Build Crypto Trading Bots Without Coding (2 EASY METHODS)

There are two ways to build crypto trading bots without coding – by using a no-code crypto trading bot platform or building one from scratch using ChatGPT.

In a landscape where split-second decisions can mean the difference between success and missed opportunities, crypto trading bots become essential allies for traders. In this guide, we’ll cover step-by-step methods of building a crypto trading bot without writing a single line of code.

What is a Crypto Trading Bot?

In essence, a crypto trading bot is a software program that automates buying, selling, and managing digital assets on various crypto exchanges. Think of it as a digital assistant that tirelessly executes trading strategies based on predefined parameters and rules you set.

These bots are created to capitalize on market movements, track trends, and make timely decisions without requiring constant human supervision, allowing you to focus on devising your trading strategies more effectively.

In many ways, crypto trading bots are better than humans. For instance, it’s faster, more efficient, and can operate around the clock. Moreover, they can swiftly execute trades, monitor multiple markets simultaneously, and react to market shifts in milliseconds – something human traders might find challenging.

However, understand that trading bots are just a tool and not a replacement for you, as it has its own many limitations.

How does it Work?

At its core, a crypto trading bot operates based on a set of rules and strategies defined by its users. These rules guide the bot’s actions, from identifying potential trading opportunities to executing orders. The bot constantly analyzes market data, such as price movements, trading volumes, and technical indicators, to make informed decisions.

Picture it as a digital scout scanning the vast landscape of the crypto markets for signals that align with your chosen strategy. Once these signals are detected – be it a certain price threshold, a specific pattern formation, or a convergence of indicators – the bot swiftly executes trades on your behalf.

Types of Crypto Trading Bots

The following is a non-exhaustive list of types of crypto trading bots commonly used by traders:

Trend-following Bots: These bots identify and capitalize on prevailing market trends, executing buy orders in uptrends and sell orders in downtrends, aiming to ride the momentum.

Arbitrage Bots: These bots exploit price differences between exchanges. They buy on one platform where the price is lower and sell on another where it’s higher, pocketing the difference.

Check out our guide on arbitrage trading to learn about this strategy in-depth.

Market-making Bots: Market-making bots aim to profit from the spread between buy and sell prices, placing both buy and sell orders to create liquidity and earn profits from the spread.

Mean Reversion Bots: These bots operate on the premise that market dynamics often steer prices back to their mean or average value over time. They buy undervalued coins and sell overvalued ones.

Now that we’re done with the basics of crypto trading bots, let’s get on with the good stuff and discuss what you need to build crypto trading bots without coding.

What You Need to Build Crypto Trading Bots from Scratch?

To successfully build crypto trading bots from scratch, the following are some skills, tools and data you need:

Trading Skills: You must have a strong grasp of your trading skills to design a strategy for your bot effectively. Familiarity with technical analysis, which involves studying price charts and patterns, as well as fundamental analysis, which delves into the underlying value of cryptocurrencies, is essential for this.

Check our comprehensive guide on the best crypto trading strategies to get more insights.

API Access to Your Preferred Crypto Exchange: APIs allow your bot to fetch real-time market data, place orders, and manage your portfolio. It’s like giving your bot a virtual passport to the exchange’s ecosystem. Hence, you must have API access to your preferred crypto exchange to interact with it programmatically.

Access to Historical Market Data: Having historical market data is akin to providing your bot with a history book of past market movements. This data is crucial for backtesting your strategies – that is, evaluating how your bot’s decisions would have performed in the past, helping you refine your strategy and prepare it for real-time action.

Basic Understanding of Programming Language (Optional): Having a basic understanding of programming languages can help you customize your bot’s behavior more extensively and effectively. However, they’re not an absolute necessity.

Method #1: Leverage No-Code Crypto Trading Bot Platforms

You don’t need to be a coding wizard to bring your crypto trading bot to life. In fact, most top crypto trading bot platforms offer a beginner-friendly approach to bot creation through intuitive interfaces and drag-and-drop visual code editors. These platforms allow you to define your trading strategy, indicators, and parameters without diving into complex programming languages.

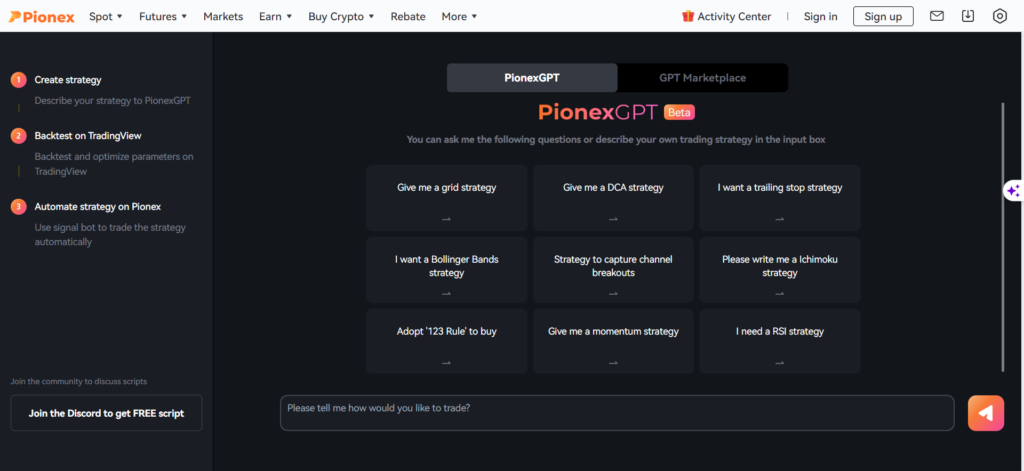

Recently, Pionex, a crypto exchange that offers in-built trading bots, added a new feature called PionexGPT. It allows you to interact with ChatGPT’s API to generate trading strategies, customize bot behavior, and fine-tune parameters – all without delving into code.

