Crypto Taxable Events

Recently, the IRS has been coming after everyone in the crypto space who are avoiding taxes. To make sure you aren’t one of them, you must accurately report all your taxes on crypto to the IRS. But the crypto taxation isn’t as simple as it looks. What are the tax rates on selling crypto? Is Bitcoin taxable? What about crypto-to-crypto trade? How do we know what’s a crypto taxable event? In this article, we’ll answer all of this and discuss how various taxable crypto events work and things you need to look out for.

Selling Crypto for Fiat Currency

Before we start talking about the various crypto taxable events, first, we must understand the foundation of it all, and it begins with understanding how the IRS views crypto. As per IRS guidelines, crypto is treated as “property.” Therefore, selling crypto for fiat currency is considered disposing of a capital asset. Hence, tax rates for crypto are the same as tax rates for capital gains/losses.

There are two factors that influence the capital gains tax rate – Income and Holding period.

If the holding period of your asset (crypto) is less than 365 days, you’ll have to pay the short-term capital gain tax rate, which ranges between 10%-37%, based on income level. On the other hand, if the holding period is more than 365 days, you’ll pay a long-term capital gain tax rate, ranging between 0-20%.

How to Calculate Capital Gains/Losses

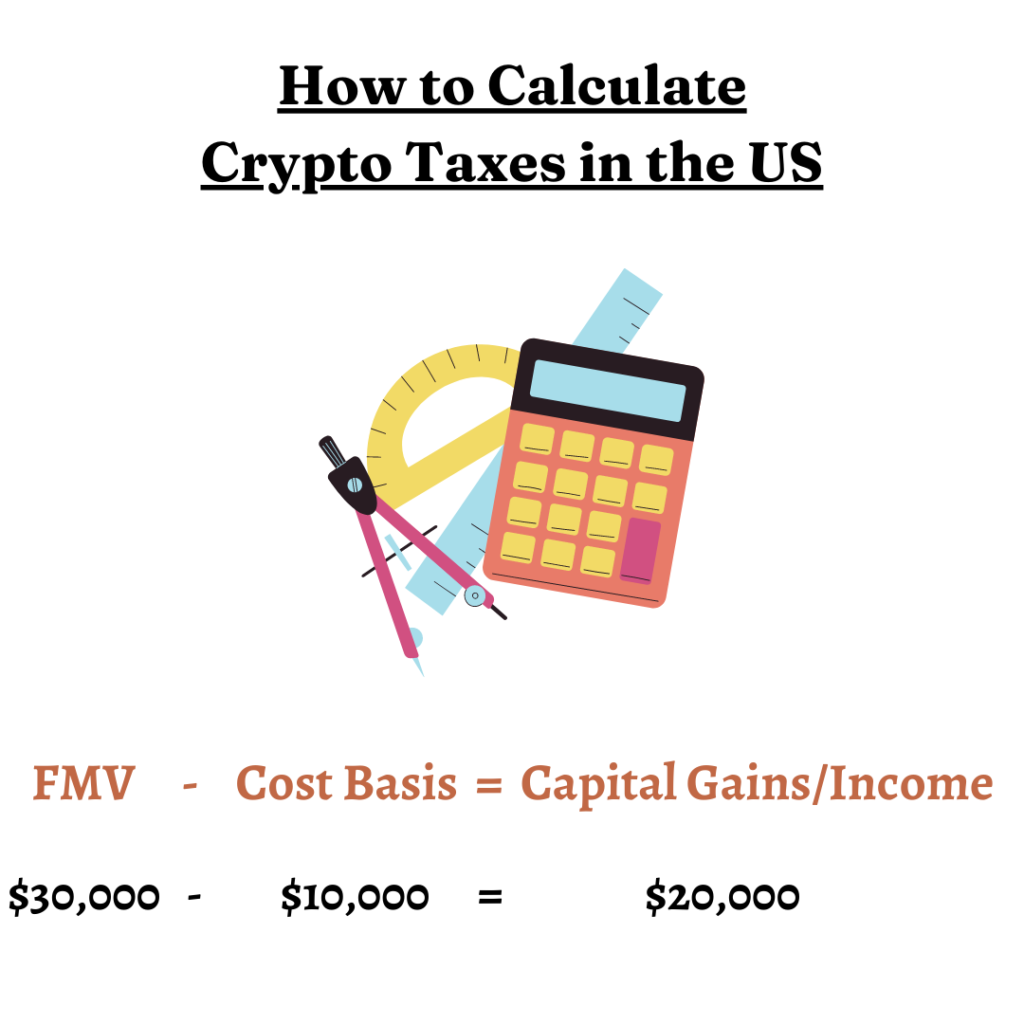

The simple formula for calculating your capital gains and losses is this –

Cost Basis – Fair Market Value (FMV) of the Coin = Capital Gain/Loss

Cost basis refers to the amount you paid for incurring a coin, and the fair market value represents the price you sold that coin for or the price it would generally sell in the market at that point in time. Subtracting the cost basis from the fair market value will give you your capital gain/loss.

