Crypto Tax Software – Streamline Crypto Tax Reporting

Crypto tax software simplifies the tax reporting process for crypto investors and traders. By addressing the complexities unique to digital assets, like crypto and NFTs, these tools allow users to track and calculate their taxes more efficiently and ensure compliance with tax regulations.

Accurate tax reporting is a top priority for crypto investors and traders, as it ensures compliance with tax regulations and helps avoid hefty fines and penalties. However, the complexities of crypto transactions can make this process overwhelming and time-consuming. This is where crypto tax tools come to the rescue.

In this guide, we’ll explore the benefits, features, and limitations of crypto tax software, helping you understand how these tools can help you streamline the tax reporting process.

What is Crypto Tax Software?

Crypto tax software refers to specialized tools designed to simplify the tax reporting process for crypto investors and traders.

By automating various aspects of crypto tax reporting, these tools alleviate the otherwise daunting task of manually calculating and reporting capital gains or losses, income from staking or mining and other taxable events related to cryptocurrencies.

Additionally, they help users stay compliant with tax regulations by generating accurate tax reports and forms specific to the crypto tax laws of their country.

These crypto tax tools provide users with a centralized platform to track, manage, and calculate their crypto transactions while offering features tailored to handle the unique challenges of cryptocurrencies, such as multiple exchanges, various types of digital assets, such as different tokens and NFTs, and complex transaction histories.

How Do They Work?

We know what crypto tax software does, but how does it do what it does? From importing transaction data to generating tax reports, what are the steps involved? Let’s take a look.

First, you must import your transaction data into the software. Crypto tax tools provide multiple methods for importing data, ensuring flexibility and convenience for users. The most common two are – API integrations and uploading CSV files.

API integration allows users to retrieve information from one application (an exchange) to another (a crypto tax calculator), eliminating the need for manual entry. Alternatively, users can also import transaction data using CSV files by downloading their transaction history from an exchange or wallet in a CSV format and uploading it to their choice of tax tool.

Some crypto tax software, like Bitcoin.Tax, goes a step further by allowing users to import trades directly from popular exchanges such as Coinbase, Binance, Gemini, Kraken, and more. This direct integration simplifies the process even further, allowing users to import transactions with just a few clicks.

Once you import the transaction data, the crypto tax software works its magic. Behind the curtains, these tools utilize advanced algorithms and built-in tax rules for different countries to classify transactions and calculate taxable events.

For example, they can easily separate buy-and-sell transactions from mining and staking rewards. Furthermore, the software factors in cost basis, holding periods and applicable tax rates to calculate capital gains or losses accurately.

Once that is done, the tool will generate comprehensive tax reports and a clear overview of their tax obligations. As mentioned, some software will generate tax forms specific to your country, like Form 8949 in the US, to assist users in accurately reporting their crypto activities to tax authorities.

Key Features of Crypto Tax Tools

Crypto tax tools offer a range of essential features that simplify the tax reporting process for crypto investors and traders, such as:

Portfolio Tracking: Most crypto tax software allows users to track and manage their crypto portfolios in one centralized platform, providing a comprehensive overview of their holdings, including the current values and performance of each asset. Users can monitor their investments and track changes in portfolio value over time.

Transaction Categorization: These tools can recognize and classify various types of transactions, such as buys, sells, trades, mining rewards, staking income and more. Accurate categorization ensures proper identification of taxable events. Therefore, precise calculation and reporting of capital gains and losses.

Tax Form Generation: As mentioned before, one of the primary benefits of crypto tax software is the ability to generate accurate and detailed tax reports and forms, summarizing the user’s crypto-related activities.

In addition to these essential features, some crypto tax software may offer additional functionalities to enhance the user experience, such as:

Tax-Loss Harvesting Suggestions: Some advanced crypto tax tools, like Bitcoin.Tax, provide suggestions for tax-loss harvesting. They automatically analyze the user portfolio and identify opportunities to strategically sell cryptocurrencies at a loss to offset capital gains, allowing users to reduce their tax bills.

Audit Defense Support: Certain crypto tax software may also offer audit defense support, providing users with guidance and assistance in case of audits or tax-related inquiries from authorities. They do this by generating audit-ready reports and providing documentation to support the accuracy of the reported crypto transactions.

Integration with Popular Tax Preparation Program: Some crypto tax tools integrate with widely used tax preparation programs, such as TurboTax and TaxACT. It streamlines the overall tax filing process by directly transferring your crypto-related tax data to your preferred tax preparation tools.

Benefits of Using Crypto Tax Tools

Time Savings: By automating various processes, such as transaction categorization and tax form generation, these tools save you valuable time that you can better utilize in other aspects of your life.

Accuracy: With the specialized algorithms and built-in tax rules, crypto tax tools ensure accurate calculations of taxable events, capital gains and losses. By eliminating the possibility of human error, they significantly reduce the risk of potential penalties and audits.

Ease of Use: These tools are designed to be user-friendly, even for individuals without a deep understanding of tax regulations. Most crypto tax calculators have intuitive interfaces and guided workflows, allowing users to easily navigate the software, import transaction data, and generate tax reports.

Identification of Tax Deductions: By analyzing the transaction data, these tools can highlight eligible deductions, such as transaction fees, mining expenses, crypto gifts or donations, allowing users to maximize tax savings.

