What are Airdrops & How are They Taxed?

There are more than 7000 cryptocurrencies as of 2022. Just in the last 24 hours, CoinMarketCap has listed nine new cryptocurrencies. This tells us how hard it is for new cryptocurrencies to make a place in the market, already dominated by established coins like Bitcoin and Ethereum. Forget standing out. These cryptocurrencies are fighting just to get noticed. And that’s where Airdrops come in.

Airdrops are a great way for new blockchain-based start-ups and cryptocurrencies to get noticed. In simple words, Airdrops are free money for investors and early adopters. However, just because it’s free money, doesn’t mean that it’s tax-free. Though in some countries, it is, in most countries, it isn’t.

In this article, we will find out what exactly airdrops are, how they work, their pros and cons, and most importantly, how they are taxed.

What are Airdrops?

An airdrop occurs when a crypto project distributes newly minted coins or tokens to its users free of charge. As we said before, it’s basically free money. Airdrops and their uses vary a lot depending on the project and its goals.

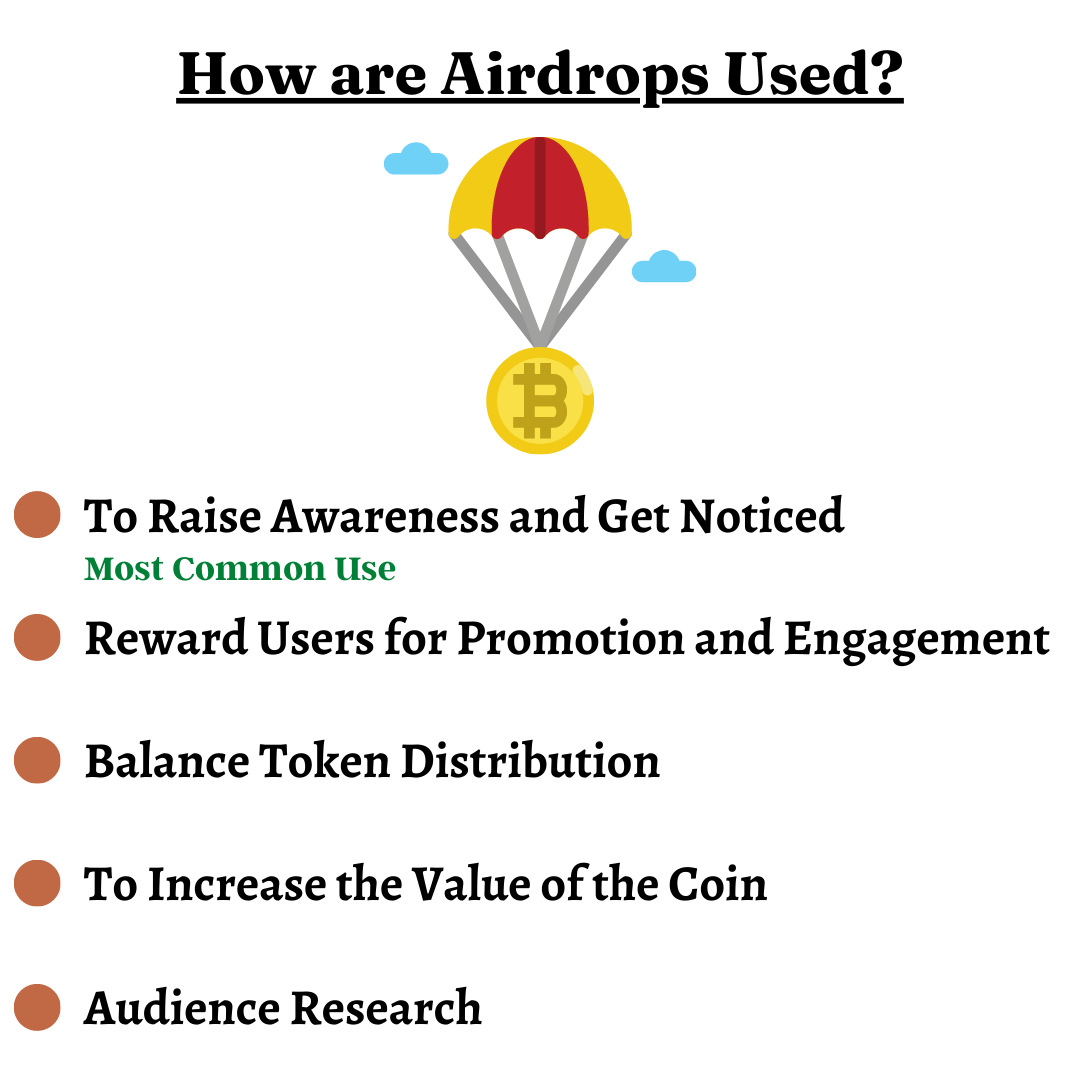

These are some common ways new crypto projects and startups use airdrops –

To Raise Awareness and Get Noticed

Airdrops are a great way to get people’s attention to a new cryptocurrency in the market. It also encourages early adopters and investors by rewarding them with free coins. Announcements for these airdrops are usually made on the official website of the coin itself or third-party sources of airdrop trackers.

