Crypto Staking Taxes Lawsuit Explained: Jarrett v. United States

The three-year-long lawsuit involving the IRS and how it treats crypto staking taxes finally came to an end a couple of months ago. Or did it?

The IRS never clarified its position on crypto staking. The closest thing we have to that are guidelines for mining rewards, based on which staking rewards are treated as taxable income.

Many taxpayers feel this is unfair and that staking rewards should not be subject to taxes. And that is exactly the position Josh and Jessica Jarrett took in this lawsuit.

Today, in this article, we’ll explain everything you need to know about this lawsuit, its timeline and what the court ruling means for tax consequences of crypto staking.

What is Crypto Staking & Staking Rewards?

If you stake crypto in a Proof-of-Stake (PoS) network, you become one of its validators. The validator is responsible for validating transactions and creating new blocks in a blockchain. And as a reward, the validator receives part of the transaction fees (depending on the cryptocurrency) and newly minted coins.

It’s the alternative to the traditional Proof-of-Work (PoW) consensus mechanism (crypto mining). Most recently, Ethereum also transitioned to a PoS consensus system after the much-awaited Ethereum Merge on 15th September 2022.

This is what crypto staking and staking rewards are in a nutshell. Check out our in-depth guide on DeFi staking to know more.

Tax Consequences of Staking Rewards

As mentioned before, taxes on staking rewards are a bit unclear at this moment, as the IRS hasn’t released any specific guidelines for it.

But the IRS did release guidelines for crypto mining taxes, and using the same logic, staking rewards should be treated as taxable income and subjected to income tax rates on its fair market value. Not only that, but you’ll also pay capital gain taxes when you sell them in the future.

However, Josh and Jessica Jarrett disagree. According to them, the existing tax guidelines say that newly created property is only taxed at the time of its sale, and since the IRS treats crypto as property, staking rewards should receive the same treatment. But it doesn’t.

Time of Jarrett v. United States (the Staking Court Case)

