Crypto Charitable Remainder Trust – Avoid All Taxes?

If you know anything about crypto charitable remainder trust, you’d think it sounds too good to be true.

In case you don’t, be ready because we’re about to make a few very bold claims here.

Are you ready? Here it is.

You can avoid all capital gain taxes on your crypto. Not only that, you’ll actually make more money every year. And lastly, you can donate a decent chunk of your money to your choice of charity, all while leaving with more money than what you initially put into your crypto CRT.

But how does it work? If it’s true, why haven’t I heard of it before? Is there a catch?

These are all questions you might be asking yourself right now? Well, worry not. We’ll answer all of these, plus everything you need to know about crypto charitable remainder trust. So read on.

What is a Crypto Charitable Remainder Trust?

In a crypto charitable remainder trust, you, the donor, will donate a certain amount of crypto, or any other property, even cash, to an irrevocable trust.

In return, you’ll receive multiple tax benefits, which we’ll talk about later in this article and an annual income stream for the rest of the term or life, depending on the term itself.

At the end of the trust’s term, the IRS requires you to donate between 5-50% of your total payout, depending on the type of CRT you choose, the duration and whatnot.

So, you get to donate a decent amount of money to charity before leaving with more than what you initially put in while saving a lot of taxes.

That’s crypto CRT in a nutshell for you.

It’s hands-down one of the best tax-saving strategies that most people either don’t know or don’t talk about enough.

How to Set Up a Crypto Charitable Remainder Trust?

Before setting up a crypto charitable remainder trust, you need to ask yourself what kind of CRT you wanna invest in.

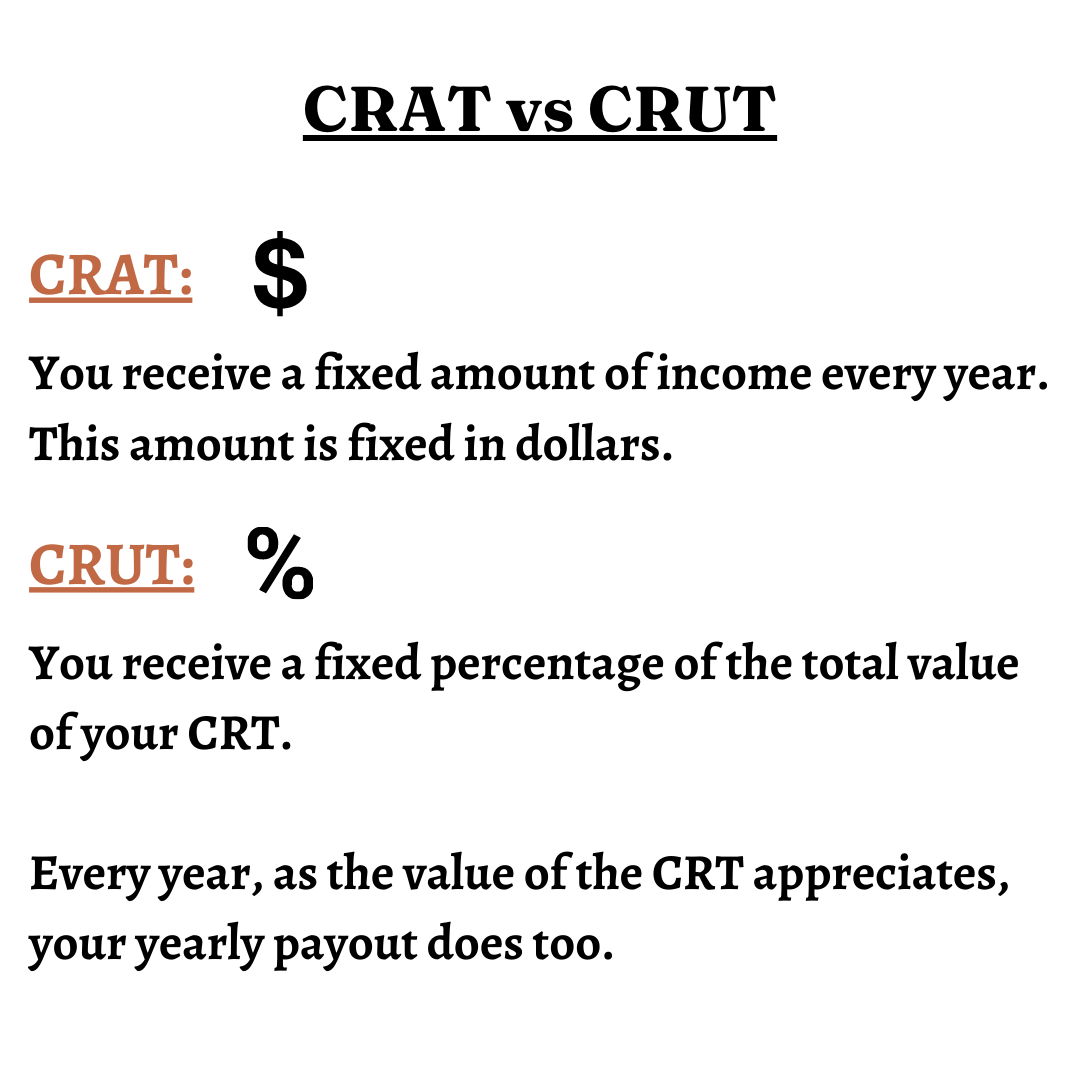

Generally speaking, there are two main CRT types – Charitable Remainder Annuity Trust (CRAT) and Charitable Remainder Unitrust (CRUT).

