Crypto Loan Taxes in 2022 – A Sneaky Tax Saving Strategy?

As you’ll find out in this article, crypto loan taxes are fairly simple.

When we talk about crypto loans, it means – borrowing fiat currency using your crypto assets as collateral.

Pretty similar to how traditional loans work, right?

Yes, but there are a few key differences, especially the tax implications.

In this guide, we’ll find out all about crypto loans, how it works, how people use them to avoid short-term capital gains taxes and the only few instances when it’s taxable.

How Do Crypto Loans Work?

Today, many DeFi platforms allow you to earn passive income by lending your crypto assets.

Similarly, you can also borrow loans using your crypto assets as collateral. This is what we refer to as crypto loans.

You take a loan, keep your crypto as collateral. You pay back the loan and get your crypto back.

Pretty simple, isn’t it?

However, if you default on your loan, the lender, which in this case would be the platform, can and probably will liquidate or sell your crypto assets to get their money back.

In a similar scenario, if the collateralized crypto drops in value, the platform may liquidate some amount of it to maintain the required loan-to-value ratio (LTV).

Different platforms have different limits set after which they’ll liquidate your crypto assets.

Keep these in mind for when we discuss their tax consequences.

What are Self-Repaying Crypto Loans and How Do They Work?

Some platforms take your collateralized crypto and deposit them in yield generation schemes. These are called self-repaying crypto loans.

How do they work?

Over time, your collateralized crypto will generate income and repay the loan amount on its own.

Alchemix is an example of one such platform that provides self-repaying loans.

Where to Get Crypto Loans?

These are some platforms, both centralized and decentralized, to get crypto loans from –

Crypto Loans – A Tax Saving Strategy?

Let’s talk about the use of crypto loans.

As we said before, crypto loan taxes are pretty simple. They are generally non-taxable, except for a few unique scenarios. That’s why, unlike traditional loans, many people use crypto loans as a way to avoid short-term capital gains taxes.

Consider this –

You bought 5 BTC for $5000 last month, which appreciated in value by $1000.

Now, for some reason, you need the cash.

You have two options:

a) Sell those 5 BTC, get your $6000 and incur short-term capital gain taxes.

b) Take a loan for $6000, using your 5 BTC as collateral and avoid paying short-term capital gain taxes.

Many people prefer to hold on to their crypto for more than 12 months because long-term capital gain tax rates are cheaper than short-term capital gain tax rates.

Therefore, crypto loans are a great way to spend your crypto’s value without actually triggering any taxable event.

