8 Best Crypto Staking Platforms in 2023 (+3 More DeFi Protocols)

People’s interest in alternate streams of crypto income is surging, and in tandem, the search for the best crypto staking platforms is gaining momentum.

In this list, we’ll explore the 8 best crypto staking platforms in 2023, delving into their features and offerings. And if you stick till the end, we’ve listed 3 DeFi staking platforms for all you DeFi enthusiasts reading this.

Choosing the Best Crypto Staking Platform in 2023

While “best” will always be subjective, there are some factors you must consider when choosing the best crypto staking platforms based on your specific investment goals, needs, and appetite.

Security & Reputation: Platform security should be your top priority. Look for reputed platforms with robust security measures, like two-factor authentication (2FA), cold storage for funds, and high-grade encryption protocols. Also, look for user reviews, ratings, and feedback from the crypto community to get a sense of their experiences with the platform to make a better judgment.

Supported Cryptocurrencies: Different staking platforms support various cryptocurrencies. So, keeping that in mind, you would want to choose a platform that supports the specific cryptocurrency you want to stake.

Staking Rewards and Fees: Compare the APY (Annual Percentage Yield), which is the rate of interest or staking rewards you accumulate yearly, offered by different platforms for the same coin. Additionally, look into any fees they might charge for staking, withdrawals, and other transactions. Some staking platforms may have hidden fees, so read the terms and conditions carefully.

Minimum Staking Requirements: Check if the platform has any minimum requirements for staking, such as a minimum amount of cryptocurrency or a specific staking period. Make sure these requirements align with your investment goals.

Now that we have a better idea of what to look for (and what to avoid) based on your specific context, let’s explore the best crypto staking platforms in 2023 and what each has to offer.

1. MyCointainer

MyCointainer is one of the best crypto staking platforms because that is what it specializes in. The platform has an abundance of options in cryptocurrencies supported for staking and APY ranges, along with one of the lowest fee structures on this list.

Supported cryptocurrencies: MyCointainer supports staking for 120+ cryptocurrencies, including Ethereum, Solana, Polygon, etc.

APY: The highest APY on MyCointainer is 108.7% on TeriTori, while coins, like Ethereum, offer a more stable APY of 3.9%.

Minimum Stake: Depends on the coin you stake. For instance, Ethereum requires a minimum of $1,847 to start. However, you can start as low as $0 with some coins.

Fee Structure: The average fee here is 1-2%. However, users can opt for MyCointainer POWER to enjoy 100% rewards.

Lock-in Period: There are no Lock-in periods on this platform.

2. Coinbase

As one of the largest and most reputable crypto platforms globally, Coinbase not only provides a secure and user-friendly trading experience but also offers a seamless way to earn passive income through crypto staking.

It allows you to stake your crypto directly from the “Coinbase Earn” section or from your own portfolio of cryptocurrencies (the ones that support staking).

Supported cryptocurrencies: Coinbase allows you to earn passive income on 66 coins, but only 58 of which are through staking, including Ethereum.

APY: The highest APY Coinbase offers is 957.13% on Yearn.Finance, while offering a more stable APY of 4.90% on Ethereum.

Minimum Stake: No minimum staking limit.

Fee Structure: While Coinbase has no staking fees, the platform charges 15-35% commission on your staking rewards based on the coins you stake. Coinbase One members will pay lower rates.

Lock-in Period: There are no Lock-in periods on Coinbase. You can unstake your assets whenever you want. However, certain coins may require a ‘cooldown’ period before you can sell or spend your crypto.

