9 Best Crypto Lending Platforms in 2024

Crypto loans made up almost half (47.4%) of DeFi in total value locked (TVL) in 2021, and it shouldn’t come off as a surprise. The best crypto lending platforms out there offer lower interest rates and better loan terms than traditional banks. It also allows investors to use their crypto’s value without actually selling it and triggering taxes.

This, combined with the growing adoption of DeFi and cryptocurrency, only makes the crypto lending market more visible and prominent.

However, with increasing demand, we’ve also got a growing number of options, some of which are good, while some are not. Today, we’ve compiled a list of the 10 best crypto lending platforms in 2024 based on factors we’ll discuss and their popularity and impact.

But before that, let’s quickly recap what crypto lending platforms are.

- What are Crypto Lending Platforms?

- How to Choose the Best Crypto Lending Platforms?

- 1. AAVE

- 2. Compound

- 3. Nexo

- 4. OKX

- 5. YouHodler

- 6. Ledn

- 7. CoinRabbit

- 8. SpectroCoin

- 9. Celsius

- Final Thoughts

- FAQ

- Are there any fees associated with using a crypto lending platform?

- What are the risks involved in using a crypto lending platform?

- How do I ensure the security of my funds on a crypto lending platform?

- What happens if I can’t repay my loan?

- How do I apply for a loan on a crypto lending platform?

- How long does it take to receive a loan after applying?

- Can I use a crypto lending platform to earn interest on my crypto holdings?

- How do I track my loans and interest payments on a crypto lending platform?

What are Crypto Lending Platforms?

Crypto lending platforms are online DeFi marketplaces that allow you to use cryptocurrency as collateral to borrow loans. They are a great way to raise capital without actually selling your crypto assets and triggering taxes.

Some platforms even let you use your collateralized crypto to earn yields, automatically reducing or offsetting any interest you may have to pay on your loan. These are known as self-repaying loans.

However, it’s important to note that if you default on the loan or if the value of the collateralized crypto drops, the platform can liquidate a portion or all of your crypto to recover its funds and maintain the loan-to-value (LTV) ratio.

Nonetheless, crypto loans are still better than traditional bank loans in many aspects, such as accessibility, as anyone can apply for a loan without extensive credit checks, flexibility on loan terms, interest rates, and repayment options, as well as the global reach of crypto loans compared to traditional bank loans.

How to Choose the Best Crypto Lending Platforms?

The DeFi economy is growing rapidly, and so is the number of new crypto lending platforms. Thus, choosing the best among them isn’t easy, especially if you’re new to this. There is no one-size-fits-all solution. Your specific needs and situation will dictate what’s best for you.

The following six factors will help you prioritize what’s important and what’s not when picking the best crypto-lending platforms.

Interest rates: The industry standard for crypto loan interest rates are 0%-5%. But, of course, you would want to find a platform that offers the lowest interest rates. You may also want to look out for platforms that allow you to earn yields on your collateralized crypto, automatically offsetting the interests.

Supported cryptocurrencies: Not all platforms accept the crypto you want a loan against. Most crypto lending platforms accept the top cryptocurrencies, like Bitcoin, Ethereum, Litecoin, etc., but some don’t. In fact, some of the best lending platforms don’t support Bitcoin. So, keep an eye out for that.

Loan terms and repayment options: Next, consider the loan terms and repayment options a platform is offering. Are they flexible enough? Do they align with your needs?

Crypto loan terms can be as low as seven days and as much as a year or more. As for repaying your loan before the loan term, most crypto lending platforms don’t charge an additional fee for that.

Allowed loan amounts: Typically, you can get a loan between 50% to 60% of your collateralized crypto’s value. However, some platforms may offer loans up to 90% or even 100% of your crypto’s value. However, with higher loan amounts comes a higher risk of liquidation.

Security: DeFi hacks were rampant in 2022 due to their vulnerabilities. That is why it’s crucial you choose a platform that ensures the safety and security of your crypto assets. Additionally, look for options that also offer insurance.

