10 Best Liquidity Pools

In the last few years, DeFi has become a trending phenomenon in the crypto space, and if you know anything about DeFi, you’d know that liquidity pools are an integral part of it. Hence, increasingly more people are searching for the best liquidity pools today.

On the surface, most of you would probably know how liquidity pools work. You add liquidity to a DeFi platform and, in return, receive a share of its trading fees. But there’s more to it.

Here are the 8 best liquidity pools of 2022 –

Before we jump into the specifics of each, let’s quickly go over the basics of liquidity pools.

What are Liquidity Pools?

Liquidity has always been one of the weaknesses of DEX platforms and strengths for CEX platforms, along with other differences.

But with the introduction of liquidity pools and AMM (Automated Market Makers), everything suddenly changed. Trading crypto on DEX was only possible in theory, but now, it’s actually possible, and people are doing it.

Liquidity pools are just a collection of crypto funds and assets locked in a smart contract.

A pool usually consists of a pair of tokens, generally ERC-20 tokens. So, if a liquidity pool has Token-A and Token-B, you can only trade between the two. No third token. But most platforms have a pool for all the possible pairs. Plus, you can always create one.

AMM is probably the most common use case for liquidity pools, but it’s not limited to that only.

Liquidity pools play a crucial role in yield farming, DAOs, synthetic assets, blockchain gaming, on-chain insurance, etc.

It eliminates the need for any third-party entity to control the market and liquidity, making it easier and more accessible for anyone to contribute liquidity to crypto exchanges while earning additional income.

As the technology grew, more and more new liquidity pools started popping out every day. Of course, not all of them are great, but some are, which brings us to the following list of the best liquidity pools in the market right, starting with…

1. UniSwap

Launched in 2018, Uniswap is the platform that initially popularized the idea of liquidity pools and has been one of the best liquidity pools ever since.

It’s an ERC-20 token decentralized exchange. Since it’s a decentralized platform, anyone can open a new exchange pair in a new liquidity pool with ERC-20 Tokens for no cost.

Uniswap has an easy-to-learn, user-friendly interface. Even a beginner can grasp how it all works in a matter of minutes.

The only downside – high gas fees.

Also, Uniswap doesn’t require you to register a new account or provide KYC to swap on their platform. This might appeal to people who look for anonymous crypto exchanges.

2. Kyber Network

Kyber Network is a decentralized platform that provides liquidity for many different Dapps. As a result, users can trade or swap between many different pairs of coins.

So, one way to earn is by adding liquidity to the third-party Dapps. Another way is by buying its native token, KNC. Buying this token will allow you to take governance decisions for the platform while earning rewards.

And that’s why Kyber Network is one of the best liquidity pools.

3. DiversiFi

Founded in 2017, DiversiFi offers 13 trading pairs. Its new upgrade DiversiFi 2.0, is built on 2-layer scaling technology by StarkWare, allowing high-speed transactions of up to 9000 transactions per minute.

Also, due to its high-speed transactions, the transaction fees on this platform are very cheap, almost free. However, this could mean fewer rewards for people adding liquidity.

Much like Uniswap, DiversiFi also doesn’t require you to sign up to trade crypto or add liquidity.

On the other hand, it also has its downside, like the complex user interface and fewer trading pairs.

4. PancakeSwap

PancakeSwap runs on the Binance Smart Chain. So, users can swap BEP-20 tokens. Other than the name, PancakeSwap has many more similarities to Uniswap.

Returns on liquidity pools and farms are very high. But there’s always the risk of impermanent losses.

PancakeSwap is more popular and has more daily transactions than Uniswap, but before you think it’s a good sign, know that it’s also why its network is congested most of the time.

Other than that, the platform offers competitive fees and has many other features and options to explore. It’s easily one of the best liquidity pools.

