Crypto Bear Run? Make the Most of it

It’s official. We’ve officially entered a crypto bear run. Some might call it a crypto winter. Whatever you wanna call it, it’s here.

If you’re into crypto, trading or stocks, you might already know what a bear market is.

Different people have different definitions for it, but generally, it’s when prices are going down, and people are more defensive with their investments instead of offensive.

For some people in the crypto space, this is the first bear run they are experiencing. If you’re one of them and don’t know what to expect, how to navigate through it and most importantly, how to make the most out of it, keep reading.

And even if you’re not a complete beginner, you’ll learn a lot.

In this article, we’ll discuss:

- How is this bear run different from the last one?

- Is crypto dead?

- How long before the market starts going up

- The lessons we learned

- How to make the most out of it

The Last Bear Run and How it’s Different this Time

The key difference that stands out between the last bear run and this one is the correlation of the crypto market with macroeconomics.

During the last crypto bear run in 2018, crypto prices were going down while equities, the stock market and the overall economy were doing relatively well.

This time, crypto’s bear run is heavily correlated with the overall downfall of the global economy, with some people believing that a recession is just around the corner.

Also, it’s hard to talk about what triggered this downfall without talking about the recent Terra crash and everything that happened around it.

Is Crypto Dead?

“Is crypto dead?”

Every time crypto goes through a bear run, we start seeing these headlines.

The short answer is NO. Crypto is not dead yet. Even given the current circumstances and the price dips, crypto is far from dead.

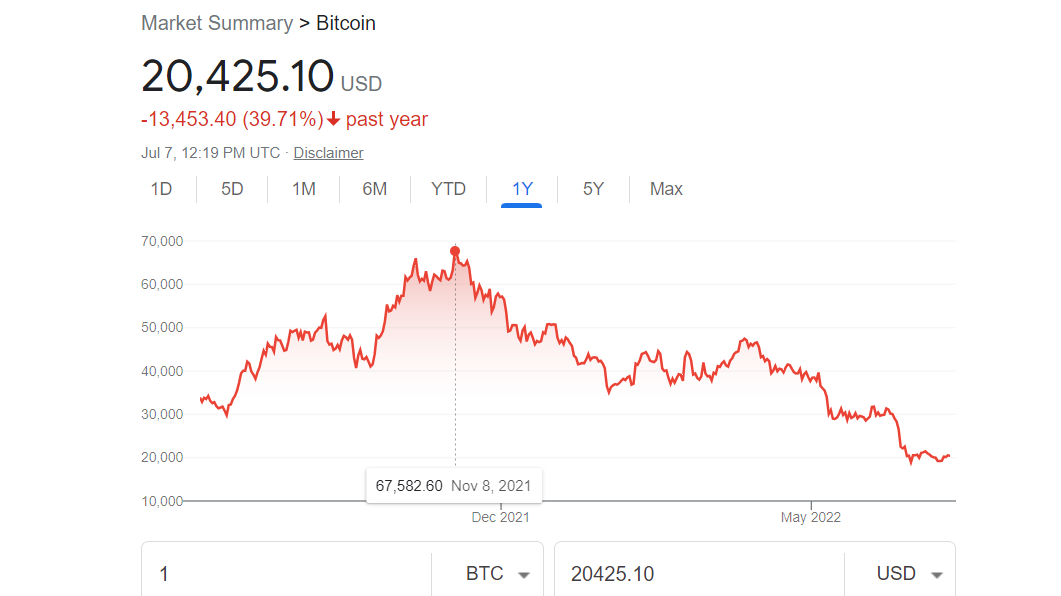

The number one mistake people are making right now is comparing crypto’s current market to its peak in 2021, when Bitcoin reached a soaring high of $67,000.

Sure, this looks bad. But that was the peak of the market, not the average. So, comparing the current prices of crypto with its peak is a flawed comparison.

Instead, if you see the growth of Bitcoin from the time of its invention, you’ll realize that it’s actually not that bad. The dip right now is still not as low as the highest peak of Bitcoin in 2017.