Customer support: Customer support may not be a concern for many, but something you should consider anyway. There is nothing more frustrating than unresponsive customer support, especially when it concerns your hard-earned money.

1. AAVE

AAVE is a DeFi lending platform built on Ethereum. It was originally launched in 2017 as ETHLend but later rebranded to AAVE in September 2018. It’s one of the most popular and trusted lending protocols in the DeFi space, boasting over $5 billion in total-value-locked (TVL).

Its popularity mainly comes from low interest rates, ranging from 1%-14%. It also supports a variety of cryptocurrencies, including Bitcoin, Ethereum, and stablecoins like USDT and USDC. The maximum loan-to-value ratios (LTVs) may fluctuate depending on the token.

One unique feature that AAVE pioneered is its flash loans. Flash loans allow users to borrow funds without collateral for a brief period, provided the user repays the borrowed fund within the same transaction.

Another really cool feature is its ability to switch between fixed and variable interest rates, allowing users to choose the most optimal lending or borrowing strategies.

AAVE offers flexible loan terms, ranging from a few days to a year, and it supports both traditional and flexible repayment options. Additionally, AAVE stores all its crypto in cold storage to ensure the security of user funds.

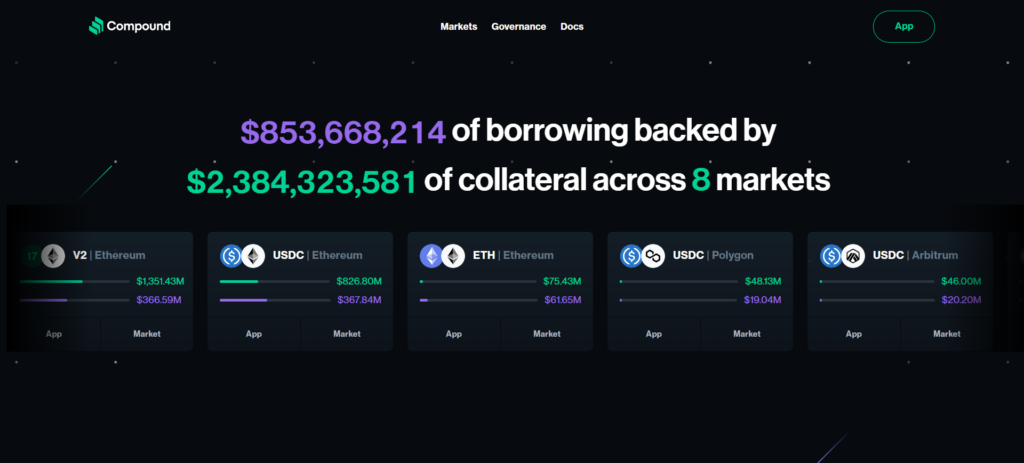

2. Compound

Similar to AAVE, Compound is also a lending platform built on Ethereum. Robert Leshner, a former Google employee, and Geoffrey Hayes, a former venture capitalist in 2017 founded it.

Right away, what separates Compound from every other lending platform is its algorithmic interest rate model, which adjusts rates based on supply and demand for each crypto, making it one of the best crypto lending platforms for affordable loans.

As a consequence, interest rates can (and mostly do) fluctuate in real-time, providing borrowers and lenders with competitive rates. Users can also earn yields on their collateral, which may reduce or offset interests.

It also supports a range of cryptocurrencies, including Ethereum, Basic Attention Token (BAT), DAI, USDC, etc. Repayment options on Compound are flexible. So, you can repay your loan at any time without incurring additional fees. It also allows you to borrow crypto by providing collateral for a different one.

Lastly, Compound runs smart contract audits and a bug bounty program to identify and fix vulnerabilities to fight off cyber-attacks and hacks.

3. Nexo

If you’re looking for a lending platform that offers high LTV ratios, look no further than Nexo. Founded by Antoni Trenchev and Kosta Kantchev in 2018, Nexo aimed to simplify instant crypto loan access.

Offering competitive interest rates, starting at 6.9%, Nexo supports a wide array of cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin and many more.