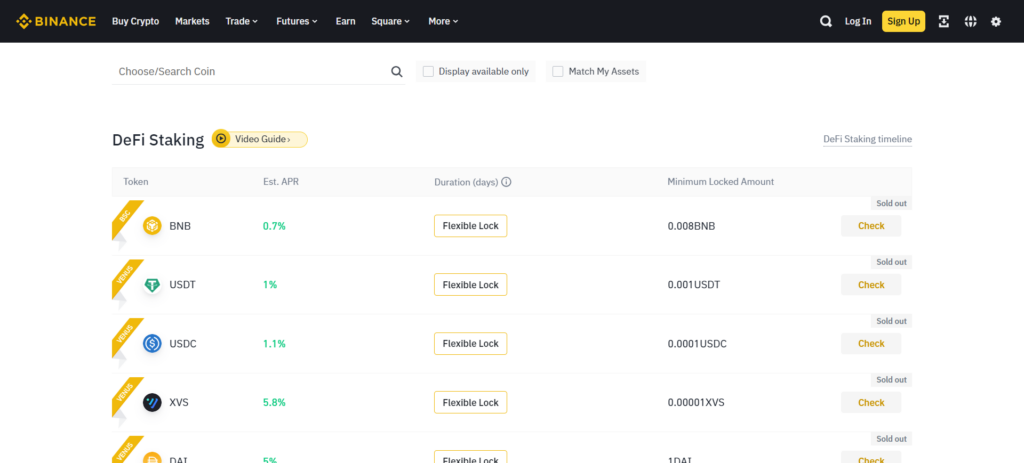

3. Binance

Much like Coinbase, Binance is also one of the largest crypto exchanges in the world. However, it’s also one of the best crypto staking platforms, providing an easy and seamless staking experience for some of the most popular cryptocurrencies.

Supported cryptocurrencies: Currently offers 9 coins you can stake, including Ethereum, Aave, BNB, etc. However, this number may change occasionally.

APY: The highest APY on Binance is 19.8% on Convex Finance, while on APY on coins, such as Ethereum, is as low as 0.49%.

Minimum Stake: Different minimum locked requirements for different coins. For instance, Ethereum has a minimum locked requirement of 0.001ETH.

Fee Structure: Binance may charge a fee or commission for providing the DeFi staking services, but the platform doesn’t specify how much. Read the Binance Terms and Conditions page for more info.

Lock-in Period: While some coins have a fixed Lock-in period, others offer more flexibility. However, early redemption will result in staking rewards being deducted from your earnings.

4. Gemini

Gemini, another well-known crypto exchange, only started staking services as early as last year. Currently, the options are pretty limited on the platform, but considering its reputation, we can hope for Gemini to expand its staking services further in the near future.

Supported cryptocurrencies: Currently, Gemini only supports staking for Solana, Ethereum, and Polygon. However, some coins may not be available in the US and UK.

This may be a dealbreaker for some compared to the other best crypto staking platforms in this list.

APY: APY on all three coins ranges from 3.14% (ETH) to 5.19% (SOL).

Minimum Stake: Depends on the coin and whether you’re opting for ordinary Staking or Staking Pro.

Fee Structure: Gemini charges a 15% staking service on your staking rewards, which includes gas fees and infrastructure costs.

Lock-in Period: The minimum Lock-in period for Ethereum and Polygon is 14 days and 4 days, respectively.

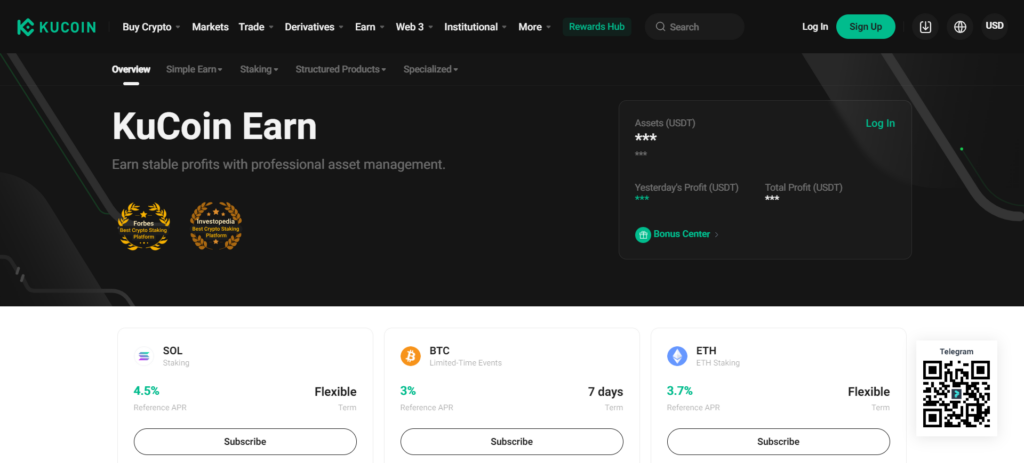

5. KuCoin

KuCoin is an excellent crypto exchange with a user-friendly interface and attractive features, one of them being KuCoin Earn. Not only does KuCoin Earn allow you to earn passive income with staking, but it also offers various other products to earn interest on their cryptocurrencies.

Supported cryptocurrencies: KuCoin supports staking for 40+ cryptocurrencies (and more for other passive income tools), including Ethereum, Solana, and Polygon.

