Crypto Taxes in Canada – Everything you Need to Know

As you’ll find out in this article, crypto taxes in Canada are pretty straightforward, but as you know, when it comes to taxes, nothing is as simple as it looks.

Unlike in the US, cryptocurrency is not treated as property here.

Also, not all profits on crypto sales qualify for capital gains.

In this article, you’ll find out –

- How the CRA treats crypto?

- What taxes do you pay on profits made from crypto?

- What taxes do you pay on crypto mining?

- How to calculate your crypto taxes?

- The importance of keeping records.

How the CRA Treats Crypto

The CRA views cryptocurrency as commodities – a capital property like a stock. Therefore, all profits made from crypto either qualify as business income or capital gains.

Similar to the IRS in the United States, the CRA also works with almost all large crypto exchanges to extract information and track crypto transactions.

It allows them to monitor if taxpayers are complying with government guidelines on crypto taxes in Canada.

Business Income or Capital Gain?

We can divide crypto taxes in Canada into two categories – business income taxes and capital gains taxes.

But how do we determine the difference between the two?

When do we pay business income taxes, and when do we pay capital gains taxes?

First, we need to understand how the CRA defines business income.

According to the CRA, if you fit in one or all of the following criteria, you’ll be liable to business income taxes –

- You carry out crypto activities intending to make profits.

- You carry out regular or repetitive crypto activities to make profits.

- You carry out crypto activities in a commercial or business-like manner.

- You promote goods or services.

Based on this, most people involved in business-like activities will pay business income, including activities like trading crypto, mining crypto or staking crypto.

Business income will be taxed as per the income tax rates for the current year.

Now, let’s talk about capital gains.

Profits made from crypto that doesn’t qualify for business income will qualify for capital gains.

Some examples of crypto transactions that qualify for capital gains include:

- Swapping one crypto for another.

- Spending crypto to buy goods and services.

- Gifting crypto.

Interestingly, only half of your capital gains are taxable.

So, for example – if you realize a gain of $10,000 on selling a few Bitcoins, you’ll only pay capital gains taxes on $5,000.

Also, you’re only allowed to offset losses against capital gains and not ordinary income.

And that’s how crypto taxes in Canada works.

Crypto Taxes in Canada on Mining

Generally, crypto mining is taxed as business income. However, there are a few exceptions.

What taxes you pay depends on how you’re carrying out your mining operations.

According to the CRA, if you’re mining crypto in a commercial, business-like manner, you’ll most likely pay business income taxes.

What does that mean?

Basically, if you have a property or house, equipment, maybe even employees, or a team dedicated to mining, you’re most likely running a business and will be taxed as such.

However, if you don’t mine crypto regularly or only do it as a hobby, the tax consequences may vary.

Find out how crypto mining is taxed in the US.

Tax-Free Crypto Transactions in Canada

The following are some tax-free crypto transactions in Canada –

Buying crypto with fiat currency – Since you’re not disposing of your crypto, you’re not liable to any taxes.

HODLing crypto – You can hold onto your crypto for as long as you want without paying your taxes. But as soon as you sell (dispose of) it, you’ll be liable to standard crypto taxes in Canada.

Moving crypto between your own wallets – Once again, since you’re not disposing of your crypto, only transferring it from one wallet to another, you pay no taxes.

Donating crypto to charity – Donations are not only exempt from taxes but are also tax deductibles.

Being gifted crypto – The person who gifts the crypto will get taxed, not the one being gifted.

Creating a DAO (Decentralized Autonomous Organization) – To know what DAOs are, click here.

