10 Best DEXs in 2024: Trade Crypto Without KYC

Looking for the best DEXs but feeling overwhelmed by the multitude of options? This blog post offers a solution by providing insights into the best DEXs of 2024. We’ll discuss their features, benefits, and potential drawbacks in a straightforward manner, helping you make informed decisions about your crypto trading journey.

What are DEXs (Decentralization Exchanges)?

Decentralized Exchanges (DEXs) are reshaping how people trade digital assets. Unlike centralized exchanges, DEXs work directly on blockchain networks, offering features like spot trading, margin trading, lending, and yield farming without relying on a central authority. This is possible through smart contracts, which execute trades automatically based on predefined rules.

Compared to centralized exchanges (CEXs), where the exchange holds users’ funds and manages the order matching process, DEXs rely on mechanisms like peer-to-peer networks, liquidity pools, and automated market makers for direct asset swaps. This approach enhances security and privacy and reduces the risk of censorship.

Check out our complete guide on DEX vs CEX to learn more.

How to Choose the Best DEX in 2024?

Liquidity, Supported Assets, and Fees

Liquidity is vital for smooth trading, ensuring you can buy or sell assets at fair prices without huge price changes. Next, look for a DEX that supports a diverse range of cryptocurrencies, especially if you’re interested in niche tokens like Lido and Aave. Also, consider the fees charged for trading and withdrawing funds. Lower fees can make a big difference, especially if you’re a frequent trader.

User Experience and Accessibility

A user-friendly interface is essential for a positive trading experience, whether you’re new to trading or experienced. Choose a DEX that’s easy to use and navigate so you can quickly find what you need and make trades without hassle. It’s also important that the platform runs smoothly and doesn’t slow down, especially during peak hours. Cross-chain functionalities are a big bonus if you want to trade across different blockchains.

Security and Decentralization:

Security is a top priority when choosing a DEX. Check how the platform protects your funds and transactions. Look for audits by trusted companies to ensure the smart contracts are secure. Privacy is equally important. Some DEXs require less personal information than others. Consider how decentralized the platform is in terms of governance and operation, as more decentralization may mean better security and resistance to censorship. And be aware of any regulatory risks, especially in places with strict cryptocurrency laws.

Community Support and Reputation:

A strong community and good support are valuable when using a DEX. They can provide help, advice, and updates on the platform’s progress. Before choosing a DEX, read reviews and testimonials to see what others say about it. A good reputation is a sign of reliability and happy users.

Here are the Best DEXs in 2024:

1. Uniswap

Uniswap is a decentralized exchange (DEX) known for its impressive liquidity, handling over $2.8 billion in trades daily and offering support for 600+ cryptocurrencies. It charges a flat 0.3% fee per transaction, competing well with bigger exchanges. However, users might face higher fees during peak hours on the Ethereum network. Despite occasional user-reported issues, Uniswap generally enjoys positive reviews.

Uniswap prioritizes user privacy and security, requiring no KYC to sign up and offers a simple and intuitive interface for beginners. All transactions are securely recorded on the Ethereum blockchain, and governance is decentralized, overseen by UNI token holders and delegates.

Uniswap’s impact extends beyond numbers, with over 219 million trades and 300+ integrations. Supported by a community of 4,400+ delegates, Uniswap remains one of the best DEXs in 2024.

2. dYdX

dYdX is a standout in DeFi, focusing on advanced trading like perpetual and margin trading. With 25,000+ users and $2.1 billion+ in daily trades, it offers deep liquidity and supports 52+ assets, including leveraged trading.

It’s praised for low fees, using StarkWare for gas-free trades. Its easy-to-use interface, no KYC policy, and recent blockchain launch on the Cosmos ecosystem for better scalability and privacy enhance accessibility.

Security is strong with Ethereum protocol and self-custodial measures, though some users report account issues. Governance is decentralized through the DYDX token, offering voting rights and fee discounts, but some question its true decentralization and token use.

Despite challenges, dYdX attracts traders with its advanced features and dedication to DeFi’s progress.

3. PancakeSwap

PancakeSwap is a decentralized exchange on the Binance Smart Chain known for its low fees and fast transactions. It supports a wide range of cryptocurrencies, with over $400 million traded daily.

Its low trading fees, typically 0.25% per transaction, make it popular among users. However, some find its setup process confusing, especially when choosing between Metamask and Binance Chain.