APY: The highest APY KuCoin offers is 33.03% on HYDRA, while the more stable ones offer 3-5% APY.

Minimum Stake: Depends on the coin you’re staking, but mostly the minimum stake amounts are reasonably low. For instance, you can start with as little as 0.01 ETH.

Fee Structure: KuCoin definitely charges fees for its operating costs, but it isn’t clear how much.

Lock-in Period: The Lock-in period depends on the coin. Nonetheless, the platform offers a mix of flexible and fixed-term staking options.

6. Crypto.com

We didn’t initially plan to include Crypto.com in this list of the best crypto staking platforms. Why? The existing Crypto.com Earn feature doesn’t really stake crypto to generate rewards or interests.

However, recently, the platform has launched its on-chain staking feature on its app only. Presently, staking is limited to selected cryptocurrencies and jurisdictions, but given the platform’s reputation and past track record, they might expand their offers very soon.

Supported cryptocurrencies: Currently, Crypto.com only supports staking for Ethereum, Solana, Polkadot, Polygon, and Cronos.

APY: The platform doesn’t provide any estimated APY. Instead, the rewards entirely depend on the blockchain you choose.

Minimum Stake: As per Crypto.com, the minimum stake amount for all coins is 1.00E-08.

Fee Structure: The platform charges a flat fee of 20% for all tokens except Ethereum. For Ethereum, it’s 15%.

Lock-in Period: There are no Lock-in periods imposed by the platform.

7. eToro

Next up on this list of best crypto staking platforms, we have eToro. eToro offers automated staking, where users will receive monthly rewards with no action from their side. Although the platform has an unorthodox reward structure, it’s ideal for people looking for a hassle-free solution for staking crypto.

Supported cryptocurrencies: Only supports staking for Cardano, Tron, and Ethereum. However, there are further limitations based on jurisdictions. For instance, US users can’t stake Ethereum on eToro.

APY: Rewards on eToro are calculated and distributed differently than other staking platforms on this list. We would refer you to their official staking page for more information on how they generate and distribute rewards.

Minimum Stake: There is no minimum staking amount, but it should be enough to generate a minimum yield of 1% every month.

Fee Structure: eToro has a tiered fee structure that charges 25% of the user rewards from Bronze members, 15% from Silver members, and only 10% from Diamond members.

Lock-in Period: Different for each coin. For instance, you must stake Cardano for 9 days and Tron for 7 days before beginning to receive rewards on them.

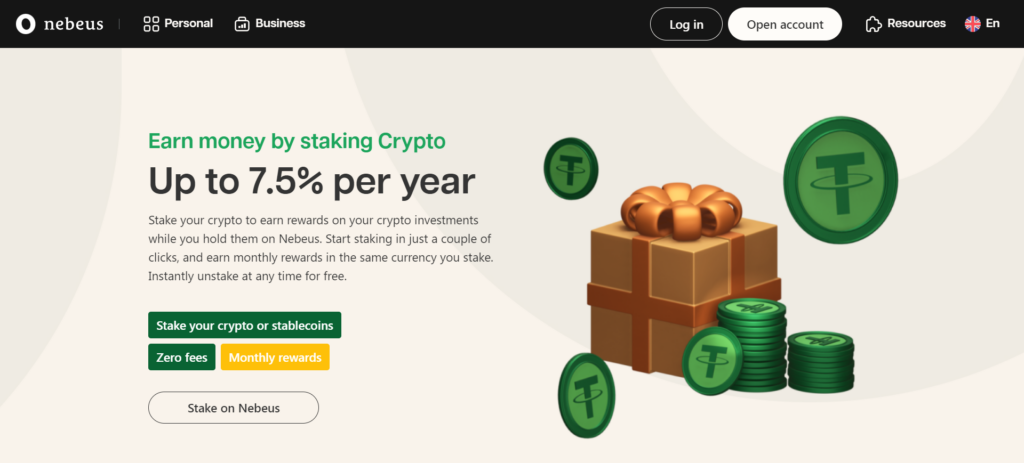

8. Nebeus

Nebeus, a platform registered with the Bank of Spain, mainly offers user IBAN accounts linked to crypto wallets in a single ecosystem. However, within the ecosystem, the platform also offers exchange, lending, and staking features.

Supported cryptocurrencies: Supports staking for over 21 cryptocurrencies, including Ethereum, Aave, Polygon, etc.

APY: APY on Nebeus range from 3-7.5%.

