Stablecoin Taxes: Unfair Treatment by the IRS?

Using Bitcoins and Ethereum in everyday transactions isn’t really practical for mainly two reasons though there are more – a) price volatility b) you’ll incur capital gains (or losses) every time you use Bitcoin or Ethereum to buy any goods or services.

You would expect stablecoins to solve this problem, right? Well, you would be wrong. Turns out stablecoin taxes and most other crypto taxes are pretty much the same.

In this guide, we’ll learn everything about stablecoins and how they are taxed.

What are Stablecoins?

Even though we call Bitcoins and Ethereum digital currencies, we use them for speculative and investment purposes. Stablecoins were created to provide a viable alternative to Bitcoin as a currency.

The value of these cryptocurrencies is pegged to a commodity, gold, currency or algorithm. Usually, they are pegged to the US dollar. It allows these coins to stay at a stable price point so people can actually use them as an alternative currency.

Stablecoins have significantly grown in the last few years. According to a report by digital asset analysis firm Messari, stablecoins surpassed $1.7 trillion in transaction volume in 2021.

Here are some of the most popular stablecoins in recent times –

- Tether (USDT)

- Dai (DAI)

- Binance USD (BUSD)

- TrueUSD (TUSD)

- USD Coin (USDC)

How does the IRS treat Stablecoin Taxes?

Since stablecoins are still cryptocurrencies, the IRS treats them the same. To know how the IRS treats crypto and how they are taxed, click here.

Nonetheless, here’s a quick overview. The IRS treats cryptocurrencies, including stablecoins as ‘property’, meaning you’re liable to capital gains tax rates on selling (disposing of) crypto.

The only other scenario is if you receive crypto as payment or salary for your goods or services. In that case, you’ll be liable to ordinary income tax rates.