Similar to Compound, Nexo also has an auto-credit feature, allowing users to earn yields on their collateralized crypto and simultaneously offset interests. Hence, the name auto-credit.

Loan terms on Nexo can range from as little as seven days to as much as a year, with no additional fees for early repayment. And as mentioned, Nexo offers maximum LTV ratios of around 80%.

Nexo is up-to-date with industry standards with security measures like 256-bit encryption, two-factor authentication, and cold storage for your crypto assets. And that’s not it. The platform also offers insurance on all custodial assets, adding an extra layer of protection, making it one of the most secure crypto lending platforms on this list.

4. OKX

OKX, previously OKEx, is considered one of the most secure and reputable lending platforms out there.

Interest rates on OKX range from 2% to 10% APR depending on the coin. Users can also earn up to 20% in annualized returns on their deposited assets, making it a great passive income opportunity. You can also borrow stablecoins instead of fiat currency.

OKX supports 10+ cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, etc., and offers flexible loan terms ranging from a single day to 180 days, with no hidden fees or charges for early repayment. Users can even choose from various repayment options, including principal repayment, interest repayment, or both.

OKX’s strength lies in its strong security. Not to mention, it also offers insurance protection for user assets.

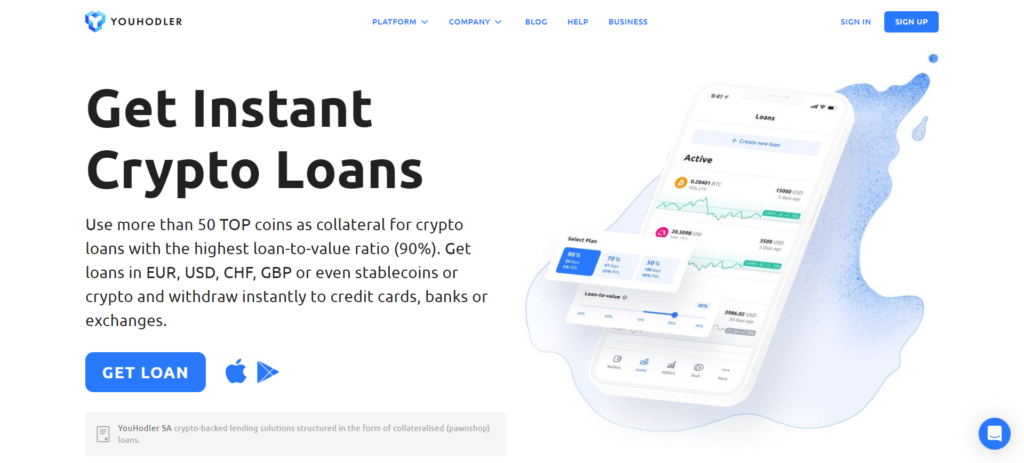

5. YouHodler

YouHodler is a Swiss-based crypto-lending platform launched by Viacheslav Taran and Ilya Volkov in 2018. Its USP – it offers loans up to 90% of your collateralized crypto’s value.

The platform supports most cryptocurrencies, including Bitcoin, Ethereum, XRP and more. Interest rates can be as low as 3%, while you can earn up to 12% APY on your collateralized crypto, which also automatically offsets the interest.

YouHodler offers flexible loan terms ranging from 30 to 120 days, and you can repay at any time without additional fees. Moreover, YouHodler allows you to repay in your preferred currency.

YouHolder also has a unique Turbocharge feature. Similar to a loan top-up, the Turbocharge feature allows you to get an additional loan on top of your existing loan. It’s quite useful when you need more funds quickly without having to go through the entire loan process again.

YouHodler also takes security seriously, ensuring that all crypto assets are stored in cold storage and protected by multi-sig technology. They also offer an insurance fund to protect users against potential losses due to hacks or other security breaches.

6. Ledn

Ledn is a crypto lending platform founded by Mauricio Di Bartolomeo and Adam Reeds in 2018. The platform offers loans in US dollars and stablecoins, including USDC, PAX, and GUSD, with interest rates up to 2.25% APY.