While security measures are in place, users should be cautious of risks associated with Binance Smart Chain tokens. Despite lacking dedicated support, PancakeSwap has an active community-driven governance model.

It offers unique features like yield farming, an NFT marketplace, and a lottery program, adding to its appeal. However, users should stay informed about potential risks and explore detailed resources for more insights.

4. 1inch

1inch is a top DEX aggregator, helping users find the best rates across various decentralized exchanges (DEXs). With access to over 50 liquidity sources on Ethereum, 20 on Binance Smart Chain, and 8 on Polygon, it ensures traders get optimal rates with minimal slippage.

Unlike other DEXs, 1inch doesn’t charge extra fees for trading, depositing, or withdrawing, except for network fees and those from the exchanges it aggregates. Its user-friendly interface makes trading easy, but it might be tricky for newcomers due to its complexity.

1inch prioritizes user security, with no known breaches and a decentralized approach. Founded in 2019, it has gained a solid reputation in the DeFi community for its innovative DEX aggregation and cost-saving features as one of the best DEXs right now. However, its complexity and lack of support for fiat currency may be challenging for beginners.

5. IDEX

IDEX stands out as one of the best decentralized exchanges (DEX) by offering a unique hybrid liquidity model blending centralized and decentralized features. It tackles common DEX issues like failed transactions and high slippage while staying decentralized.

Fees are simple, with a 0.125% charge for takers and fair compensation for liquidity providers. The upgraded interface offers advanced trading options, making it user-friendly while maintaining complexity.

As a non-custodial exchange, IDEX prioritizes user security, letting users control their private keys. It integrates with Polygon to reduce costs and offers special trading features, like Fill-Or-Kill orders and a fee-sharing staking program.

Overall, IDEX combines the best of both worlds, offering efficient trading like centralized exchanges and the security of a DEX, making it a top choice in the market.

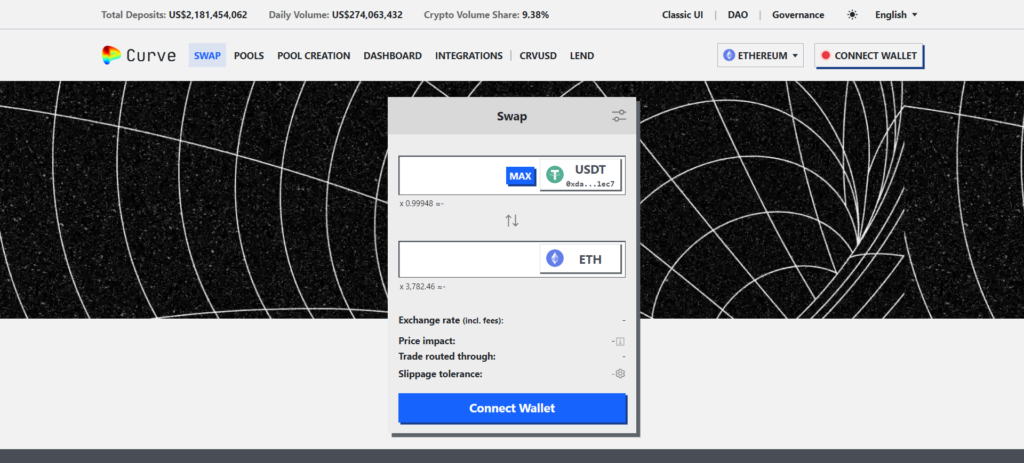

6. Curve

Curve Finance is a unique decentralized exchange (DEX) known for its focus on stablecoin trading. Its innovative bonding curve mechanism minimizes price impact, ensuring stable trading conditions.

With various stablecoin pools like DAI, USDC, and USDT, Curve offers reliable trading options. Its fee structure includes a standard 0.04% trading fee that benefits both traders and governance token holders.

While Curve’s unique features may require some learning for newcomers, Curve’s decentralized governance allows token holders to participate in decision-making. Despite past security incidents, Curve remains committed to user safety.

As one of the best DEXs out there, Curve continues to innovate, earning trust in the community. While it may take some time for newcomers to grasp, its dedication to secure trading makes it a vital part of the DeFi landscape.

