7 Tax-Saving Strategies to Reduce Crypto Taxes

Taxes, especially crypto taxes, can be a real headache. That’s why most people like not to think about taxes until tax season comes around. However, seasoned crypto investors know that creating a year-round tax-saving strategy is crucial to reduce taxes as much as possible. Otherwise, you could be losing many good opportunities to save a lot of taxes.

In this article, we will share with you the 7 crypto tax-saving strategies that will help you massively reduce your crypto taxes.

1. Tax Loss Harvesting

Tax loss harvesting is the process of deliberately selling crypto sitting at a loss to realize a capital loss, which you can use to offset your other capital gains.

Suppose you bought 2 Bitcoins for $5000 and 5 Ethereum for $9000 in 2019.

Two years later, you sell the 2 BTC for $8000, realizing a capital gain of $3000.

At the same time, the 5 ETH you bought has now depreciated in value and is priced at $8000.

Now, you can go one of two ways.

You hold those 5 ETH and pay taxes on the realized capital gain of $3000.

You sell those 5 ETH, realizing a capital loss of $1000 that you use to offset your capital gains. Hence, paying taxes on only $2000, instead of $3000.

Tax-loss harvesting is a very popular and widely used tax-saving strategy. However, like anything else, there’s a right way to go about it and a wrong way. Check our Guide to Crypto Tax Loss Harvesting to know how to harvest loss the right way.

2. Wash Sale Loophole

The wash sale strategy is more of a loophole than a strategy. But still, many people use it to lower their crypto taxes. So, why not?

It’s almost the same as tax-loss harvesting. The only difference – after selling your crypto for a loss, you buy them back.

Let’s take the previous example of tax-loss harvesting. After selling those 5 ETH for a loss of $1000, you immediately buy back 4 ETH. Not only did you offset your capital gains by $1000 but also got to keep your assets to yourself.

The IRS has a wash sale rule that prevents taxpayers from exploiting this loophole. But luckily for crypto investors, the rule only applies to securities, and as we all know, crypto is treated as a property by the IRS. So, the wash sale rule doesn’t apply to crypto.

3. Donate Crypto

Crypto donation is one of the best tax-saving strategies. It’s a win-win for everyone. According to the IRS, donating crypto is not only tax-free but tax-deductible. What this means is that you can deduct the amount you donate to any qualified charity from your capital gains or ordinary income to save more taxes.

For example, if you donate $5000 worth of crypto to a qualified charity, you can deduct $5000 to offset capital gains or lower your ordinary income (up to $3000) to reduce income taxes.

You get to save more taxes while giving back. Isn’t it a win-win situation? Check out How Crypto Donations Can Help you Save More Taxes to know all about it.