Like most of the best crypto lending platforms, Ledn allows users to earn interest on their collateralized crypto and provides up to 50% LTV ratio on all supported cryptocurrencies. Compared to others on this list, Ledn’s loan terms are not that flexible, ranging from only 3 to 12 months.

Lastly, Ledn stores its crypto in multi-sig cold storage, and user funds are insured against theft and loss.

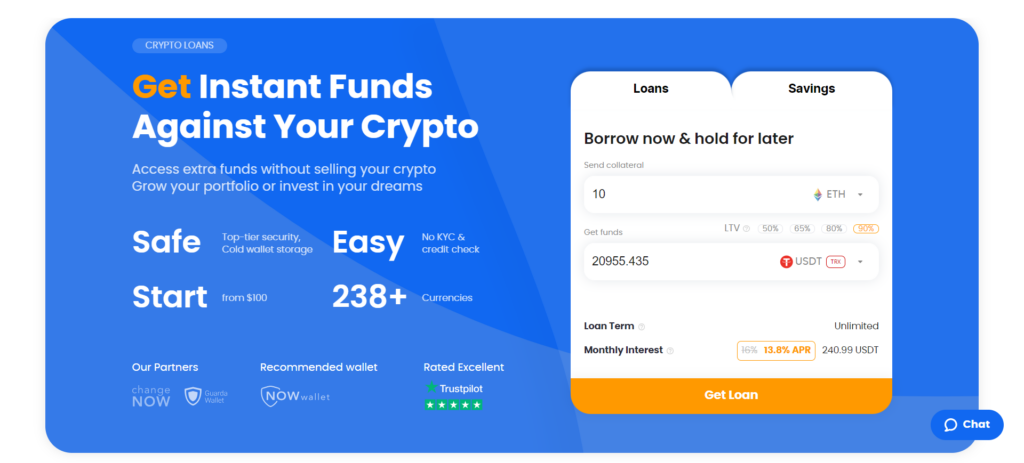

7. CoinRabbit

Founded in 2018 and based in Hong Kong, CoinRabbit is one of the best crypto lending platforms for beginners.

The platform offers decent Interest rates of around 5%, depending on the loan amount and collateral, and supports most cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Ripple, Bitcoin Cash, etc. However, you can offset your interest by yields earned with your collateralized crypto.

Loan terms are flexible, ranging from 7 days to 6 months and borrowers can take out loans up to 60% of their collateral’s value. You can also repay at any time without additional repayment fees or charges.

CoinRabbit also has a mobile app for iOS and Android, allowing users to manage their loans on the go.

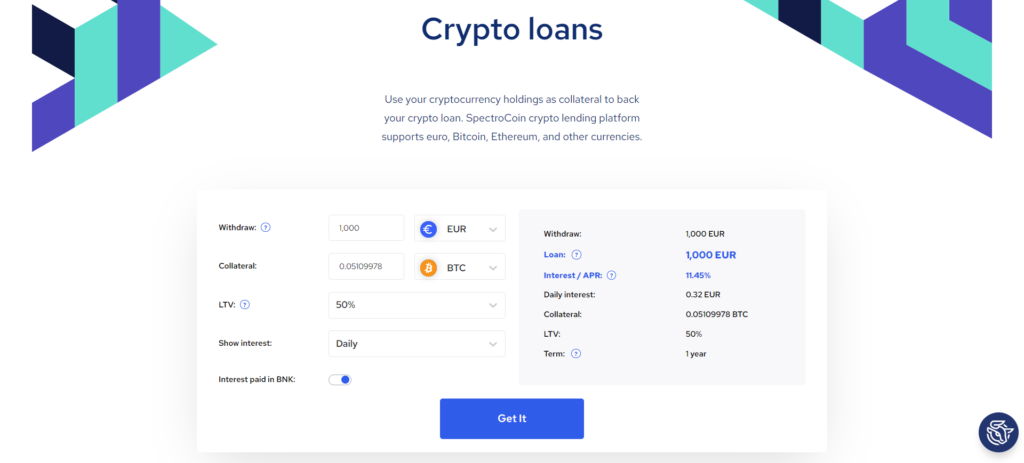

8. SpectroCoin

SpectroCoin, founded by Mantas Mockevicius and Justas Dobiliauskas in 2013, is a crypto exchange and wallet first. Its popularity comes from its user-friendly interface and huge variety of supported cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, Tether, and more.