Consider the following scenarios to understand the entire concept better.

Scenario 1

You buy 1 BTC for $1000 in January 2015 – You sell it for $5000 in September 2021

Is that 1 Bitcoin taxable now?

Yes, in this scenario, you will realize a long-term capital gain of $4000 since the holding period was more than 365 days.

Scenario 2

You buy 1 BTC for $5000 in February 2021 – You sell it for $5500 in September 2021

In this scenario, you will realize a short-term capital gain of $500 since the holding period was more than 365 days.

There are many more variations to this, which we will explore more in this article. But this was the foundation of crypto taxation that you must understand to grasp the concept of the rest of the taxable events.

However, if you’re someone who finds the entire process of going through transactions, calculating taxes, and getting all the required data to report them to the IRS a headache, then consider using Bitcoin.Tax. Just upload or add all the transactions directly from the exchanges and wallets you use, along with any crypto you might already own and Bitcoin.Tax will take care of the rest. It will calculate your capital gains and produce the required data and forms you need to file your taxes.

Crypto as Gifts

Receiving crypto as gifts doesn’t make any significant difference to how the IRS views them. It’s still a crypto taxable event, and the same capital gains tax rate will apply to gifts as well, but only if the gift passes the $15,000 threshold, in which case, the receiver will inherit the cost basis of the coin. However, gifts under the $15,000 threshold are free from taxes in the US. Laws in other countries may vary.

Trading One Cryptocurrency for Another

Some people get confused about whether trading one cryptocurrency for another is a crypto taxable event or not since you’re not selling your crypto for fiat currency. However, that’s not the case. As per IRS guidelines, when trading one crypto for another, you’re technically disposing of your cryptocurrency and buying another one. In this case, the fair market value of the crypto you dispose of would be the cost basis for the crypto you traded it for. Confusing? Let’s see an example to understand it better, and for the sake of simplicity, we won’t involve the holding periods for these cryptos.

You buy 1 BTC for $1000 – You then trade it for 5 ETH, and at the time of trading, the FMV of 1 BTC is $2000 – You realize a capital gain of $1000

In this scenario, you’ll be actually disposing of the 1 BTC to buy 5 ETH, and since the FMV of 1 BTC at the time of disposing of is more than the cost basis, you’ll realize a capital gain. At the same time, the FMV of the 1 BTC will now be considered the cost basis of the 5 ETH.

However, this was not always the case. Prior to 2018, trading one crypto for another wasn’t a taxable event since the tax laws at that time weren’t clear for these kinds of transactions. So, if you’re still filing your taxes from 2017 and before, you don’t need to report crypto-to-crypto trades.

Buying Products/Services with Crypto

Buying something or paying someone with crypto is becoming more and more common these days. However, very few people know the tax consequences of paying with crypto. To explain how buying something could be a crypto taxable event, let’s look at some examples.

Suppose you bought 0.5 BTC for $500. You then use it to buy a new pair of headphones worth $800. Now, by applying the usual capital gains logic, you’ve realized a capital gain of $300.

However, what happens when you don’t know the worth of a product or service. Let’s look at another example.

Suppose you bought 0.5 BTC for $500. You then hire someone to drive your car who charges 0.5 BTC for his services. In this scenario, if the FMV of the 0.5 BTC is more than its cost basis, let’s say $600, you’ll once again realize a capital gain of $100.

Buying NFTs

Despite no apparent guidelines from the IRS, most people consider NFTs as collectibles, and collectibles are subject to capital gain tax rates. Therefore, buying NFTs is almost the same as trading one crypto for another.

More on NFT taxes.

Getting Paid with Crypto

Taxes on getting paid with crypto are pretty simple and straightforward. You pay ordinary income tax rates on the equivalent amount of money that the crypto you receive as payment is worth.

For example, say your wage is $2000 per month, and instead of getting the pay in your fiat currency, you receive the equivalent worth of crypto. In that case, you would still be taxed for only $2000 under ordinary income tax rates.

