Crypto IRA: Is it Really Worth it in 2022?

Crypto is making its way in all sectors, including IRAs. Today, many people are opening up crypto IRAs, hoping to become a millionaire by the time they retire. And honestly, it’s not a far-fetched idea.

According to data published by Congress last year, approximately 28,000 people have IRAs worth over $5 million.

Isn’t that crazy? Who knows how many of them are cryptocurrency IRAs?

And given the potential of Bitcoin and the speculations that it’ll eventually cross $100k in value, it makes sense. Or maybe not.

Along with tremendous potential, crypto is also tremendously risky.

In this article, we’ll talk all about crypto IRAs, how it works, how it’s taxed, pros, cons, risks and lastly, if it’s really worth it.

Understanding Crypto IRA

Crypto IRAs are essentially the same as your usual IRAs. The only difference is you’re not investing in traditional assets like stocks and securities. Instead, you’re investing in cryptocurrency.

Most self-directed IRAs allow you to invest in alternative assets that include cryptocurrency, along with real estate and gold or other precious metals.

How Does it Work?

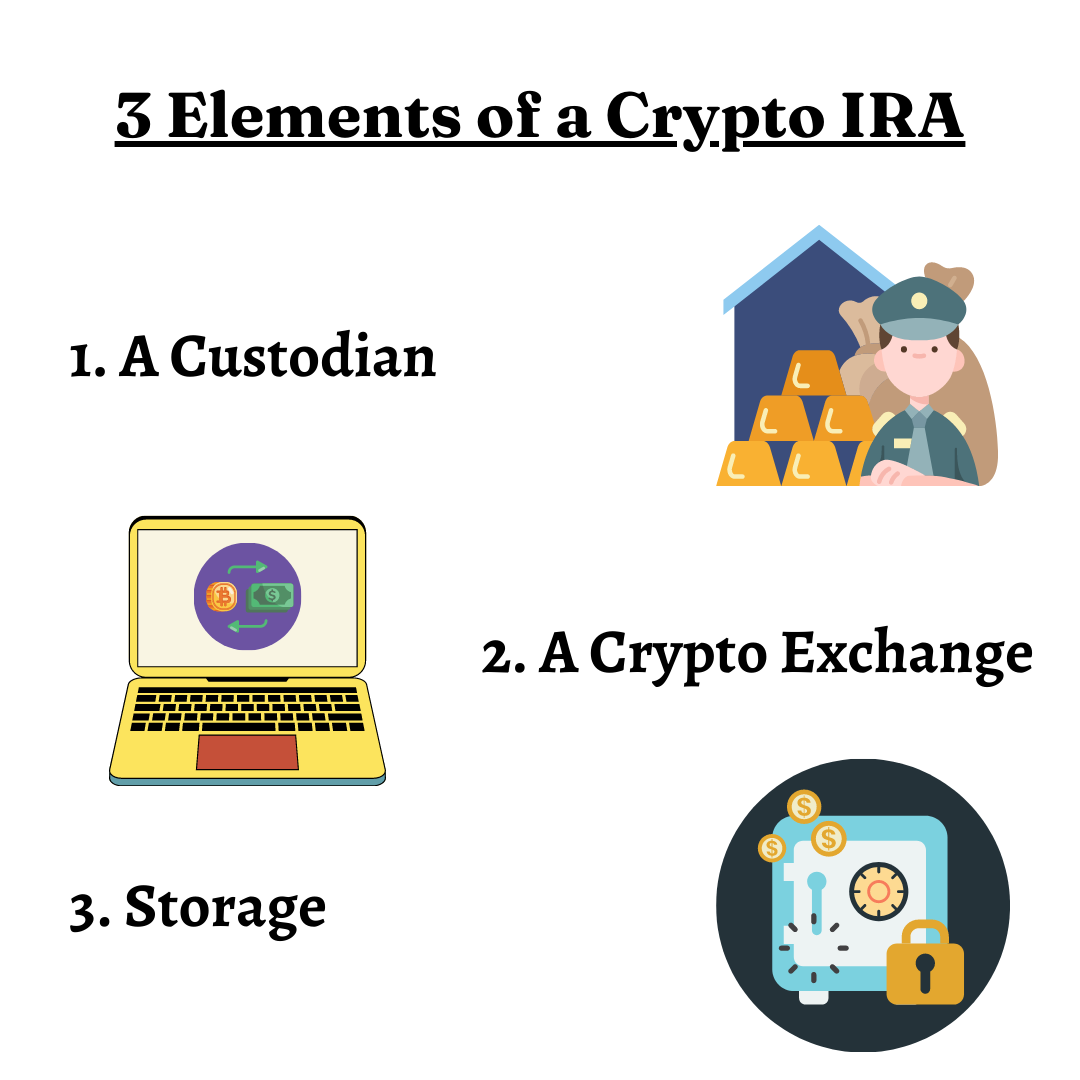

You need the following three elements to open and manage a crypto IRA – a custodian, a crypto exchange and storage.