The platform offers competitive interest rates of 4% to 8% based on different tokens. Interest rates are calculated daily and paid weekly.

It also provides short, but flexible loan terms ranging from 30 days to 12 months with no additional fees for early repayment. Users can borrow from $50 to a million, based on the value of the collateralized crypto and the LTV ratio.

The only potential downside is it requires KYC to take out a loan, which might repel some people who prioritize their privacy and anonymity.

On a side note, SpectroCoin also offers one of the best crypto debit cards, allowing users to spend their crypto anywhere Visa is accepted.

9. Celsius

UPDATE: Celsius has filed for bankruptcy.

Launched by Alex Mashinsky in 2017, Celsius is known for its high interest rates of up to 17.78% for stablecoins and 0.1% to 8.95% for other cryptocurrencies, depending on the LTV ratio. However, it offers a 25% discount on interest rates if you pay in CEL, the native token of Celcisu.

Celsius supports most cryptocurrencies, like Bitcoin, Ethereum and Litecoin. However, the loan terms (6 months to a year) are not as desirable as some of the other options on this list. But it allows users to repay loans at any time without incurring additional fees.

The “Earn in Kind” program allows you to earn interest in the same currency as your collateralized crypto. So, if you collateralize Bitcoin, you’ll earn in Bitcoin. Its native token, CEL, offers several benefits, like reduced interest rates and higher returns on collateralized crypto.

The biggest positive of Celsius that helps make it in the list of best crypto lending platforms is its reputation for excellent customer support, with a responsive team available 24/7 via email, phone, or chat.

Final Thoughts

With the rise of DeFi and an overwhelming number of options, choosing the best is not easy, to say the least. Hopefully, this guide will help you know what to look for and the list we’ve compiled will help narrow your search for the best crypto lending platforms.

FAQ

Are there any fees associated with using a crypto lending platform?

Ans: Yes, there are multiple fees associated with using a crypto lending platform, such as processing fee, interest rates, and platform usage fees. These may vary depending on the platform and loan terms you’re opting for.

What are the risks involved in using a crypto lending platform?

Ans: The primary risk with using a crypto lending platform is liquidation due to defaulting on loans or price fluctuations. Other than that, there are risks of theft and hacks, but you can avoid that by using a platform with strong security.

How do I ensure the security of my funds on a crypto lending platform?

Ans: You can safeguard your crypto funds by choosing a reputable platform with strong security measures, cold storage for user funds and insurance coverage. From your side, ensure you use a strong password and enable two-factor authentication.

What happens if I can’t repay my loan?

Ans: If you don’t repay your loan, the lending platform will simply liquidate your collateralized crypto and recover their funds.

How do I apply for a loan on a crypto lending platform?

Ans: Applying for a crypto loan is as simple as creating an account and providing collateral. The exact process may vary based on different platforms, while some may even need additional KYC verification.

The simplicity and ease of access are one of the main appeals of crypto loans compared to traditional bank loans.

How long does it take to receive a loan after applying?

Ans: It depends on the platform you’re using, but typically, you’ll receive the funds instantly, except for some platforms that may take up to several days.

Can I use a crypto lending platform to earn interest on my crypto holdings?

Ans: Yes, most, if not all, crypto lending platforms offer you to lend your crypto to earn interest. It’s a way to earn passive income from your crypto holdings, which otherwise will idle in your wallet. In fact, even as a borrower, you can earn interest and yields on your collateralized crypto.

How do I track my loans and interest payments on a crypto lending platform?

Ans: Most crypto lending platforms have dashboard or account summary sections where users can track their loans and interest payments. Additionally, you may also receive regular updates via email.