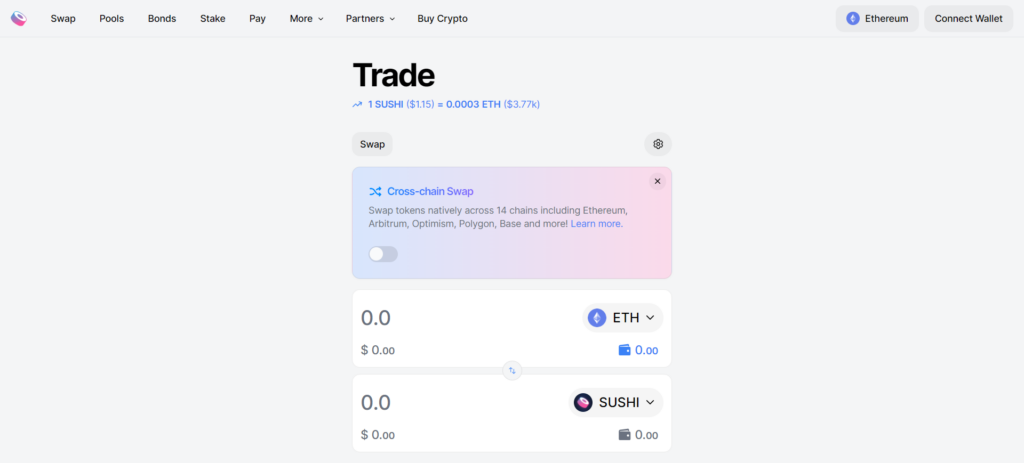

7. SushiSwap

SushiSwap is a decentralized exchange (DEX) known for its innovative liquidity solutions and rewards. Despite its history of challenges, it remains one of the DEXs in the DeFi space.

With over $48 million traded daily, SushiSwap offers a wide range of ERC-20 tokens for trading and rewards users who provide liquidity. Its fee structure benefits both liquidity providers and SUSHI token stakers, with a 0.3% fee on trades. However, its sushi-themed interface might be confusing for new users.

SushiSwap prioritizes user control and has transitioned to community governance following a series of security challenges and controversies, including a high-profile incident involving its founder. It now spans multiple networks, offering features like yield farming and lending.

8. Balancer

Balancer is like a decentralized index fund, letting users create pools based on their crypto portfolios. These pools, known as Balancer pools, enable liquidity providers (LPs) to earn a share of trading fees.

With support for up to eight tokens and over $11 million traded daily, Balancer offers diverse trading opportunities for LPs. Fees from trades go to LPs, encouraging liquidity provision. Balancer’s Vault architecture ensures pool integrity and security.

Through its token BAL, Balancer involves the community in decisions. Known for its versatility, Balancer is one of the best DEXs in decentralized finance, offering advanced options for traders and liquidity providers alike.

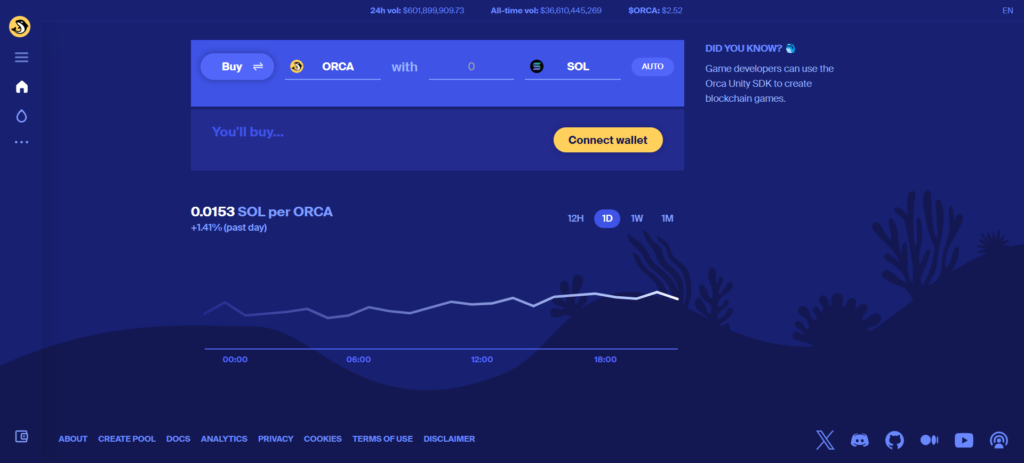

9. Orca

Orca is a user-friendly decentralized exchange (DEX) on the Solana blockchain, known for its speed and low fees.