But even beyond that, we must understand that trends will come and go, but the technology will remain. Good projects with real utility will still last, while hyped-up projects with no underlying value will die off.

For example, NFTs really came to the forefront of the blockchain world in the last couple of years. Many NFT artists made millions selling NFTs. Some of these NFTs were good, while some were pretty much a joke.

While experts suggested not to ride trends, many, of course, didn’t listen.

Now, with the current bear market, the value of these hyped-up NFTs are suddenly declining.

But the ones with real utility and strong fundamentals are still standing strong.

On an even broader scale, the underlying technology of NFT will survive and go on to bring new innovations. But the trends, as always, will die off.

It’s actually better for the industry in the long run because it eliminates the bad actors.

Lastly, as mentioned before, this crypto bear run is largely fueled by many factors such as the Russia-Ukraine war, rising inflation and, as a result, rising interest rates, which we already covered here, and the overall economic collapse.

So hopefully, once the economy starts recovering, we might see crypto prices going up again, which leads us to the next section…

How Long will this Crypto Bear Market Last?

Although there’s no definite answer to this question, industry experts believe that this crypto winter will last up to 2-3 years.

The last bear run also lasted for around two years.

What Did We Learn?

There are actually a lot of lessons to be learned from what went down during the last couple of years.

Don’t invest without investigating the fundamentals – This is not something new or novel. Experts always advise studying the fundamentals before investing in any project.

But we just don’t seem to learn our lesson. But hopefully, this time, we will.

Check out our guide on how to do a fundamental analysis of cryptocurrency.

If it sounds too good to be true, it probably is – Once again, nothing new, but still, so many people ignore the red flags.

Crypto scams are at an all-time high. Every day, thousands of new crypto scams and rug pulls are created. And unfortunately, some people still fall into the trap.

In 2021, there was a massive controversy around Safemoon. Although it still hasn’t been proved a rug pull, most people believe it was one.

Then there’s Dogecoin. How can we forget about that? Even though it wasn’t a scam or rug pull, many people did lose a lot of money on that coin because they believed in something too good to be true.

Invest often, but invest little – You might have heard the phrase, “only invest what you’re okay losing.” Well, that’s absolutely true.

Some people invest their life savings on this stuff, which you should never do. You should always only invest a tiny portion of your active income into any investment, whether it’s crypto, stocks or anything.

Check out this guide to learn how to actually make money with crypto without risk.

Focus on long-term sustainable returns instead of quick riches – Lastly, to conclude the last two points – the best strategy is to focus on long-term, sustainable returns instead of blindly going for the next trend, the next protocol, the next coin.

Make the Most Out of it

So, what do you do now?

The first thing people are asking is whether to HODL or not?

Before we answer that, understand that panic selling is not a good strategy. The color red might not seem too pretty on your portfolio, but it’s not a good enough reason to sell everything you have.

Understand, we’re not suggesting to not sell at all. There are good reasons and opportunities where exiting the market may be a good choice. But panic selling is not the answer.

Now, whether to HODL or not?

If you believe in the future of crypto, you should HODL because sooner or later the market will rise again, and you’ll make your money back.

But understandably, not everyone has the patience or trust to wait that long. In that case, you can sell a large percentage of your crypto assets, but still keep a small percentage to yourself.

Selling can also be beneficial in terms of taxes.

You can sell your crypto assets, realize some losses and use it to offset other gains. It’s called tax-loss harvesting.

Even better, you can sell your crypto, realize losses and buy it back since the wash sale rule doesn’t apply to crypto yet.

Final Thoughts

It’s a difficult time for everyone. However, panicking and stressing over it won’t help. Finding solutions and ways to make the most out of this situation will.

If you need help sorting out your taxes, consider using Bitcoin.Tax.

It automatically collects all your transactions, calculates your taxes using your preferred accounting method, and creates a tax report for you, while you can just sit back and relax.