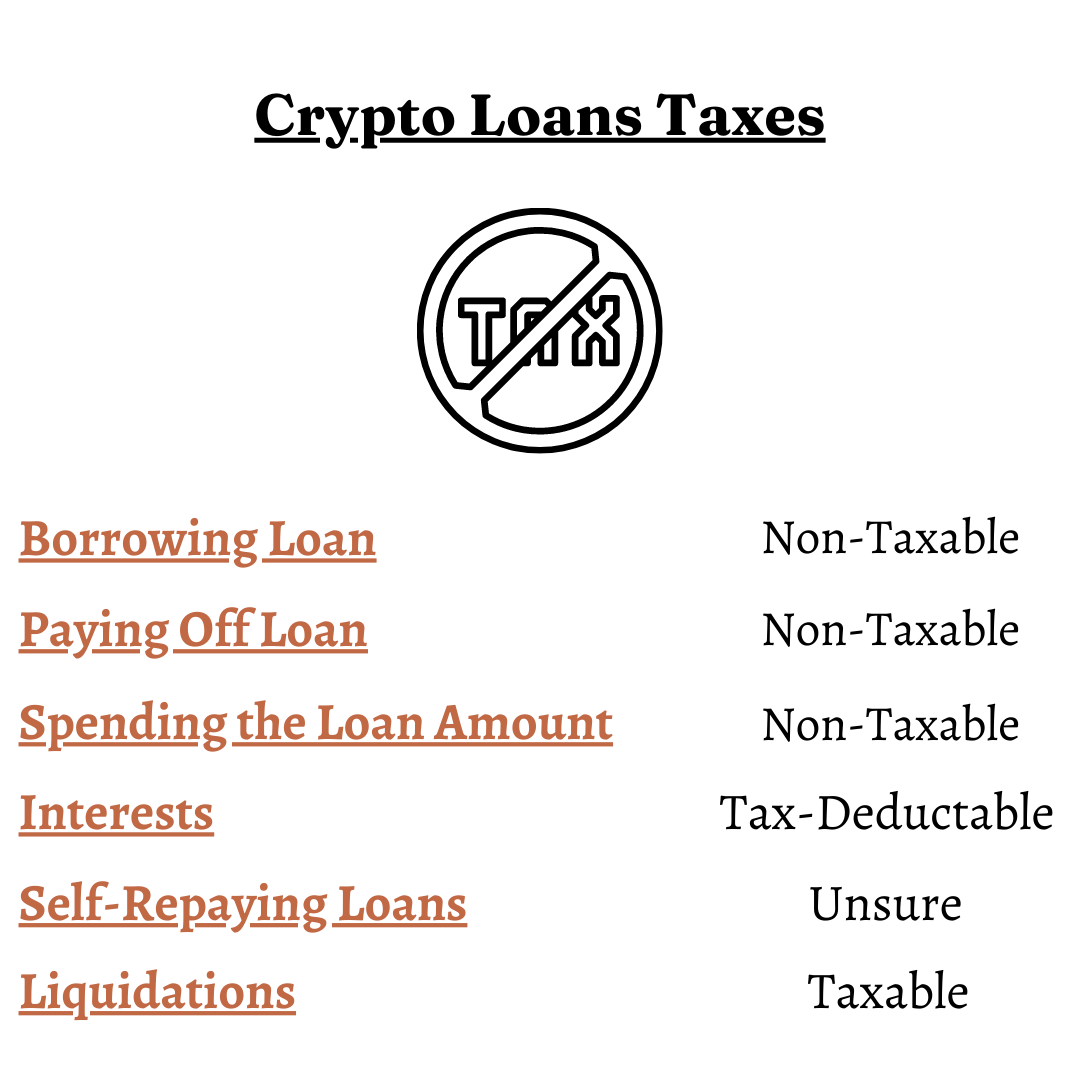

Crypto Loan Taxes

Now, let’s talk about the different tax consequences of crypto loans.

Are Crypto Loans Taxable?

No, taking loans using your crypto as collateral isn’t taxable.

As covered in our crypto tax guide, disposing of your crypto triggers a taxable event.

However, in the case of crypto loans, you’re not actually disposing of your crypto. You’re only collateralizing it. So, it doesn’t trigger a taxable event. Hence, there are crypto loan taxes on borrowing a loan.

Crypto Loan Taxes on Paying Off the Loan

The same logic applies when paying off your crypto loan.

In other words, no, repaying your crypto loan isn’t taxable.

Crypto Loan Taxes on Spending the Loan Amount

Unless you’re borrowing crypto for crypto, you won’t get taxed on spending your loan amount.

Only if you borrow another cryptocurrency, say Ethereum, will you get taxed on spending the loan amount.

Crypto Loan Taxes on Interests

The only time interests on crypto loans are tax-deductible is when you take the loan for business purposes. Interests on any loan taken for personal use and expenses will not be tax-deductible.

Crypto Loan Taxes on Self-Repaying Loans

Though guidelines on this are not very clear, our best guess is that it’ll trigger income tax liability under debt cancellation income.

Crypto Loan Taxes on Liquidations

This is the only time you have to pay crypto loan tax. It’s when the platform liquidates your collateralized crypto assets.

As discussed before, it can happen for one of two reasons –

a) You are defaulting on your crypto loans.

b) The value of your collateralized crypto drops below a certain threshold set by the platform.

In both scenarios, you’ll trigger an unwanted taxable event. Not only will you lose your collateralized crypto, but you’ll also have to pay taxes for it.

Final Thoughts

Overall, crypto loans are a pretty good way to use your crypto’s value without disposing of your crypto or incurring short-term gains.