Let’s break down each and figure out how it all fits.

The custodian is usually an institution or a firm that holds your IRA. Typically, in the case of a traditional asset, this role would be played by a financial institution like a bank, responsible for keeping it safe and making sure it adheres to regulations.

However, the custodian may not be responsible for making investment decisions. That’s still your responsibility.

A crypto exchange is a platform where you can buy and sell cryptocurrencies like Bitcoin, Ethereum, Dogecoin, etc. It’s pretty obvious why you need it – to buy (and sell) crypto for your IRA. Here is a list of the 5 best crypto exchanges in the US.

Lastly, storage. As we mentioned before, it’s the custodian’s responsibility to store your crypto and keep them safe.

Taxes on Crypto IRA

We already know that IRA has tax benefits, but what are they?

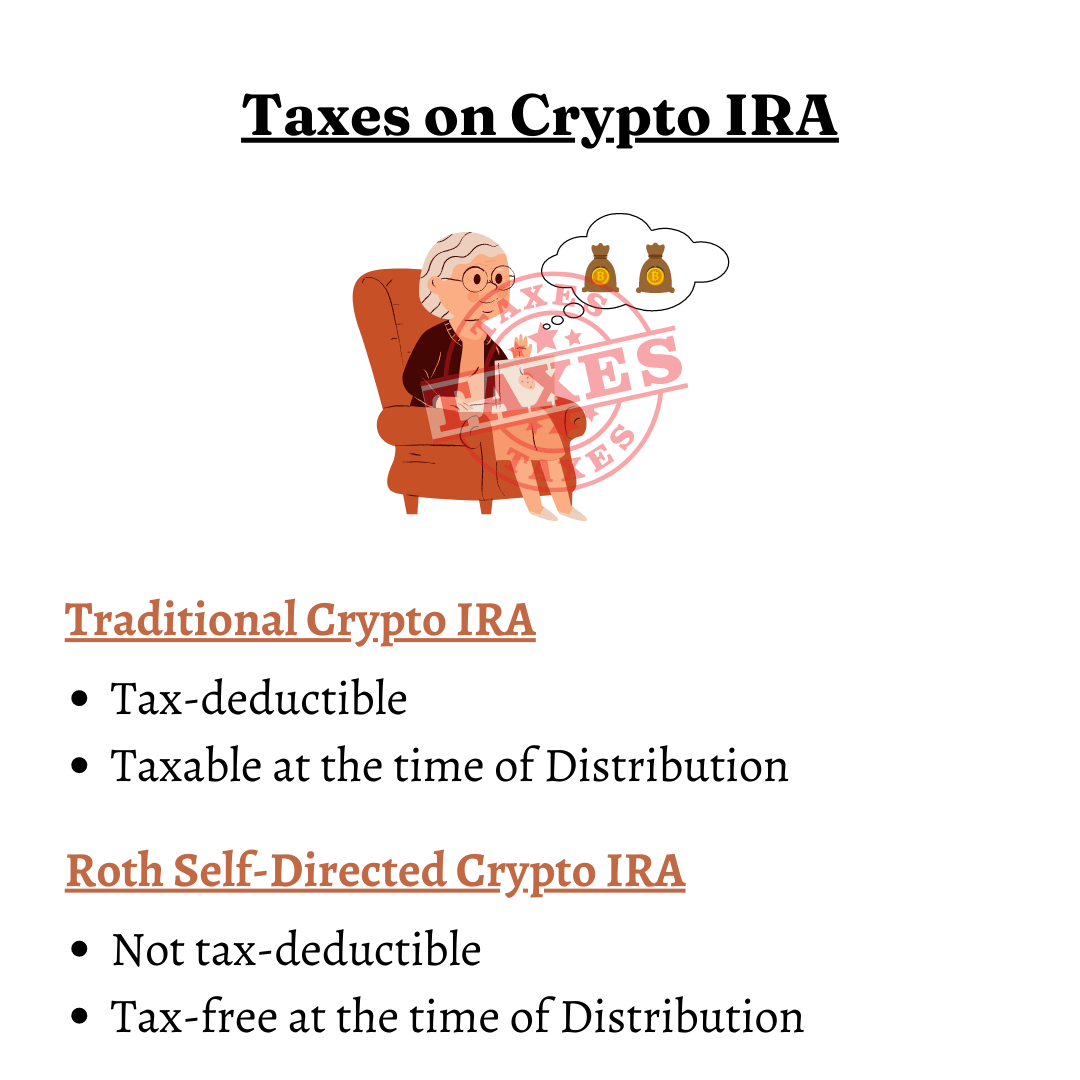

Well, taxes work differently based on what kind of crypto IRA you have. There are primarily two kinds of IRA – Traditional IRA and Roth self-directed IRA.