Reward Users for Promotion and Engagement

Sometimes, people receive airdrops as a reward for completing a task. These tasks include sharing a social media post about the coin, signing up for a newsletter, completing a transaction or joining a forum, and participating in discussions. These are some ways startups encourage people to promote their coins and engage with their community, which builds an even larger audience.

Balance Token Distribution

One of the major criticisms Dogecoin faced when it was at its peak was that only a handful of people owned 93% of all the coins. That’s a problem we see time and time again in new coins and tokens. Airdrops are one way to neutralize and balance token distribution so that a small group of people doesn’t control the entire market.

To Increase the Value of the Coin

By giving away free coins to investors and early adopters, these startups encourage people to use their coins for different transactions and trading purposes, which increases the coin’s value. And the more the value of the cryptocurrency increases, the more people will start using it, creating a ripple effect.

Audience Research

Some airdrops require you to fill out some personal information cum survey. It allows these startups to gather data that helps them better understand their target audience and create better marketing and advertising campaigns tailored to their target audience.

Uniswap – An Example of A Successful Airdrop

You may already know this, but it’s worth mentioning a successful airdrop story where everyone profited. The company profited because their coin increased in value, and the users profited because they made a lot of free money without any capital. And that is what Airdrops are supposed to be – a win-win situation for everyone involved.

Uniswap, one of the top decentralized exchanges, launched its native token, UNI, in 2020. They announced an airdrop of 400 units of UNI to all wallets of Uniswap users that had performed at least one transaction before Sept 1, 2020.

Out of the many people that received the airdrop, most quickly dumped them for $2-$3. But the few of those who held on to it were in for a treat. The value of UNI tokens increased from $2 to $30 by April 2021. That is $12,000 free money for everyone that held on to their coins.

Pros and Cons of Airdrops

On the surface, it may seem like there’s no downside to airdrops. The best-case scenario – you get free tokens that may increase in value overnight, making you filthy rich. In the worst-case scenario – you get some free tokens. Doesn’t seem too bad. Right?

Only that that is not really the worst-case scenario. The real worst-case scenario is that you can get scammed and get all your cryptocurrencies stolen.

However, a little bit of caution and research before diving nose-first into an airdrop can easily protect you from all kinds of scams.

