8 Best Crypto ETFs in the US (2022 Updated)

Crypto ETFs in the US don’t actually track the performance of any cryptocurrency, for instance, Bitcoin.

Instead, most of the popular ones, like ProShares Bitcoin Strategy ETF and Valkyrie Bitcoin Strategy ETF, track the prices of Bitcoin Futures because the US Securities and Exchange Commission (SEC) hasn’t yet approved any spot crypto ETF.

The reason behind it is a little complicated. Check out this guide if you’re interested in learning how ETFs with cryptocurrencies work and the differences between a spot Bitcoin ETF and a Bitcoin Futures ETF.

So when we say crypto ETF, what we’re actually referring to is ETFs that invest in Bitcoin Futures contract, blockchain or crypto-based startups and companies that generate (part of their) revenue in crypto. Keeping that in mind, here is a list of the 8 best crypto ETFs in the US you can invest in to diversify your portfolio with cryptocurrency-related investments.

- 1. ProShares Bitcoin Strategy ETF (BITO)

- 2. Valkyrie Bitcoin Strategy ETF (BTF)

- 3. VanEck Bitcoin Strategy ETF (XBTF)

- 4. AdvisorShares Managed Bitcoin Strategy ETF (CRYP)

- 5. Siren Nasdaq NexGen Economy ETF (BLCN)

- 6. Amplify Transformational Data Sharing ETF (BLOK)

- 7. Global X Blockchain ETF (BKCH)

- 8. Bitwise Crypto Industry Innovators ETF (BITQ)

- Final Thoughts

1. ProShares Bitcoin Strategy ETF (BITO)

The U.S. ProShares Bitcoin Strategy ETF was the first crypto ETF to get approved by the SEC in October 2021. Within two days of its launch, the ETF attracted over $1 billion in assets. Even since then, it has been the favorite among investors and traders. Currently, they only have $815 million in assets under management.

Instead of tracking the price of actual Bitcoin, BITO gathers investors’ funds and invests in Bitcoin Futures to sell its shares back to investors. The prices start from $11. Along with Bitcoin Futures contracts, it may also invest in Treasury securities and cash.

1.2 ProShares Short Bitcoin ETF (BITI)

Launched only in June 2022, ProShares Short Bitcoin ETF (BITI) allows investors to profit off declines in Bitcoin prices.

BITI has already become the second largest crypto-focused ETF in the US, with $647 million in assets under management, making it one of the best crypto ETFs to invest in right now.

This is in line with the current market sentiment toward cryptocurrency and Bitcoin. Bitcoin has significantly dropped in prices this year, and a short Bitcoin ETF at a time like this was the perfect way to capitalize on the current market sentiment.

Its prices start from $39.40.

2. Valkyrie Bitcoin Strategy ETF (BTF)

Launched just three days after ProShares Bitcoin Strategy ETF, Valkyrie Bitcoin Strategy ETF also invests in Bitcoin futures contracts.

It, however, attempts to buy equal to 100% of its net assets. Any remaining assets will include U.S. government securities, money market funds and corporate bonds.

It currently holds $22 million in assets under management and is selling at $7.29.