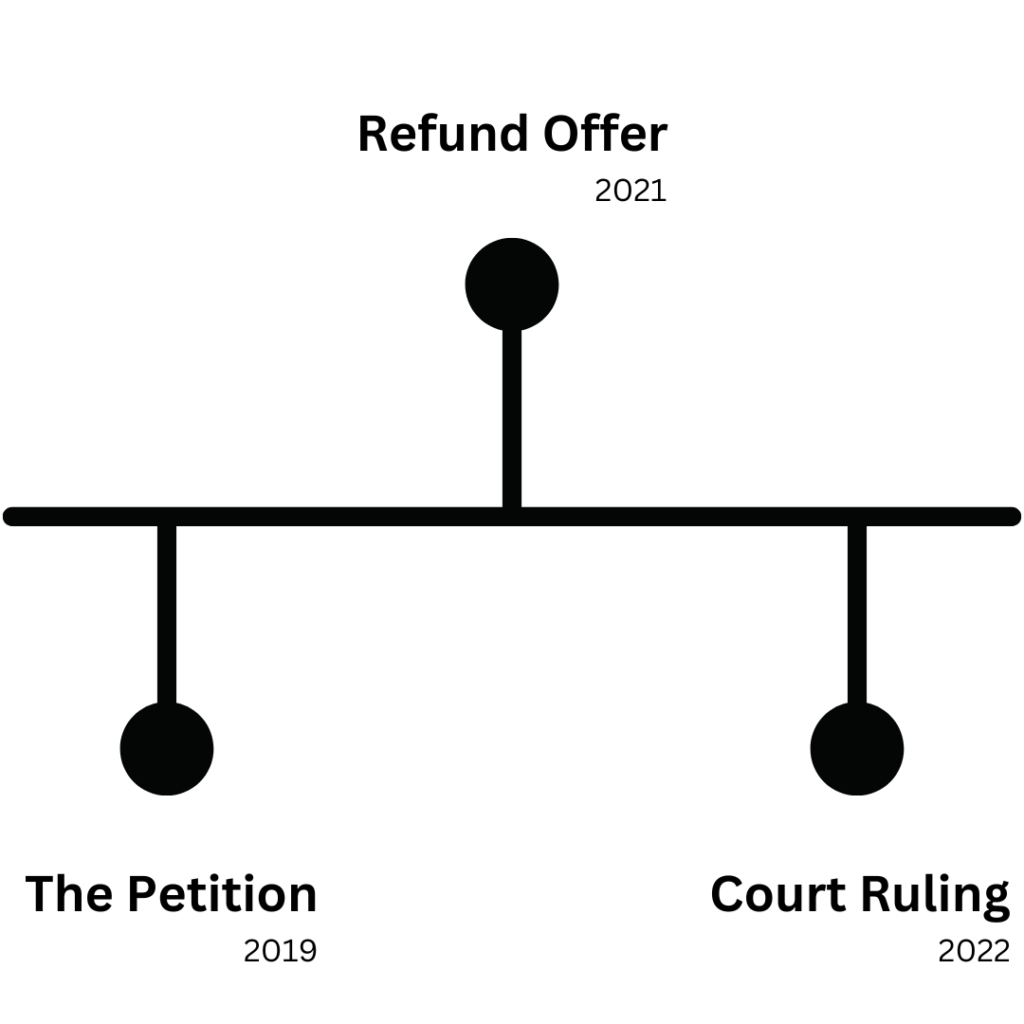

2019 – Nashville-based Josh and Jessica Jarrett directly petitioned the IRS, asking for a refund on taxes paid on 8,876 XTZ Tezos (around $4000) staking rewards.

When the couple didn’t receive any response from the IRS, they decided to file a federal lawsuit against the IRS.

Their argument was that the IRS is clear with their tax treatment on a newly created property – only taxed when it’s sold, not created. But staking rewards don’t receive the same treatment.

For example, a baker is only taxed when he sells his cake at the bakery, not when it comes out of the oven. The same logic holds true for newly minted coins (staking rewards) since crypto is considered property by the IRS.

December 2021 – The couple receives a letter from the government granting them a full refund of $3,793 plus interest concerning their 2019 tax return. On further discussion with the IRS, the couple refused their offer on 25th January 2022 and continued to pursue the lawsuit in court until they got an official ruling from the court.

On the surface, the refund offer may look like a win, setting up a new precedent for staking taxes. But that is not true.

According to the Jarrets, this was a trick for them to avoid defending their position in court, as the ruling may not end up in their favor, setting a new precedent for how staking rewards should be taxed. And as a consequence, this may force the IRS to refund millions of dollars to taxpayers.

So instead, they offered a full refund, refusing to provide any clarification on whether staking rewards are indeed not taxable.

In February 2022, the couple published a letter, explaining the entire situation up until this point.

October 2022 – Jannet’s case was dismissed by the US District Court for the Middle District of Tennessee as moot.

The District Judge William L. Campbell, Jr. wrote in his official ruling “As stated above, the instant controversy was limited to whether Plaintiffs were entitled to a refund of taxes paid for the 2019 tax year. This particular issue is not capable of repetition as any subsequent claim for refund would necessarily apply to a different tax year.”

After the ruling, Josh Jarret responded on Twitter saying he will not give up and that he plans to appeal.

We’ll add to this article as new updates emerge regarding this case. But as far as the lawsuit goes, this was the end of it.

What Does this Mean for Taxes on Staking Rewards in the Future?

Since the court ruled in favor of the IRS, some people might think it set a new precedent that staking rewards are indeed taxable.

But that is not the case. If you read the Judge’s statement carefully, you’ll find that it doesn’t say anything about the tax treatment of staking rewards.

The court dismissed the case claiming that there is no reasonable expectation that the Plaintiffs will be subject to the same issue again since any refund claim would apply to a different tax year.

Simply put, there is still hope.

If in the future, the Jarrets (or someone else) set a new precedent for tax laws around staking rewards, it would also affect crypto mining taxes, as the same argument would also apply to mining rewards.

But until then, your staking rewards are liable to income taxes under the current framework.