad range of digital assets, including art, videos, music concert tickets, and virtual land. While not all NFTs are collectibles, some collectibles can be NFTs. For instance, a virtual land in Decentraland may be classified as property, while NBA Top Shots NFT collections could potentially be categorized as collectibles.

3. Does the Wash Sale Rule Apply to Crypto?

The wash sale rule is an important regulation that prevents investors from selling an asset to generate artificial losses and immediately repurchasing it. The law states that if you repurchase the same assets within 30 days before or after selling them, you are not eligible to claim losses on them.

In the US, this rule specifically only applies to stocks and securities. This means you can sell your crypto assets at a loss, utilize those losses for tax purposes, and repurchase them instantly without penalty.

Although the government attempted to address this loophole through the Build Back Better bill in 2021, the proposed changes never came into effect. However, the government will most likely close this loophole in the near future. But until then, it’s technically legal.

While some tax experts advise to be conservative and avoid repurchasing the same asset within 30 days, whether it’s stocks, securities or even cryptocurrency, others suggest that you can take advantage of this loophole as long as you don’t misuse or overuse it.

However, we would suggest you consult a tax professional before considering utilizing this tax loophole.

4. Staking Rewards Taxes

Staking cryptocurrencies allows you to become a validator on a blockchain network, receiving newly minted coins as well as a portion of trading fees for validating transactions. This automated staking process can be a lucrative passive income source for crypto investors, where they can stake their crypto and forget about it.

Recently, Ethereum also transitioned from the traditional Proof-of-Work (PoW) consensus mechanism, which Bitcoin still operates on, to a more energy-efficient Proof-of-Stake (PoS) mechanism.

While there are no explicit guidelines for staking rewards taxes, we can draw parallels from the existing framework of crypto mining taxes.

Both mining and staking involve the receipt of rewards for validating blocks of transactions. Consequently, these rewards are considered taxable income under the premise of completing a task (validating transactions). Therefore, income tax rates apply to staking rewards.

However, in 2019, a US taxpayer couple, Josh and Jessica Jarrett, challenged the tax treatment of staking rewards, which later escalated into a lawsuit.

Their argument relied on an existing IRS framework for newly created property, which states that newly created property is only taxed upon its sale and not upon creation. Since staking rewards are newly minted coins, and the IRS treats crypto as property, the Jarretts argued that it should not be subject to taxation by their own standards.

Although the Jarretts eventually lost their lawsuit, the dismissal did not address the core argument regarding the fairness of taxing staking rewards. Instead, the case was dismissed on different grounds related to their specific context.

If you’re interested in finding out the reason and the complete timeline of the lawsuit, read this.

As taxpayers navigate the gray areas of crypto taxation in the US, it’s interesting to see whether the IRS provides further clarity on staking rewards taxes in the future.

Final Thoughts

Bringing more clarity to the gray areas of crypto taxation in the US requires concentrated efforts from industry participants, tax experts, and regulators to establish precise definitions that adapt to technological advancements and, at the same time, align with the existing tax framework while clarifying reporting obligations.

That is a lot. We know. But striking the right balance between innovation and regulatory oversight is essential to foster the growth and development of the crypto industry in the United States.