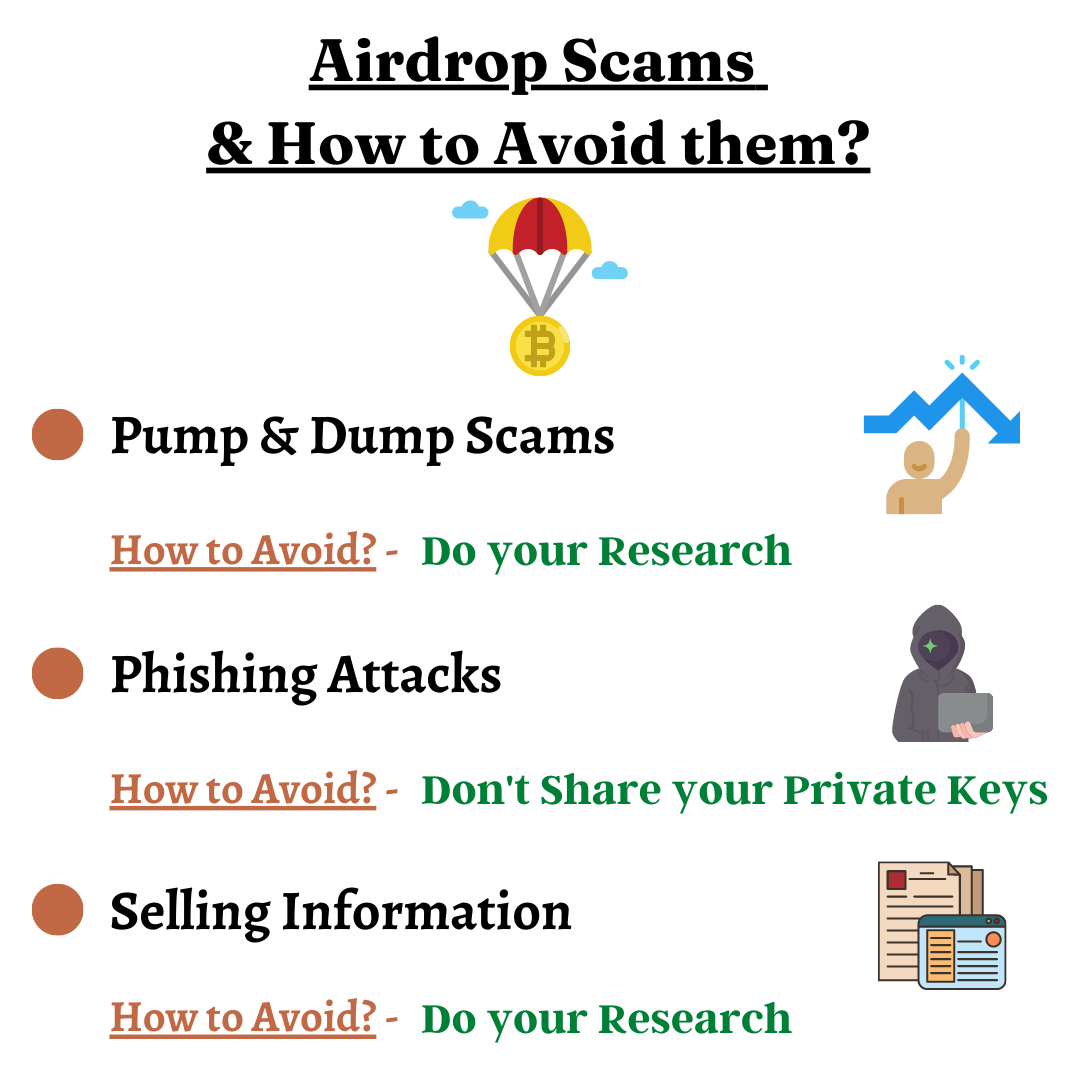

What are the Different Airdrop Scams & How to Avoid them?

Just like with everything in crypto, if you’re not cautious enough, you can get scammed. Though scams related to airdrops are relatively low compared to DeFi, they still do exist. Below are some of the most common scams related to airdrops that you should avoid at all costs.

Pump & Dump Scams

We have talked about pump and dump schemes and how to avoid them in great detail here. But quickly summarizing, these are scams where a group of people and developers create a buzz around a new cryptocurrency. Once its prices rise, the developers dump all their tokens to make a quick but big profit, leaving the project inactive.

One of the ways these projects create buzz is by airdropping free tokens. So, even though it’s not a direct airdrop scam, you can still get scammed in the long run.

Phishing Attacks

People who are new to the world of crypto or those who don’t fully understand how wallets, wallet addresses and private keys work are most vulnerable to phishing attacks. These scams will claim that they need your private key in order to send you the airdrop tokens. In reality, no one needs your private key to send you crypto. They might only need the wallet address at most. But people who are not aware often get scammed.

The best way to avoid it is to not reveal your private keys to anyone, no matter who they claim they are. Other than you, no one should have your private key.

Selling Information

These scams are very similar to phishing attacks. The only difference is that they are stealing your information instead of crypto. These fake crypto projects will get all your personal information like name, email address, social media info, wallet address, etc. Using this data, they can easily find out more about you and your crypto portfolio. And if you’re a big target, your information will be sold to hackers and scammers who might then attempt to steal your crypto with various methods.

To avoid these scams, all you have to do is do a little research about the project. Read its white paper, check out their social media accounts and check out other investors’ social media accounts. You can easily tell which ones are fake and which ones are real.

Are Airdrops Taxable?

In countries like Canada and Germany, there are no tax implications for airdrops. However, in most countries, including the United States, receiving airdrops is subject to income tax.

Airdrops are treated the same as if you would get a bonus on your salary. Therefore, you pay income tax rates on airdrops. And when you go to sell these airdropped tokens, you’ll be subject to capital gains/losses, with the cost basis being the Fair Market Value (FMV) of the coin at the time of receiving the airdrop.

So basically, you’ll be paying double taxes.

Bitcoin.Tax is a crypto tax software that automatically identifies and calculates your taxes from different exchanges and wallets. So, the next time you receive an airdrop, you can just upload the transaction history on our software, and it will automatically calculate your taxes and even help you file your tax reports.