For the most part, we’ll cover CRUT in this article.

Why?

Well, because it’s more popular and offers greater flexibility to the donor.

In a CRAT, you receive a fixed amount of income every year. This amount is fixed in dollars.

But in a CRUT, you receive a fixed percentage of the total value of your CRT. As you can imagine, every year, as the value of the CRT appreciates, your yearly payout does too.

That’s why most people prefer CRUT over CRAT.

Other than that, you can choose between lifetime trust and term trust.

As the term suggests, the lifetime trust will continue till your death. The term trust, however, is set for a specified period.

Now that you know about the different crypto CRTs. Let’s find out how you can set up one –

1. The first step is to choose and designate a charity. This charity will get a specified amount from your CRT after the term is over. The charity must be recognized by the IRS as a 501(c)(3) organization.

2. The second step is to choose a beneficiary. This can be you or someone else of your choice.

3. Lastly, transfer your crypto assets to the trust, and you’re done. After that, you can sell your crypto, or the trust will do it for you.

4. As an additional step, we suggest you consult a professional who can guide you and help you choose the best option.

Benefits of Crypto Charitable Remainder Trust

Tax-Deductions

The first major tax benefit of a crypto CRT is you get to deduct a certain percentage of the fair market value (FMV) of your crypto contributions the first year from your ordinary income.

Typically, you can deduct around 5-10% of the FMV. But with a good lawyer or tax consultant, you can deduct as much as 30%.

Though you only get the tax-deduction benefit for the first year, the deductions themselves can be used for five future consecutive years.

Confusing?

Well, here’s an example.

Suppose you have $10 million worth of crypto in your CRT.

You get to deduct 10% of the FMV, which would be $1 million.

So now, you can deduct $1 million from your ordinary income for the next five consecutive years.

Maybe you only wanna deduct $100k in the first year and $200k in the second year or vice versa.

The bottom line – with good planning and a professional’s help, you can save a lot of taxes just from this alone.

Sell Crypto Tax-Free

It’s probably one of the biggest reasons people choose to put their money in a crypto charitable remainder trust.

We have a crypto tax guide that goes into great detail about the different tax consequences of selling crypto.

But to quickly recap, every time you sell your crypto, you incur short-term or long-term capital gains (or losses) and have to pay taxes accordingly.

However, if you put your crypto into a CRT, you don’t get taxed on selling crypto.

The reason behind it is that it’s not you selling your Bitcoin, Ethereum or whatever cryptocurrency you sell. It’s the charity selling it. At least, that’s how the IRS sees it. And charities are exempt from taxes. So, you don’t pay any taxes.

Keep in mind that you won’t be able to use the funds after selling your crypto because part of it is entitled to your choice of charity. However, part of it is still yours that you’ll eventually receive after the trust’s term ends.

Additional Income Stream

Here comes the best part. Every year after you sell your crypto, you’ll receive a fixed percentage of the total value of your CRT.

The percentage depends on the kind of CRT you choose, but it ranges from 6-11%.

But on a macro level, you’ll realize that your total payout by the end of the term is almost the same amount you initially put in, or maybe even more.

And don’t forget that you’ll also receive a part of the original amount you put into it. So, it’s a double win. Add to that the tax benefits you receive, and you’ll realize why crypto charitable remainder trust is an overpowered tax-saving strategy.

Now, to be fair, the claim we made at the start of this article was a wee bit misleading.

All of it is not entirely tax-free. You do have to pay capital gain taxes on the annual income. But that’s all. That’s the only catch if you can even call it that.

Liquidity

“Yeah, all of this sounds great, but what about liquidity?”

The problem of liquidity can be solved in one of two ways.

Firstly, you have to understand that you’ll be receiving a substantial amount of income every year, which should, for the most part, solve your problem of liquidity. But if it doesn’t, there’s another way.

You can use the future potential income till the end of your term as collateral to get loans.

We’ve already talked about crypto loan taxes in great detail.

However, you can’t use the crypto or the cash in your CRT as collateral for the loan, as part of it still belongs to charity.

But borrowing loans using your future income as collateral has the same tax consequences as crypto loans, and that is, it’s non-taxable unless you fail to repay the loan, of course. Read the guide to have a better understanding.

How Does the IRS Benefit from a Crypto CRT?

Objectively speaking, the IRS doesn’t get anything. It’s a win-win for us and a lose-lose for them.

However, since a large portion of your income is going to charities, which in general is beneficial for society as a whole, the IRS allows it and has been for many years now.

The donor/taxpayer gets the best of all worlds, while a good chunk of his money goes to charity. So, looking at it from a broader worldview, it’s a win-win for both parties