Minimum Stake: Depends on the blockchain you’re staking on.

Fee Structure: It seems Nebeus doesn’t charge any fees other than transaction fees. However, we’re not sure.

Lock-in Period: There are no lock-in periods for staking on Nebeus.

Best DeFi Staking Platforms in 2023

Now that we’re done with the best “centralized” crypto staking platforms, let’s take a look at the top DeFi staking platforms in 2023.

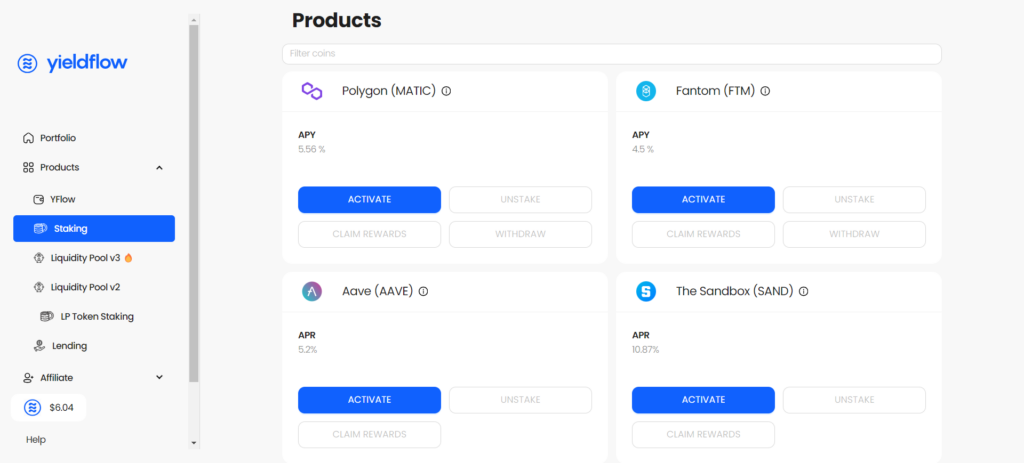

1. YieldFlow

Not only is YieldFlow one of the best DeFi staking platforms, but it can also hold its own among the overall best crypto staking platforms.

YieldFlow is a comprehensive platform that allows staking, lending, and yield farming. Moreover, the platform incentivizes users to hold and use its native token, $YFlow, for greater rewards and added benefits.

Supported cryptocurrencies: Only supports staking for Polygon, Fantom, Aave, and The Sandbox.

APY: The highest APY of 10.87% offered is on The Sandbox, while the others range from 4.5-7%.

Minimum Stake: Depends on the coin and the minimum stake amount required by that particular blockchain.

Fee Structure: YieldFlow doesn’t charge any fees for their staking services.

Lock-in Period: It offers flexible and fixed-term Lock-in periods, ranging from 6 months to 3 years.

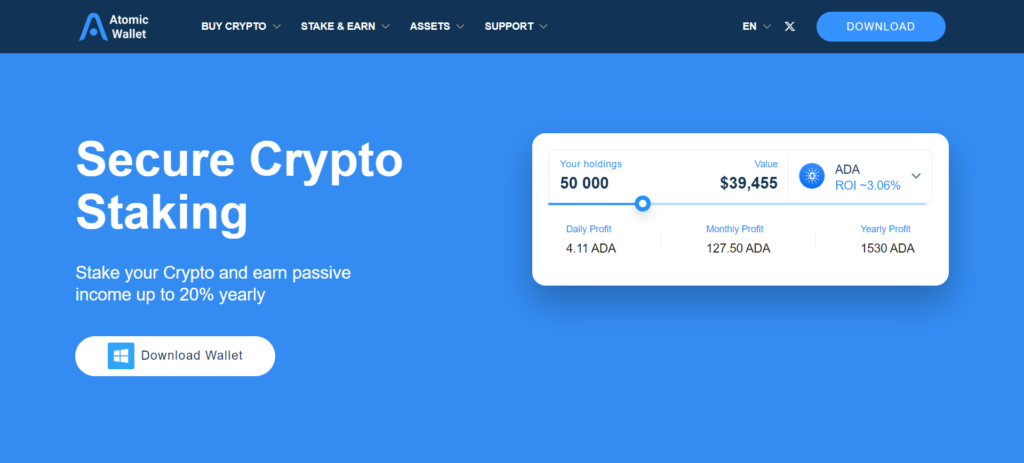

2. Atomic Wallet

Atomic Wallet is a non-custodial crypto wallet that allows its users to stake and receive rewards directly from their app. The entire process is simple and quick, making it an ideal option for beginners and passive investors.