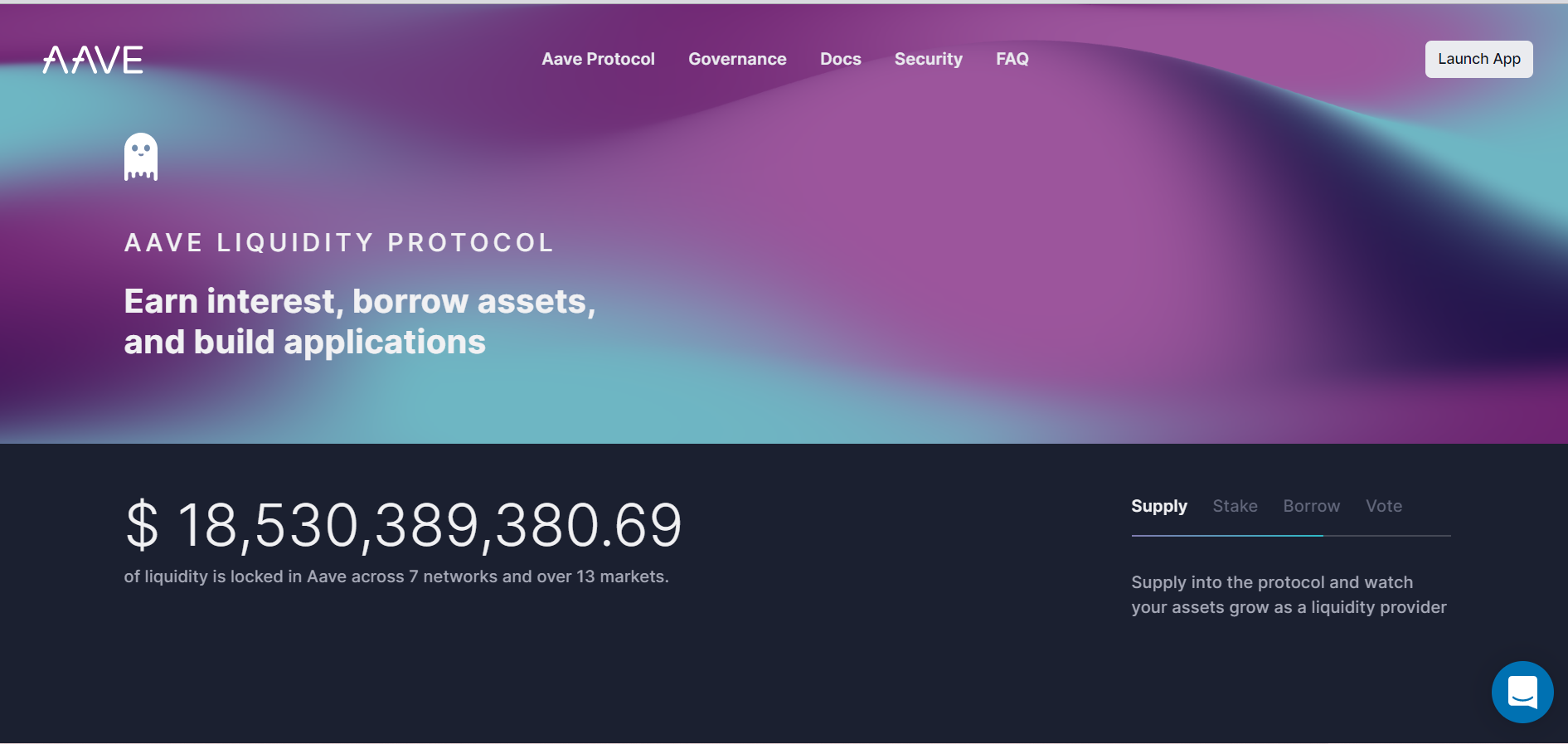

5. Aave

Aave is primarily an open-source, decentralized lending protocol with a huge liquidity pool.

It offers something called flash loans that allows users to borrow quick but small amounts of loans instantly without any collateral. This exposes the platform to hackers and scammers who have exploited this feature in the past.

Aave lacks in some key areas, like a relatively poor user interface and not enough incentive for people to add funds into their lending pools.

But overall, it has one of the best liquidity pools when it comes to crypto lending platforms.

6. ICTE

ICTE is a unique entry in this list of best liquidity pools. It’s the only inter-exchange platform that allows trading across different exchanges and blockchains.

All the exchanges on this platform are completely independent of each other, but at the same time, they are a part of the global ICTE Alpha server architecture.

The idea is to reduce latency and increase speed and liquidity for all its users.

7. OIN Finance

OIN Finance is a relatively new and pretty secretive decentralized platform. We don’t know much about its future plans and upgrades, but it claims it has a lot to offer, including services and products like OINwap, wallet, Lend, Stablecoin, and DAO.

As for liquidity pools, OIN Finance works a little differently. Instead of the traditional way of receiving rewards for adding liquidity, you receive rewards for holding its utility tokens as per the guidelines of its smart contract.