This is the easiest method to build crypto trading bots without coding. But if, for some reason, this doesn’t suit you and you want to create a crypto trading bot from scratch without any third-party platforms, take a look at method #2.

Method #2: Build a Crypto Trading Bot Using ChatGPT

In case you’re living under a rock, ChatGPT is an AI chatbot that uses LLM technology to do just about anything, including code.

So, for this method, we’ll leverage ChatGPT to build crypto trading bots from scratch, all without the need to craft a single line of code ourselves. But there are two ways to do this –

Method #2.1: Prompt ChatGPT to Write Code

Prompting ChatGPT to write a working code for your trading bot will require some trial and error, but the following are some details you must provide for ChatGPT to build an effective crypto trading bot.

Explain Your Trading Strategy: Provide a clear and detailed explanation of your trading strategy. This may include the following and more –

- Technical Indicators and Tools: If your strategy involves specific technical indicators or other tools, list them, and indicate if you need help integrating them into the bot. This could involve using technical indicators, price patterns, or machine learning models.

- Risk Management Rules: Specify the risk management rules you want to implement, such as stop-loss levels, position sizing, and take-profit targets.

- Timeframe and Schedule: Tell ChatGPT the specific timeframes you want the bot to operate (e.g., 1-hour candles, daily candles) and any scheduling preferences (e.g., trade only during certain hours).

- Target Asset: Specify your target assets. Is it Bitcoin, Ethereum, or some other coin?

Choose a Programming Language: Specify which programming language you want ChatGPT to use for your trading bot. Common choices are Python, JavaScript, and C++.

Select an Exchange: Provide any relevant information about your preferred exchange’s API documentation and requirements.

Additional Requirements: Inform ChatGPT of any other requirements or features you want it to include in the trading bot.

Method #2.2: Prompt ChatGPT to Edit Existing Code

In this method, we’ll skip the previous approach of building a crypto trading bot from scratch. Instead of starting from the ground up, we’ll tap into the wealth of existing trading strategies and indicators created by seasoned traders and mold them to match our unique parameters and preferences.

How to go about it?

Source Code from TradingView: Begin your journey on TradingView, a comprehensive platform for financial market analysis. Here, you’ll discover a treasure trove of popular trading indicators and strategies crafted by experts in the field. These codes will act as your starting point, offering a foundation to build upon.

Prompt ChatGPT to Edit: Take the code you’ve sourced and present it to ChatGPT, specifying the changes you want to align the code with your specific parameters and signals.

Refining the Process: Keep in mind that ChatGPT isn’t perfect. More often than not, it may produce code with errors.

But that is easily fixable. Here’s the solution – After ChatGPT generates the code, apply it on TradingView. If any errors surface, extract the error code and prompt ChatGPT to rectify them using the error code as a guide. Continue this process until the code is functional.

This constant iteration also applies method #2.1.

Running your Crypto Trading Bot

So, you got the code written. Great. But you’re not done yet. Here are the next to implement your crypto trading bots on exchanges successfully and make profits –

Connect to Crypto Exchanges: Register on your chosen crypto exchanges and generate API keys. Make sure you only grant essential permissions to safeguard your bot’s actions. Next, configure your bot to execute orders and access real-time market data through the exchange APIs.

Backtest Your Strategy:

It’s time to put your trading algorithm to the test by subjecting it to historical market data. This step, known as backtesting, evaluates how your bot would have performed in the past, offering insights into its potential profitability in the present.

Once your backtest results are in, fine-tune your strategy based on the insights gained. However, avoid excessive optimization, as it might lead to overfitting and underwhelming real-time results.

The testing doesn’t stop here. Next, implement a paper trading mode where your bot engages in virtual trades within real market conditions, minus the risk.

After that, proceed to live testing with a modest amount of actual capital initially. As you see positive results and gain more confidence, continue tweaking and raising the stakes.

Continuous Monitoring and Optimization:

Regularly monitor your bot’s performance to gauge its effectiveness in changing market conditions.

Crypto markets are dynamic, ever-shifting landscapes, and your bot should be equally adaptable. Be prepared to adjust parameters, update trading rules, or introduce new strategies altogether if needed.

FAQ

How much does it cost to create a crypto trading bot?

The cost of creating a crypto trading bot can vary widely depending on factors like complexity, features, and whether you’re building it from scratch or using a platform.

Developing a bot from scratch can incur higher expenses due to potential costs such as API access fees, data subscriptions, development, and testing. In contrast, using no-code platforms might reduce costs.

Is making a trading bot worth it?

If you prioritize your time and peace of mind, building a crypto trading bot yourself may not be worth it, especially if you lack coding skills. Instead, using a platform, especially a no-code one, offers convenience and ease of use. However, while platforms simplify the process, building your own bot provides more customization and control.

Are crypto trading bots profitable?

Crypto trading bots can be profitable, but success depends on various factors. A well-designed bot with a solid strategy, careful risk management, and adaptability to market conditions have the potential to generate profits. But of course, there are no foolproof methods.

Do trading bots fail?

Yes, trading bots can fail. Despite their automated nature, they are susceptible to technical glitches, incorrect parameters, and sudden market shifts.

Poorly designed bots or bots that lack proper risk management can lead to losses. Over-optimization based on historical data can result in poor performance in real-time trading. Additionally, unforeseen events, changes in market dynamics, or extreme volatility can challenge even the most sophisticated trading bots.

That is why regular monitoring, testing, and adapting strategies to evolving market conditions are essential to minimize the risk of failures.

Which bot is best for crypto?

CryptoHopper is the best crypto trading bot. However, “best” is a subjective matter. So, instead, we suggest you check out the list of best crypto trading bots.