Similarly, if your wage is 50 BTC per month, then you’ll have to pay the income tax rates on the FMV of the 50 BTC at that time. That’s why you must keep detailed records of all this information.

There are some other similar scenarios where the same logic applies, such as –

Mining

Miners earn rewards for completing their tasks in crypto. That’s why miners must pay ordinary income tax rates and self-employment tax rates on their earnings. And since you’ll be filing self-employment taxes as well, you’re allowed to deduct business expenses such as equipment costs and electricity costs. We talk about mining and its tax consequences in-depth in this article.

Further, selling the earned cryptocurrency will trigger another taxable event – capital gains taxes.

Creating & Selling NFTs

NFT artists and creators who create and sell NFT artwork will also have to pay ordinary income tax rates on their earnings. Similar to mining, NFT artists can also deduct business expenses.

Further, selling the earned cryptocurrency will trigger another taxable event – capital gains taxes.

Staking

Although staking may seem different from mining and selling NFTs on the surface, the tax implications are pretty much the same. Interests earned from staking your coins will be treated as your ordinary income. Therefore, ordinary income tax rates also apply to staking.

Further, selling the earned cryptocurrency will trigger another taxable event – capital gains taxes.

More on staking and its tax consequences.

Liquidity Pools

Similar to staking, interest earned from liquidity pools is also subject to ordinary income tax rates, and further, selling the earned cryptocurrency will trigger another taxable event – capital gains taxes.

On a side note, though, putting your crypto in liquidity pools may or may not be a crypto taxable event, as some platforms provide a different token in exchange for the original one. In that case, it could be viewed as disposing of your assets (crypto), hence a taxable event.

However, it’s not always the case, as some platforms work differently. The lack of clear guidelines from the IRS on DeFi only adds to the confusion. That’s why it’s best to consult your tax professional before getting involved.

Non-Taxable Events

Now that we have talked about all the possible crypto taxable events. Let’s talk about transactions that may seem taxable on the surface but actually aren’t. These are either exceptions or loopholes in the system that allow people to avoid taxes.

Taxes on Crypto Loans & Collaterals

Generally speaking, taking loans is not a taxable event in itself. What’s even more important and confusing for some people is collateral. When using your crypto as collateral against a loan, you aren’t actually disposing of your coins. Therefore, there are no tax implications for it.

There are exceptions, though, such as paying back the interest, which is a taxable event, or if you don’t pay back the loan, the platform may dispose of your collateralized asset (crypto), which is again a taxable event. However, mostly taking loans and using your cryptocurrencies as collateral are not taxable.

More on crypto loans.

Cryptocurrency Swaps

The IRS has not provided any specific guidelines regarding crypto swaps. However, based on existing guidelines, it’s safe to assume that crypto swaps are not a taxable event. Though, it’s important to keep a record of the cost basis of the previous crypto to calculate the cost basis of the new one because that’s essential to calculate the capital gain/loss when you sell it in the future.

For example, suppose you’ve bought 5 VEN for $500 (500/5= $100 per VEN), but after the swap, you get 50 VET in exchange for 5 VEN (10 VETS = 1 VEN). So, based on the cost basis of VEN, we can calculate the cost basis of 1 VET, which would be $10 (Cost basis of VEN – $100/10 VETS = $10). Some people may find this very complicated, and that’s why there are crypto tax calculator tools out there that you can use to simplify all of this, like Bitcoin.Tax.

What if your Crypto Gets Lost or Stolen?

Recovering losses on lost or stolen crypto is not the most straightforward task. But it can significantly help your case if you possess detailed info and records of all your transactions, dates, amounts, when and how the assets got stolen or lost, etc.

You can check out the 26 U.S. Code § 165 – Losses for more information on if you can recover your losses and how. Nonetheless, you should always keep detailed records of all the important data and transactions, which brings us to the last segment of this article.

The Importance of Keeping Records

Not only is it essential to keep records for calculating your taxes and providing evidence for them, but keeping detailed records can tremendously make the process of reporting your taxes easier and faster. If you don’t want a headache while filing your taxes, you might want to consider keeping records of all the taxable events that occurred while doing crypto-related transactions.

Conclusion

Cryptocurrency is a relatively new concept, and crypto-taxation is an even newer concept. That’s why it might take some time before people get used to the tax laws and all the confusion surrounding the crypto space. Until then, it’s always a good idea to consult a tax professional when in doubt.