4. HIFO Accounting Method

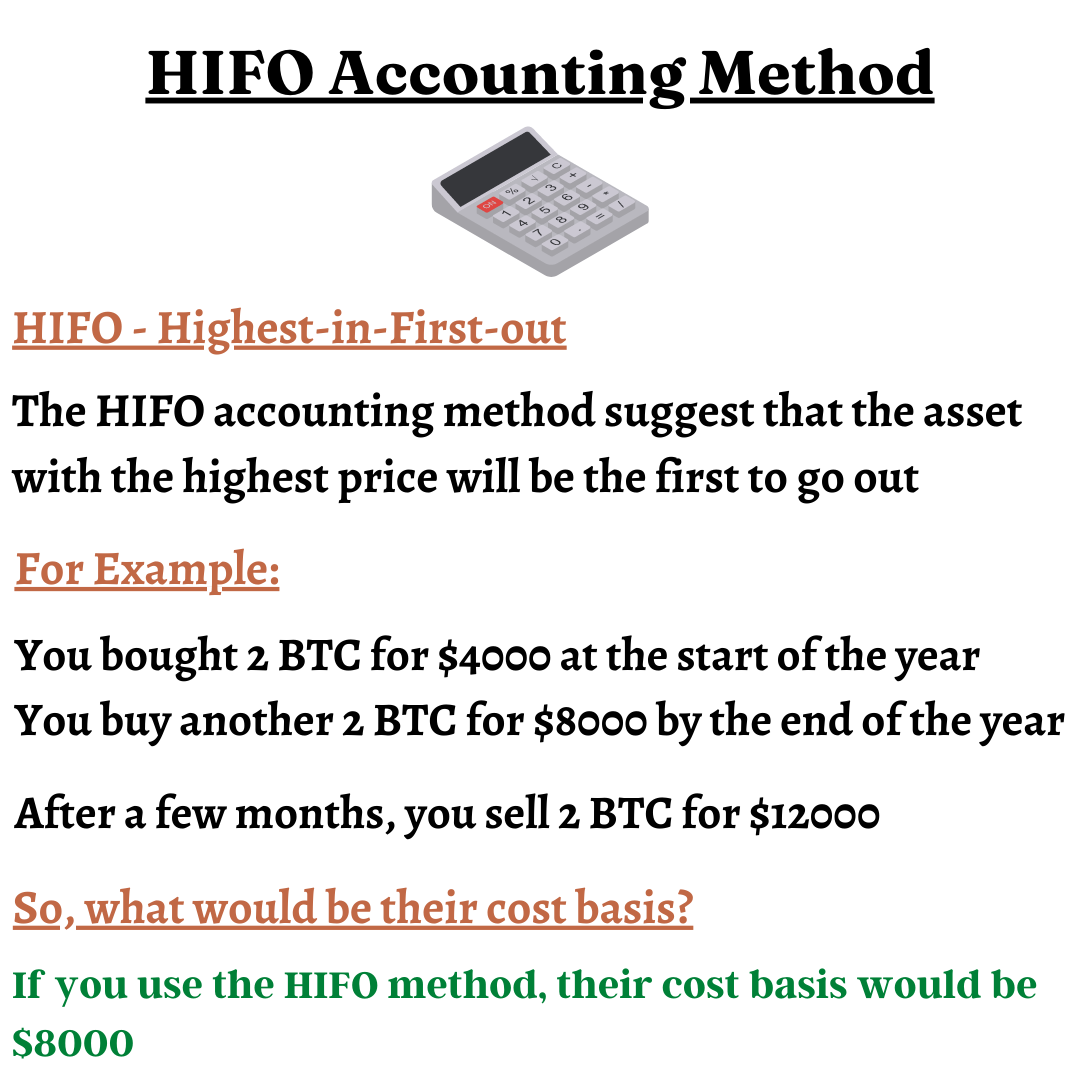

There are three major accounting methods to calculate your taxes – First-in-first-out (FIFO), last-in-first-out (LIFO) and highest-in-first-out (HIFO).

Generally, most US taxpayers use the FIFO method because it’s the easiest and most popular method. However, in some cases, using the appropriate accounting method can save you a lot of taxes.

How? Here’s how.

Suppose you bought 2 BTC for $4000 at the start of the year. By year-end, you buy another 2 BTC for $8000.

After a few months, you sell 2 BTC for $12000. Now, the problem arises – what is the cost basis of the 2 BTC you sold, as that is the determining factor for calculating capital gains.

As we mentioned, FIFO is pretty easy and straightforward. It suggests that the first asset you buy will be the first to go out. Using this method, the cost basis of those 2 BTC you sold would then be $4000. Hence, realizing a capital gain of $8000.

However, the HIFO method suggests that the asset with the highest price will be the first to go out. In that case, the cost basis of those 2 BTC you sold would then be $8000. Hence, realizing a gain of only $4000.

As you can see, using the FIFO method, you pay taxes on $8000. But using the HIFO method, you pay taxes on only $4000. Huge difference.

However, there are a few caveats. In order to use the HIFO method, you’ll be required to specify which assets you’re disposing of with the help of specific identification. Bitcoin.Tax allows you to do that.

Other than that, keep in mind that the IRS expects you to be consistent with your accounting method, meaning if you’re using HIFO, you must consistently use HIFO every tax year. You can’t use a different accounting method every year. So, if you’re transitioning to HIFO, make sure you consult with a tax professional to know if it’s really the best idea for you long-term.

5. Wait for Long-Term Capital Gains

If you sell your crypto within 365 days of buying it, you realize a short-term capital gain (or loss). If you sell your crypto after 365 days of buying it, you realize a long-term capital gain (or loss).

Short-term capital gain tax rates range from 10%-37%, while long-term capital gain tax rates range from 0%-20%.

Most US taxpayers pay 15% tax rates on long-term capital gains, while a few lucky people pay 0% tax rates. That is only possible if taxable income is $80,800 or less for married couples and $40,400 or less for single filers. Check out our article on US Cryptocurrency Tax Rates in 2021 to see the full tax brackets, both long term and short term.

It’s pretty evident that holding your crypto for at least a year before selling is much more profitable in the context of taxes.

But that’s not all.

An even better but underrated tax-saving strategy is holding your crypto for more than a year before selling them, so you pay less or even no taxes at all on your capital gains. But instead of leaving it at that, you buy back your crypto to set a new, higher-cost basis. So, the next time you sell it again, you pay even lesser taxes.

6. Move to Puerto Rico

Moving to Puerto Rico as a tax-saving strategy may sound absurd until you hear that Puerto Rico charges 0% capital gain taxes. It’s one of the most crypto-friendly countries. However, despite a great tax benefit, moving to Puerto Rico just to save taxes still wouldn’t make sense for most crypto investors unless you’re a crypto whale. Why? Because the cost of living there might end up being more than what you save on your taxes.

According to the recent Bona Fide Residency Requirement under Act 60-2019, you must buy a house within two years of moving to Puerto Rico. Due to this law, Puerto Rico has seen a huge spike in real estate prices lately, making it extremely difficult and expensive to move there.

So yeah, unless you’re a full-time crypto investor dealing in millions of dollars worth of crypto every day, this option is not suitable for you.

However, some states, including Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming, don’t have any income taxes.

US taxpayers pay an average of around 33%-40% of their total income in taxes. That’s almost half of their total earnings. So, moving to one of these states with lesser to no income tax rates and cheaper living costs could still be a great option to reduce your overall taxes.

7. Consult a Tax Professional

This might seem painfully obvious but we must add this to our list because it’s one of the better ways to save more taxes. The best tax-saving strategy you can use is one that you create by sitting and discussing with your tax professional.

This way, your tax professional can look at your case individually with better communication to devise a strategy that best suits you.

How Bitcoin.Tax Can Help you?

No matter which tax-saving strategy you use, the most difficult part of it all is collecting all the transactional data from different wallets and exchanges you have been using and calculating your taxes.

Bitcoin.Tax is the leading crypto tax software in the market that allows you to automate your tax reporting process. All you have to do is connect all your wallets and exchanges to our software and sit back and relax while Bitcoin.Tax does all the work.