Here are a few examples of how stablecoin taxes work in different scenarios –

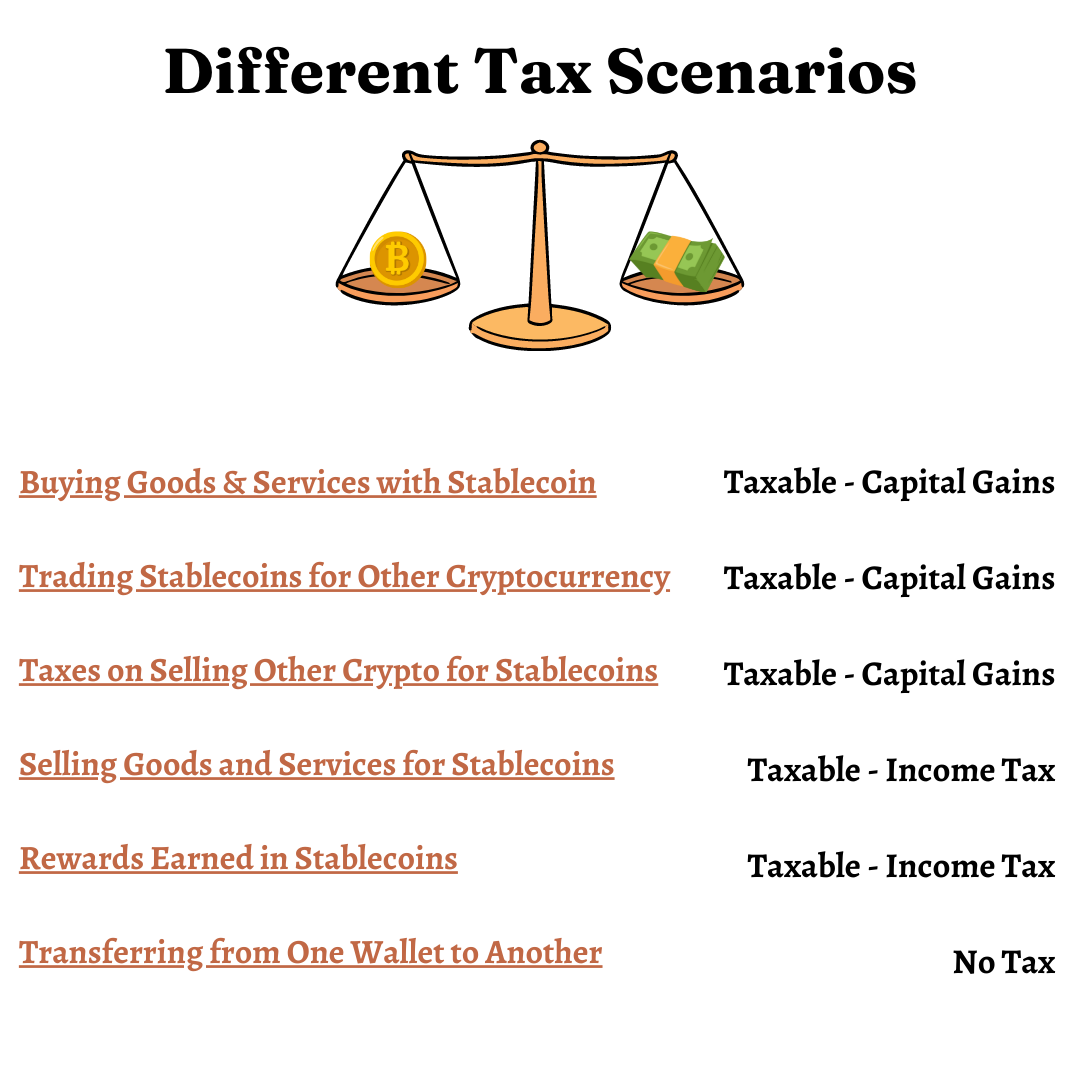

Taxes on Buying Goods and Services with Stablecoins

Using stablecoin to buy any goods and services is a taxable event since you’re disposing of your crypto and incurring capital gains (or losses).

However, stablecoin prices hardly ever fluctuate meaning, you’ll not incur any capital gains and pay zero stablecoin taxes.

But you still have to report all your stablecoin trades and transactions on your tax return.

Taxes on Trading Stablecoins for Other Cryptocurrency

Trading one stablecoins for other cryptocurrencies has the same tax consequences as buying goods and services with stablecoins.

Since the price of stablecoins remains the same, you’ll most likely not incur any capital gains when trading (disposing of) stablecoins for other crypto.

But again, you should still report all trades and transactions.

Taxes on Selling Bitcoin (or Any Other Cryptocurrency) for Stablecoins

The tax consequences are the same, but this time you’ll actually incur capital gains (or losses) since Bitcoin and most other cryptocurrency prices fluctuate quite a lot, unlike stablecoins.

Taxes on Selling Goods and Services for Stablecoins

As discussed before, if you sell goods and services for stablecoins, that will be treated as income. Therefore, you’ll report it as ordinary income and pay income tax.

Taxes on Interests or Rewards Earned in Stablecoins

Many DeFi (Decentralized Finance) platforms allow their users to stake coins to earn interest-like rewards. Taxes on DeFi staking is a whole other topic, but taxes on rewards earned with staking is pretty straightforward.

If you stake any stablecoin and earn rewards in stablecoins, you’ll report it as ordinary income and pay income taxes.

Taxes on Transferring Stablecoins from One Wallet to Another

Transferring stablecoins from one wallet to another is not a taxable event.

Is it Unfair?

Perhaps. Or perhaps not. From the perspective of an ordinary taxpayer, reporting thousands of transactions with no incurred capital gains seems quite a hassle. But from the perspective of the IRS, creating separate laws for crypto taxes and stablecoin taxes isn’t practical as well.

So, if you do use stablecoins to make transactions, the best thing you can do to report your stablecoin taxes, which will most likely be zero anyway, is to keep records.

However, if you’re using stablecoins in everyday transactions, keeping all the records and calculating them is almost impossible, especially if you use multiple exchanges and wallets.

Bitcoin.Tax, the leading crypto tax software, fixes this problem for you. All you have to do is connect all your exchanges and wallets and Bitcoin.Tax will do the rest – collect trade history, calculate capital gains and income tax, create a tax report.