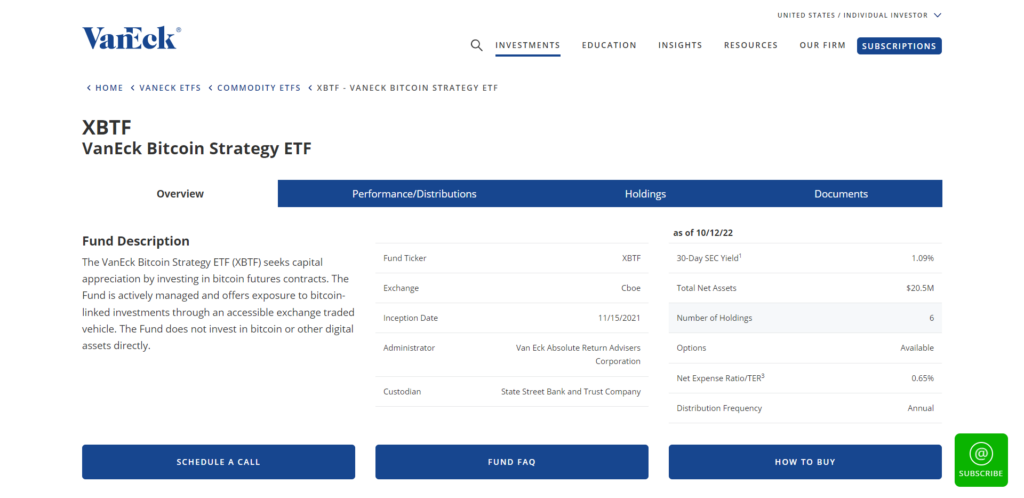

3. VanEck Bitcoin Strategy ETF (XBTF)

Launched in November 2021, VanEck Bitcoin Strategy ETF is a strong competitor to ProShare Bitcoin Strategy ETF, mainly because of two reasons – its low expense ratio of 0.65% and its tax benefits.

In terms of its assets, it’s not much different from ProShare Bitcoin Strategy ETF and Valkyrie Bitcoin Strategy ETF, as it also invests in Bitcoin Futures contracts and little in Treasuries and cash. It currently has $22 million in assets under management and sells at $18.50.

Unlike other ETFs, VanEck Bitcoin Strategy ETF is not registered as an investment corporation. Instead, it’s a C-corp. Therefore, they are not required to distribute long-term gains as dividends to investors. This is good news for investors, as it means lower taxes.

4. AdvisorShares Managed Bitcoin Strategy ETF (CRYP)

Launched in April 2022, AdvisorShares Managed Bitcoin Strategy ETF is one of the newest entries in our list of best crypto ETFs in the US.

In terms of the assets it invests in, it’s the same as the previous ones – Bitcoin Futures contracts. Currently, it has around $184,000 in assets under management and sells at $16.27.

5. Siren Nasdaq NexGen Economy ETF (BLCN)

Siren Nasdaq NexGen Economy ETF is the first in this list of best crypto ETFs in the US that doesn’t invest in Bitcoin Futures ETF. Instead, it tracks the performance of the Nasdaq Blockchain Economy Index, where investors can own part of the shares.

But then, how is it a crypto-related ETF?

Well, the Nasdaq Blockchain Economy Index includes stocks of businesses that are developing or using blockchain technology. For example, Coinbase, Marathon Digital Holdings, Canaan, Microstrategy, Hewlett Packard, etc.

So, even though you’re not technically profiting off cryptocurrency prices, you’re getting exposure to the crypto and blockchain space. Siren Nasdaq NexGen Economy ETF currently has over $114 million in assets under management and sells at $24.15.

6. Amplify Transformational Data Sharing ETF (BLOK)

Launched in 2018, Amplify Transformational Data Sharing ETF is one of the biggest ETFs in its category.

Amplify Transformational Data Sharing ETF invests 80% of its assets in equity securities of companies involved in developing and utilizing the blockchain transformational data-sharing technologies and the blockchain technology as a whole. The rest of the 20% is invested in companies partnered with BLOK.

Amplify Transformational Data Sharing ETF has over $500 million in assets under management and sells at $19.32.

7. Global X Blockchain ETF (BKCH)

Global X Blockchain ETF is a unique ETF. It’s similar to the last two ETFs because it invests in stocks of businesses in the crypto space instead of actual cryptocurrencies, like Bitcoin or Bitcoin Futures contracts.

However, this ETF only invests in companies and organizations that are employing blockchain technology and will benefit from its wider adoption beyond crypto. This may include organizations that deal in digital asset mining, blockchains and digital asset transactions, blockchain applications and dApps.

Global X Blockchain ETF has over $65 million in assets under management and sells at $6.04.

8. Bitwise Crypto Industry Innovators ETF (BITQ)

The Bitwise Crypto Industry Innovators ETF is quite similar to the previous ETF,

Bitwise Crypto Industry Innovators ETF has over $63 million in assets under management and sells at $6.65.

Final Thoughts

Crypto ETFs are a great way to gain indirect crypto exposure without having to go through the hassle of creating crypto wallets and exchange accounts. Plus, not to mention the difficult learning curve of how cryptocurrency and blockchain technology works.

Other than the best crypto ETFs in the US, Bitwise 10 Crypto Index Fund, Grayscale Bitcoin Trust (GBTC) and Grayscale Ethereum Trust (ETHE) are also great ways to add crypto investments to your portfolio without directly owning any. They are pretty similar to ETFs, except for a few key differences.

As for when we can see an actual spot Bitcoin ETF, Greyscale seems to be the newest and most promising contender. Currently, they are in the process of converting their GBTC to a spot Bitcoin ETF.