10 Best Bitcoin IRAs in 2023 to Secure your Retirement

As cryptocurrencies have become a popular investment instrument, more and more people are looking into Bitcoin IRAs as an alternative way to invest in retirement funds.

Bitcoin IRAs allow clients to invest in cryptocurrencies for their retirement funds and enjoy multiple tax benefits, which may not be there by simply investing in crypto the usual way. You can learn more about crypto taxes in the US here.

In this guide, we’ve compiled the 10 best Bitcoin IRAs in 2023 you can invest in based on many factors.

But before we dive into that, let’s quickly summarize what they are and how they work.

What is a Bitcoin IRA?

Bitcoin IRAs are retirement accounts that allow clients to hold cryptocurrencies as part of their portfolios, meaning they can gain the same tax benefits as normal IRAs, such as 401(k)s or Roth IRAs.

How Does it Work?

A Bitcoin IRA, also known as Crypto IRA, is a retirement account that holds digital currencies like Bitcoin instead of normal assets like stocks, bonds and mutual funds. With a Crypto IRA, clients can add cryptocurrency to their retirement portfolios for long-term growth and diversification.

The best Bitcoin IRAs are self-directed, meaning the investor has complete control over the account and can make their own investment decisions.

Bitcoin IRAs are typically custodial accounts. They are held and managed by a third-party financial institution. A custodian manages the account, overlooks asset transfers and purchases, and ensures that IRS rules for retirement funds are followed.

Bitcoin IRAs provide investors with tax advantages such as deferring taxes on capital gains and the ability to invest in a variety of cryptocurrencies, despite the name Bitcoin IRA. Crypto IRAs also have no limits on how much you can contribute each year and no yearly withdrawal fine.

How to Choose the Best Bitcoin IRA?

To choose the best Bitcoin IRAs for your needs, you need to consider a few key factors:

Security: The Crypto IRA you’re investing in should have all the necessary security measures, such as multiple authentication factors, data encryption technology, insurance policies and more, to protect your hard-earned money.

Investment Limitations: Some Bitcoin IRA providers have stricter asset and trading restrictions than others.

For example, some crypto IRAs only allow you to invest in Bitcoin. Others may limit the types of assets you can have, the amount of money you can invest in a particular asset class and the frequency of your transactions. While some may impose more fees or require higher minimums than others.

It’s crucial to understand the limitations of your Crypto IRA before investing in them.

Fees: Ideally, you would want to choose the best Bitcoin IRA with the lowest fees.

Tax Benefits: Depending on the type of IRA you’re investing in, you’ll receive different tax benefits. Make sure you choose the ones that align with your tax goals.

Now that we know what Bitcoin IRAs are, how they work and how to choose the best one, let’s get into the list of best Bitcoin IRAs in 2023.

1. Bitcoin IRA

BitcoinIRA is, without a doubt, the best overall choice for a Crypto IRA. The platform offers both traditional and Roth IRA options, giving users the flexibility to choose what works best for them.

BitcoinIRA allows users to invest in many popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, and Litecoin. The minimum investment required to open a standard account is $3,000. However, clients can also open a Saver IRA, which requires an initial deposit of only $100 with an automatic recurring investment of $100 per month. So, if you can’t invest $3000 at once, the Saver IRA account is a good alternative for you.

As for security, BitcoinIRA provides secure storage for digital assets, with offline cold storage wallets and multi-layer encryption. Plus, your funds are protected by a $700 million insurance.

The only potential downside is its high set-up and trading fee of 5.99% and 2% respectively.

2. BitIRA

One of the most popular Bitcoin IRA providers, BitIRA offers clients a secure and simple way to start investing in digital assets.

It boasts the highest levels of security for its clients’ funds and allows them to diversify their portfolios with seven different cryptocurrencies.

The company has a minimum investment requirement of $20,000 but offers tax-deferred benefits as well as the convenience of investing through a normal custodial IRA.

Other features include low fees, no extra trading costs, and the ability to put current IRA accounts into BitIRA. However, investors should know they can’t invest in some popular cryptocurrencies, such as Ethereum or Ripple, on this platform.

3. iTrustCapital

iTrustCapital was launched in 2018 and has already been named Innovator of the Year and Best Crypto Investment Platform at the IMA Impact21 Awards 2021. It is a leading provider of self-directed retirement accounts that allow clients to hold cryptocurrencies and precious metals.

With a minimum investment requirement of $1,000 and an additional contribution minimum of $500, the platform charges a fee of 1% per trade. It also offers over 30 different cryptocurrencies for clients to diversify their portfolios, along with gold and silver.

iTrustCapital offers 24/7 trading, secure storage and insurance for its clients’ assets. Plus, the ability to fund accounts using numerous methods, including IRA transfers and employer plan renewals.

However, before you make a cryptocurrency contribution, you must transfer your cryptocurrency holdings to your iTrustCapital account. And while iTrustCapital does offer custodial storage for your crypto, you can’t contribute using tokens you already own.

4. Broad Financial

Flexibility is the name of the game when it comes to Broad Financial’s self-directed IRA platform. This provider offers several custodial services, including normal IRAs, Roth IRAs, SEP IRAs and Bitcoin IRAs.

The company offers tax-advantaged assets in crypto with no extra trading costs. Clients can purchase any cryptocurrency through self-directed IRA accounts. Clients can also use their accounts to invest in different asset classes, including real estate, private businesses, and other alternative assets, such as gold and silver.

Broad Financial has a least possible set-up fee of $1,195 and a one-time $100 fee for custodian set-up and funding of the new trust.

The once-a-year maintenance fee is $400, which covers general maintenance and tax reporting, such as an annual IRS 5498 report.

However, clients should note that this provider does not offer direct financial advice.