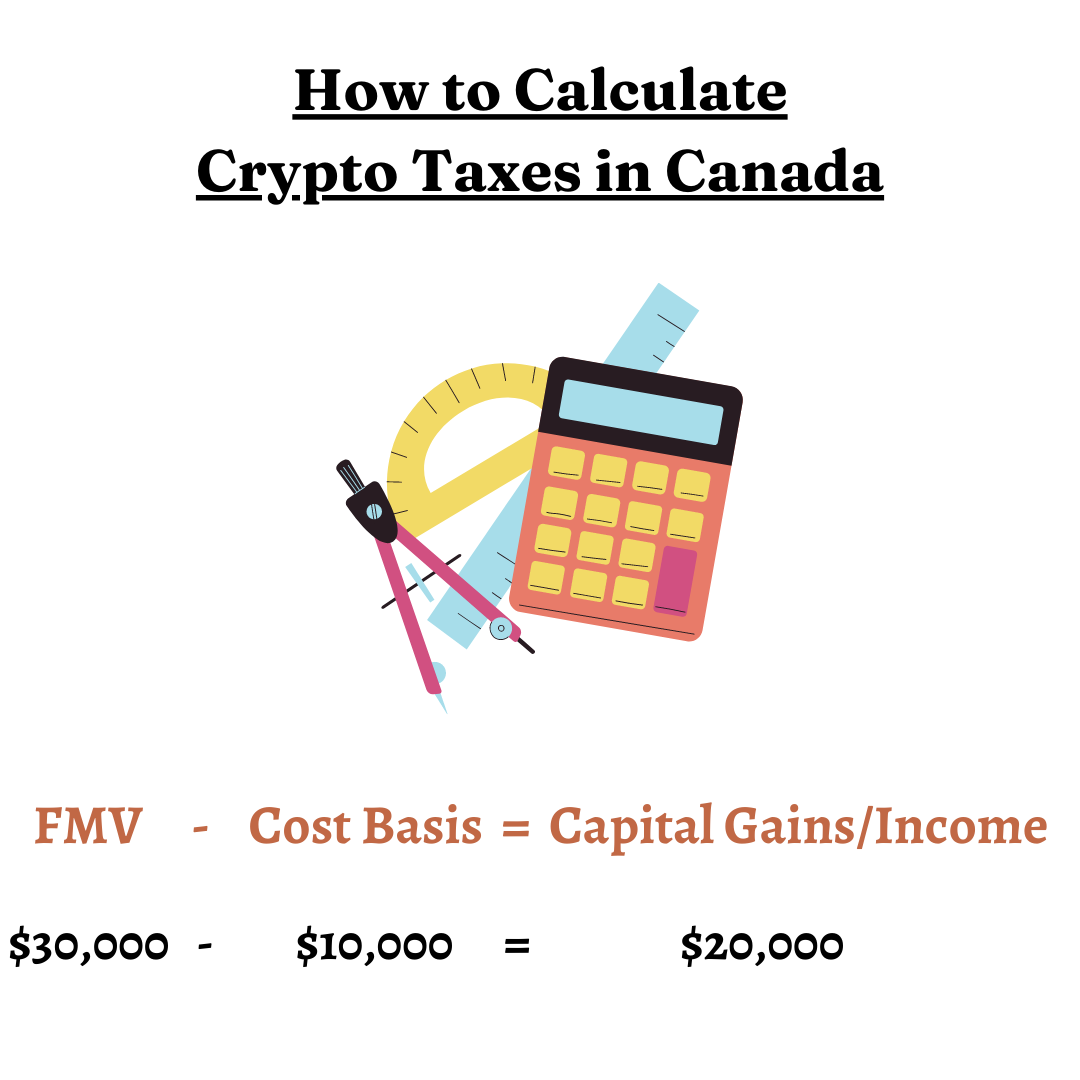

How to Calculate Crypto Taxes in Canada?

Here’s how you calculate crypto taxes in Canada.

FMV (Fair Market Value) – Cost Basis = Capital Gains/Income

Fair market value is the amount the asset or crypto is selling for in an independent and fair market.

Cost basis is the amount you initially paid to acquire or buy the crypto.

And as shown in the equation, the difference between the two is your capital gain or income.

For example –

you buy 5 Bitcoins for $10,000 in 2018.

As of now, the FMV of those 5 BTC is $30,000.

If you sell your 5 BTC, you’ll realize a capital gain of $20,000.

In Canada, you can use the Adjusted Cost Basis accounting method to report business income. The adjusted cost basis method allows you to add gas fees and other costs while buying or selling crypto.

So, while buying the crypto, if you paid an extra $2,000 for gas fees and other exchange costs, your new cost basis will be $12,000.

Similarly, while selling the crypto, if you paid an extra $2,000 in costs, you can deduct that amount from your capital gains.

Importance of Keeping Records

We mentioned this in our US crypto tax guide as well. Keeping records of all your transactions is crucial.

The date you bought a crypto, the price you bought it for, the price you sold it for, etc. This is all the information you need to report your transactions.

To be fair though, it’s not that easy. Especially finding and collecting all the data for particular transactions.

Plus, all of this becomes even more complicated if you use multiple exchanges and wallets, which is, by the way, most of us.

So, good luck doing all that by yourself.

But there’s a solution – Bitcoin.Tax.

If you don’t want yourself grabbing your head from the headache you get trying to do all this yourself, try using Bitcoin.Tax.

It’s a free crypto tax calculator that will automatically find and collect all the transactions from your exchanges and wallets, calculate the taxes and create a tax report. All while you can just sit back and relax.