Utilizing Solana’s efficiency, Orca offers fast token swaps and liquidity pools called “aquafarms.” Users earn a share of trading fees, with an average daily trading volume exceeding $600 million.

Fees range from 0.01% to 2%, rewarding liquidity providers with a significant portion of the transaction fees. Its intuitive interface, featuring tools like the Fair Price Indicator and Magic Bar, caters to both beginners and experienced traders. Security is key, leveraging Solana for secure transactions. Governance is driven by the ORCA token, allowing holders to participate in decisions.

Since its inception, Orca has been praised for reducing transaction friction on Solana. By incorporating user feedback and fostering a supportive community, Orca thrives in the DeFi space.

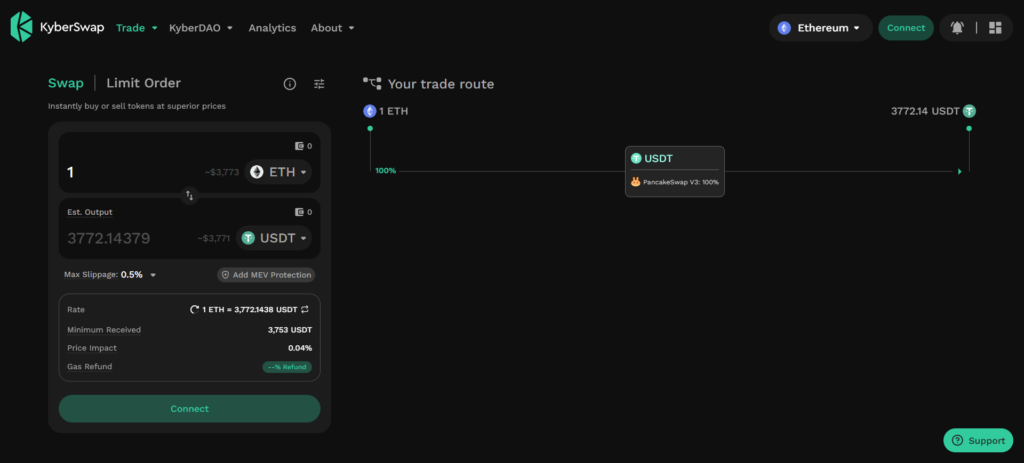

10. Kyber Swap

KyberSwap is a versatile platform in DeFi, serving as both a decentralized exchange (DEX) and aggregator. It optimizes trading by finding the best token prices and maximizing earnings for liquidity providers.

Across 12 EVM-compatible chains and Solana, KyberSwap ensures accessibility and deep liquidity, with over $7 billion in daily trading volume. Its liquidity pools reduce slippage for traders. Using a Dynamic Market Maker model, KyberSwap adjusts fees based on market conditions, protecting liquidity providers from losses and ensuring fair trading.

Known for its user-friendly interface, KyberSwap allows easy navigation and trading across different blockchains. Security is a priority, with updates and governance through KyberDAO involving the community in decisions.

FAQ

Can you avoid taxes by using DEXs?

Using decentralized exchanges (DEXs) doesn’t inherently exempt users from taxes. While DEXs offer privacy and anonymity, tax obligations still apply to crypto transactions. Users are responsible for reporting gains or losses from their trades to tax authorities per their jurisdiction’s laws.

Check out our detailed tax guides by country to know more.

What is the largest DEX in the world?

As of now, Uniswap is widely considered the largest decentralized exchange (DEX) in the world based on its daily trading volume. With its significant liquidity and high trading activity, Uniswap consistently ranks as the leading DEX in terms of daily trades, making it one of the best DEXs in the decentralized finance (DeFi) ecosystem.

What is the safest Dex?

Identifying the “safest” decentralized exchange (DEX) can be subjective and dependent on various factors such as security measures, auditing, and user experience.

However, platforms like SushiSwap, Balancer, and Curve Finance are often regarded as relatively safe options due to their robust security protocols, smart contract audits, and community trust. It’s essential for users to conduct thorough research and exercise caution when choosing a DEX for their transactions.

Which is the cheapest Dex?

Platforms like PancakeSwap and SushiSwap are known for their relatively low trading fees compared to other DEXs. However, it’s essential to factor in gas fees, which can vary depending on network congestion and blockchain used. Users should evaluate overall costs based on their trading frequency and preferences before selecting a DEX.