Clear Overview of Crypto Tax Situation: Crypto tax software offers users a holistic view of their crypto tax situation by providing detailed reports summarizing capital gains, income from mining or staking and other taxable events.

Limitations of Crypto Tax Tools

While these tools are way more accurate than trying to crunch the numbers manually, they do rely on the accuracy of the transaction data you provide. So, make sure you enter all the correct data and don’t leave anything out, or you might end up with incorrect results that don’t reflect the reality of your crypto activities.

This is especially true for DeFi transactions where you might need to make manual adjustments, as these tools might fail to capture some of the intricacies and nuances of various crypto transactions.

Remember, these crypto tax calculators are fantastic tools, but they do have their limits. They can save you loads of time and prevent significant errors, but they can’t replace the expertise of a professional. After all, CPAs and accountants are expensive for a reason.

So, use crypto tax software to simplify your taxes, but always double-check those generated tax reports to ensure accuracy and consistency. Lastly, if something seems off or you’re dealing with complex transactions, don’t hesitate to bring in a crypto tax professional.

Best Crypto Tax Tools in 2023

The following are some of the best crypto tax software of 2023:

- Bitcoin.Tax

- Cointracking.info

- Koinly

- Cointracker

- ZenLedger

To read more about each of these in-depth, check out our list of 5 best crypto tax software.

Do You Need Crypto Tax Software?

Deciding whether to use crypto tax software depends on various factors.

Firstly, the volume and complexity of your crypto transactions. If you have a high volume of crypto transactions or engage in complex activities like trading across multiple platforms, staking or participating in DeFi protocols, crypto tax software can be a real game-changer for the reasons discussed above.

Secondly, if you’re not too well-versed with crypto tax rules in your country, using crypto tax software can lift that burden off your shoulder.

However, it’s a double-edged sword. These tools might make it easier for you to report your gains and income without an extensive understanding of crypto taxes, but they will also make you blind to any potential error. That is why you must have a basic understanding of how crypto taxes work in your country.

Beyond that, there are instances where a crypto tax tool alone isn’t enough, and you need professional help. For example, if you’re dealing with unusual transactions or tax situations, like yield farming rewards or if you’re a US expat.

Some individuals may also have complicated tax situations beyond digital assets, such as multiple income streams, business ownership or international tax considerations that require professional expertise and experience to navigate the complexities, optimize tax savings and handle any potential audits or inquiries from tax authorities.

Or maybe you just prefer a CPA or accountant to handle your crypto taxes to save time and headaches. Whatever it is, the decision to use crypto tax software depends on your comfort level, expertise and need for assistance in navigating the crypto tax landscape.

How Much Does Crypto Tax Software Cost?

While most crypto tax software offers a free membership with limited features and functionalities, it’s usually the paid product that is actually useful.

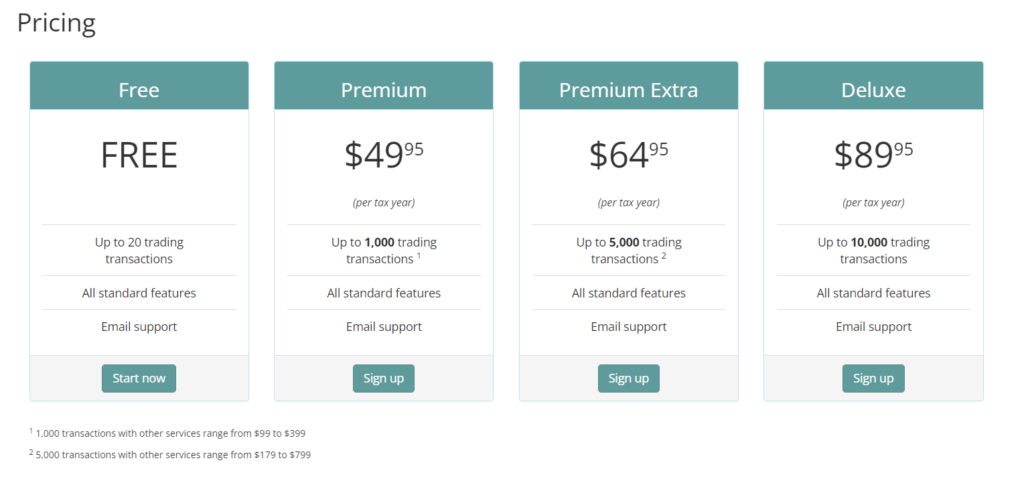

Most crypto tax tools employ a tiered pricing structure based on transaction volume, additional features and support. Basically, the more transactions and trades you would like to import, the higher you would have to pay. This model allows users to choose a pricing tier that aligns with their specific needs and budget.

Typically, a standard subscription plan, allowing up to 1000 transactions, will cost anywhere around $50-$150, depending on the platform and features offered. Bitcoin.Tax is one of the most affordable yet highly functional crypto tax calculators, with plans starting as low as $49.

While you may have to pay an upfront cost when using crypto tax tools, the time and effort you save by automating the tax reporting process is substantial. Plus, by using crypto tax software, you can also prevent potential penalties or audits that may arise from manual reporting errors.

Is Crypto Tax Software Worth it?

After considering the time saved, reduced risks and improved accuracy in comparison to its cost, paying for a crypto tax tool is a no-brainer.