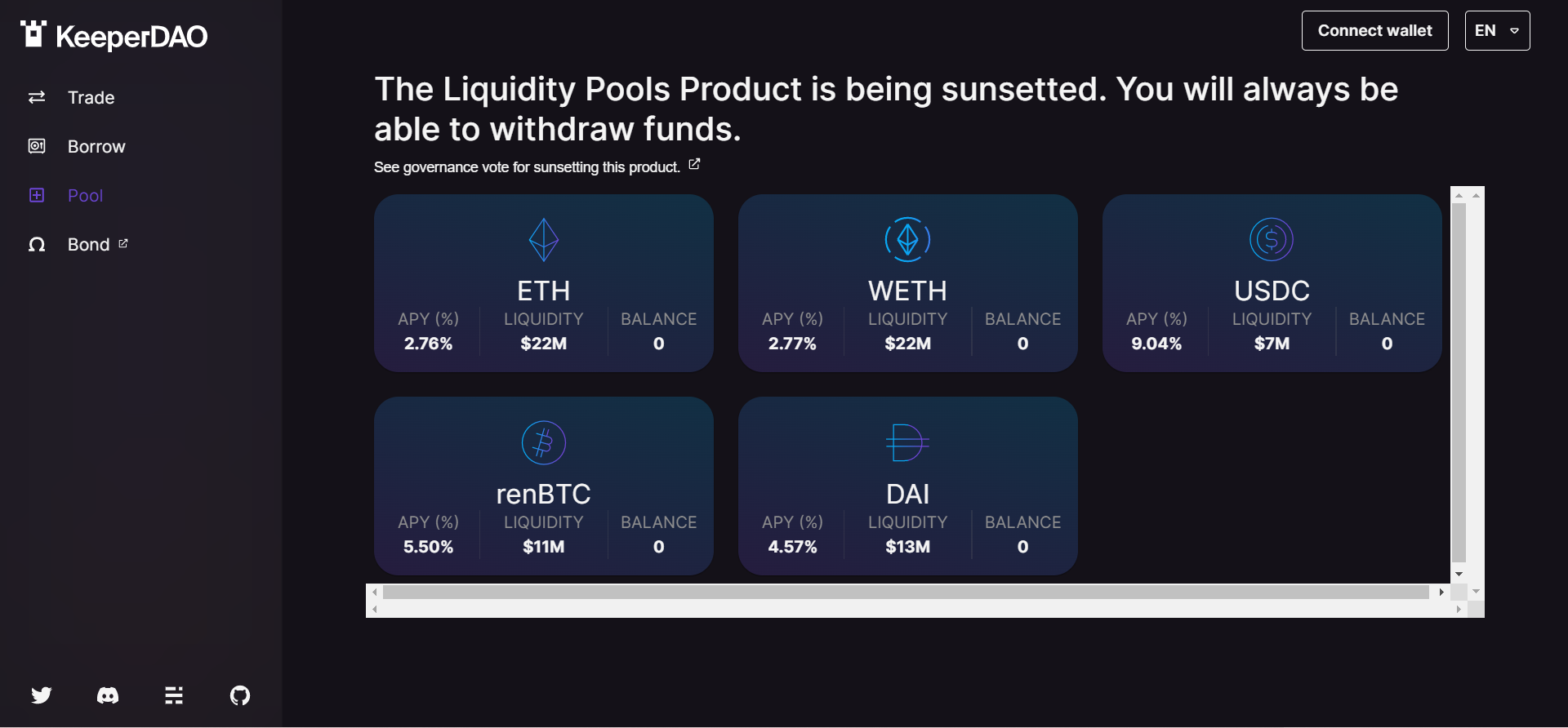

8. KeeperDAO

Fundamentally, KeeperDAO is an on-chain liquidity underwriter. Unlike other liquidity pools, this platform incentivizes its participants or “keepers” to manage liquidations, trading, lending and other operations.

KeeperDAO is probably the least popular platform in this list, but it has a very unique and promising underlying mechanism.

The platform itself is pretty easy to use, but understanding how it works and what it’s all about may take you some time.

Final Thoughts

Before you choose to put your crypto on any of these platforms, you should ask yourself – what kind of liquidity pool do you want to get involved with?

Different liquidity pools have different applications. While some provide you governance power over the network, others allow you to add liquidity for trading pairs.

Also, make sure you do your research before getting into it, and that includes learning about the tax consequences of earning from liquidity pools.