5. Choice

Choice, formerly Kingdom Trust, has a great reputation in the industry, and for good reasons.

It offers clients a low-fee, self-directed IRA that allows them to invest in traditional assets and cryptocurrencies.

A single wallet can store all of a client’s digital assets, making it easier for them to manage them. The provider has no minimum investment requirement, offers low custodian fees, and does not charge additional fees for trades.

What else can you want?

Well, it turns out there is more. Living up to its name, Choice gives you access to over 30 different cryptocurrencies and tokens to invest in. The company also boasts a highly secure cold storage solution.

However, clients should know that they must pay a 1% annual management fee and trading fees, which can add up over time if you are a frequent trader.

6. BittrustIRA

For those just starting out with Bitcoin IRAs, BittrustIRA is a good option.

In BittrustIRA, your assets are safe and secure with 100% offline cold storage. These are housed in decommissioned nuclear bunkers to ensure they are not accessible by anyone else. On top of this, they also have a team of specialists monitoring the system 24/7.

But, more importantly: there’s no minimum contribution requirement. You can invest as much or as little as you like without worrying. Plus, one of its primary benefits is all gains made inside the BittrustIRA account are 100% tax-free.

They also offer an easy transfer process from current IRAs or 401(k)s. With their portfolio rebalancing service, you can increase performance by up to 35%.

BittrustIRA offers a range of services to help you manage your Bitcoin IRA effectively, including setting up accounts, advice on best assets, and more.

7. TradeStation

A neat package that offers everything you need for an ideal Bitcoin IRA experience is TradeStation. It’s a well-known Bitcoin IRA provider with excellent customer service, a wide selection of services, and low fees.

TradeStation is a platform where users can buy, sell and hold various cryptocurrencies and stablecoins. Plus, you can also trade on a variety of cross-pairs.

The best part?

TradeStation Crypto has no crypto custody fees. This means you don’t have to worry about any extra costs associated with your assets.

There are some drawbacks, though, such as its cluttered layout, which makes navigation more confusing than necessary.

8. CoinIRA

Having been around since 2017, CoinIRA is one of the most trusted and best Bitcoin IRAs available. The company partners with Equity Trust Company to offer a secure and reliable way to store assets.

CoinIRA has no minimum investment requirement and offers free account setup and maintenance. It also charges no fees on deposits and withdrawals. Plus, it allows clients to put current 401(k)s or IRAs into a self-directed Bitcoin IRA account.

The only downside of CoinIRA is that it provides any cryptocurrency consultants available to help make contribution decisions.

9. Alto IRA

The Alto IRA is one of the best Bitcoin IRAs options, with unique features that make it an excellent choice for retirement accounts. Unlike other providers, Alto Crypto IRA uses Coinbase, a leading exchange, as its trading partner.

The platform has no account management or custody fees and allows clients to invest in over 150 different cryptocurrencies with just a $10 minimum investment. Alto Crypto IRA also offers alternative asset options, such as gold and silver.

The main downside to this platform is that it charges a 1% fee for transactions, and there are no rewards for staking. Likewise, there is no option to set up direct funding or invest from existing IRAs.

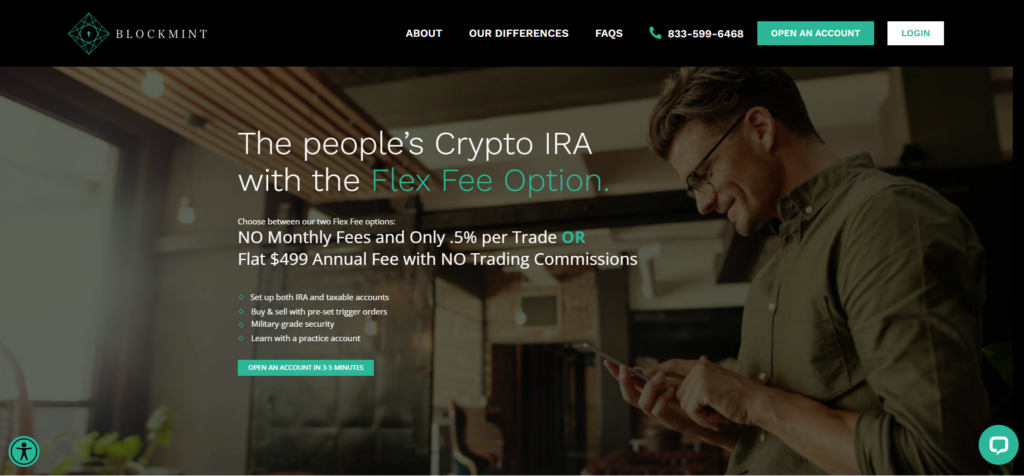

10. Blockmint

Blockmint is a Bitcoin IRA provider that makes trading and contributing to crypto simpler. The company partners with New Direction to provide better services but is not the same company.

This company uses offline cold storage vaults to safeguard client funds and offers reliable customer service. It also has a minimum investment requirement of $20,000 and charges a 15% starting fee on trading. Blockmint allows you to invest in Bitcoin, Ethereum and Litecoin. It also offers tips on how to invest.

BlockMint’s trading platform is not as sophisticated or fast as some of its competitors.

Final Thoughts

The best Bitcoin IRAs for you may be different from someone else’s. Ultimately, it all comes down to your investment needs and goals. Look for the basics we mentioned, like security, fees, tax benefits, and a range of services. But beyond that, do your own research.

You want the overall best? Go for Bitcoin IRA.

Your top priority is security? Go for BittrustIRA.

Want something flexible? Choose Broad Financials.

Want loads of options? Choice is the answer.

Long story short, this list of best Bitcoin IRAs in 2023 has it all.