Supported cryptocurrencies: Supports staking for 20+ crypto assets, including Ethereum, Solana, and Cardano.

APY: The highest APY on Nebeus is 22% by Cosmos and Osmosis, while tokens, like Ethereum and Solana, offer a more stable APY of 5-7%.

Minimum Stake: Depends on the blockchain you’re staking on.

Fee Structure: Except for the transaction fees, Atomic Wallet doesn’t charge any additional fees.

Lock-in Period: Depends on the coin you’re staking. Some offer flexible staking, while others require you to lock-in for a fixed term.

3. Stake.Fish

As the name suggests, Stake.Fish is exclusively a DeFi staking platform with a good reputation and decent options. The site layout is very straightforward and user-friendly, making it great for beginners experimenting with DeFi, and an overall great addition to this list of best crypto staking platforms.

Supported cryptocurrencies: Supports staking for 18 coins, including Ethereum, Solana, Tezos, and more.

APY: APY can be as high as 58-62% on coins like JUNO and as low and stable as 4-8% on coins like Ethereum.

Minimum Stake: Depends on the blockchain you’re staking on. For instance, you must stake a minimum of 32 ETH to get started, which is the case with most DeFi staking platforms.

Fee Structure: While there are no fees, the platform charges different commission rates on different coins. For instance, you would pay a 4% commission on your Cosmos rewards, 8% on Solana, 15% on Tezos rewards, and so on.

Lock-in Period: There are no lock-in periods. However, some coins may have an unbonding period.

FAQ

What is staking and how does it work?

Staking refers to holding and “staking” a certain amount of your cryptocurrency to support the operations of a blockchain network running on a Proof-of-Stake consensus mechanism. And in return for your contribution, you’re rewarded with the additional cryptocurrency of the same blockchain network.

It’s a way to generate passive income while also helping secure and maintain the network’s functionality. Check out our in-depth guide on staking for more.

Can you Stake Bitcoin?

No, Bitcoin currently doesn’t support the staking mechanism. Bitcoin operates on a Proof of Work (PoW) consensus algorithm, where miners validate transactions and add new blocks to the blockchain. Staking, on the other hand, is common in Proof of Stake (PoS) networks.

However, you can consider other cryptocurrencies like Ethereum, Cardano, and Polkadot for staking opportunities.

Is it better to hold or stake crypto?

Deciding between holding and staking crypto depends on your goals and risk tolerance.

If you’re looking for potential price appreciation and are comfortable with market fluctuations, holding might be preferable. Staking, however, can provide a steady stream of rewards, offering a passive income. It’s worth considering a mix of both strategies to diversify your crypto portfolio and balance potential gains and rewards.

Are staking rewards taxable?

The tax treatment of staking rewards varies by jurisdiction. In many countries, like the US, staking rewards are generally considered taxable income. This means when you receive rewards, they may be subject to income tax, similar to other forms of crypto earnings.

However, there have been disputes regarding the tax treatment of staking rewards.

Do I pay taxes on staked ethereum?

Yes, in most jurisdictions, you are required to pay taxes on staked Ethereum or any other staking rewards. As mentioned above, when you earn rewards by participating in staking, it’s considered a form of income, and you may need to report it on your tax return.

What are the risks in staking?

Staking with certain risks to be aware of:

- Market Volatility: The value of staked coins can be affected by market fluctuations, impacting your overall returns.

- Network Risk: If the blockchain network experiences technical issues, vulnerabilities, or attacks, your staked coins could be at risk.

- Slashing: Some staking networks have penalties for improper behavior, which could result in a portion of your staked coins being slashed or forfeited.

- Lock-Up Periods: Some staking protocols have lock-up periods during which you cannot access your staked coins. This lack of liquidity could be a concern if you need to access funds quickly.

- Regulatory Changes: Evolving regulations could impact the legality and tax treatment of staking, affecting your potential returns.

- Network Upgrades: Staking networks may undergo upgrades or forks, which could affect your staked coins and rewards.

Is staking crypto worth the risk?

Staking can be a viable option for those looking to earn passive income and engage with blockchain networks. However, you must approach it with caution, conduct due diligence, and only stake what you can afford to lose. If you’re unsure, consulting a financial advisor can help you make an informed decision based on your individual circumstances.