Traditional Crypto IRA

In a traditional crypto IRA, you get to enjoy your tax benefits immediately.

How?

Well, contributions to a traditional IRA are tax-deductible, meaning you can deduct the amount you invest in your IRA from your yearly taxable income. However, keep in mind that there are certain limitations to how much you can deduct.

But in the long term, when you withdraw your funds at retirement, you’ll be liable to income tax.

Roth Self-Directed Crypto IRA

In a Roth self-directed crypto IRA, you don’t get any immediate tax benefits, but all your distributions at the time of retirement are tax-free.

It means you don’t have to pay any capital gains taxes or income taxes on your earnings at withdrawal.

However, it also means that you can’t deduct your contributions from your taxable income.

Nonetheless, most people still prefer Roth self-directed IRAs over traditional IRAs.

To know more about how crypto taxes work, read this.

Benefits of Crypto IRA

One of the most evident benefits of crypto IRA is its potential for high returns.

Cryptocurrency has rapidly risen in value over the last decade, probably more than any other asset or property. So, there’s a high probability that it will continue to rise at this pace. And if that does happen, some of you might just get filthy rich.

However, we don’t wanna count that in as a benefit because there are far too many risks associated with it that we will discuss later in this article.

So, other than that, here are the two main benefits of crypto IRA –

Tax Benefits

Whether you choose to invest in a traditional IRA or Roth self-directed IRA, you’ll receive tax benefits on both.

Other than the direct tax benefit, you’ll also be relieved of the overburdening responsibility of keeping track of all your trades and transactions for tax reporting purposes.

It’s the single most frustrating aspect of reporting crypto taxes that annoys taxpayers. Outside of a crypto IRA, you can use Bitcoin.Tax to solve this problem.

Bitcoin.Tax is a crypto tax software that collects all your trade history from all the different exchanges and wallets you’ve been using. Not only that, but it also calculates capital gains taxes, incomes taxes and any other taxes. Plus, it helps prepare and file your tax report.

Portfolio Diversification

Diversification is one of the setting stones of a successful investment strategy. Still, most Americans usually only invest in stocks and bonds for their IRA.

Investing in alternative assets like cryptocurrency will not only help you diversify your portfolio but also help you maximize your returns.

Drawbacks of Crypto IRA

Investing in a crypto IRA isn’t just all good. There are drawbacks as well.

Costs

There are many costs associated with a crypto IRA, especially with a self-directed one. Costs like set-up fees, trading fees, management fees and much more.

It can get really costly.

So, make sure you account for all the costs and fees involved with your particular IRA provider and type before investing.

Limitations

There are two kinds of limitations. The first one is pretty straightforward – you’re not allowed to contribute more than $6000 in the years 2021 and 2022. If you’re 50 or older, the limit is $7000.

The other limitation is the one that comes with choosing a particular custodian or crypto IRA company. Most companies will only allow you to trade crypto on a crypto exchange that they are affiliated with.

Risks of Crypto IRA

Now that we’re done with the pros and cons. Let’s talk about some risks associated with crypto IRAs.

Volatility

The first and most obvious one is cryptocurrency’s volatile nature.

Crypto prices can shoot up the roof and fall just as quickly. The last thing you want is to invest your hard-earned money in a crypto IRA and see your valuation go down over the years.

However, as we discussed before, crypto is a high-risk, high-reward bet. You may lose all your money or become a millionaire.

That being said, there are ways you can moderate this risk. You just have to be smart about your investment strategies.

Don’t invest all your money in this. Remember, we talked about diversification.

Also, invest in small amounts that you’re comfortable losing. Avoid investing in trendy coins that come and go. Try to stick with the big ones like Bitcoin and Ethereum.

Government Bans

Though it’s highly unlikely, it’s something to consider.

Just last year, we saw China ban crypto. There are many countries that see crypto as a threat to the government and economy for various reasons.

Before Russia invaded Ukraine, the Central Bank of Russia also proposed a ban on crypto.

So far, the US has shown no such intention of banning crypto, but that can change at any moment.

It’ll likely never happen, but it’s still a risk if you’re investing in a crypto IRA.

Is Crypto IRA Worth it?

We have provided you with all the information you need to answer this question on your own.

We’re not experts in investment and trading strategies, but if you’re wondering what the experts think, they mostly warn against it.

However, that shouldn’t stop you from doing your own research and coming to your own conclusions.