Crypto Debit Card Taxes – A Solution

This is how crypto debit card taxes work –

Every time you spend your cryptocurrency from your crypto debit card, you realize capital gains (or losses) and get taxed accordingly. You’ll also have to report each and every transaction from your card on your tax return, no matter how small the gain or loss is.

In this article, you’ll find out:

- What are crypto debit cards, and how they work

- A solution to crypto debit card taxes complication

- Pros and cons of crypto debit cards

- The best crypto debit card providers

What are Crypto Debit Cards?

For the vast majority of people, cryptocurrencies like Bitcoin and Ethereum are just assets to invest in. But there are people who believe that it has the potential to replace fiat currency. They believe crypto can be used for day-to-day transactions.

Unfortunately, not everyone shares the same view. Most people, especially local shop owners and vendors, don’t accept cryptocurrency as payment due to a lack of understanding and its volatile nature.

That’s the gap crypto debit cards fill.

It lets you use your crypto to pay vendors while they receive fiat currency.

Most crypto debit cards have partnered with Visa or Mastercard. So, you can pay with your crypto to any online or offline vendor or shop owner that accepts either one of the two.

They are basically the same as your usual standard debit card. The only difference – instead of fiat currency, you have crypto in your debit card.

Even those who view crypto purely as an asset sometimes use crypto debit cards to avoid paying expensive exchange rates when they go abroad. It also helps you avoid other complications related to foreign exchange matters.

How Does it Work?

Firstly, you’ll have to create an account with the company or exchange providing the crypto debit card. So, for example, if you want a Binance card, you must have a Binance account. If you want a Coinbase card, you must have a Coinbase account.

Most of these companies require you to disclose your identity and complete KYC. Some people want anonymous crypto debit cards, but currently, the law doesn’t allow that.

Next, you have to add funds (crypto) to your crypto debit card.

Some companies allow you to connect your card with your digital wallet, so you directly use the crypto in your wallet without manually adding them to your card. After that, you can use your card.

Every time you swipe your card and make a payment, your crypto will automatically convert into fiat currency, which the vendor will receive.

Note that every time you’re paying with a crypto debit card, you’re basically selling or disposing of your crypto, triggering a taxable event. Keep this in mind for the next section, where we’ll talk about crypto debit card taxes.

Other than the tax disaster it causes, you may also have to pay a fee on every transaction.

If you’ve ever used any crypto exchange, you would know that they charge a transaction fee for buying and selling crypto. The same logic applies to crypto debit cards as well.

However, not all cards charge a fee. Some don’t. While some charge a monthly fee instead of charging on every transaction. So, it depends on what crypto debit card you’re using.

As for the cryptocurrencies available to use in these cards, it also depends. But generally, almost all of them allow you to use the big ones – Bitcoin, Ethereum, Litecoin, etc.

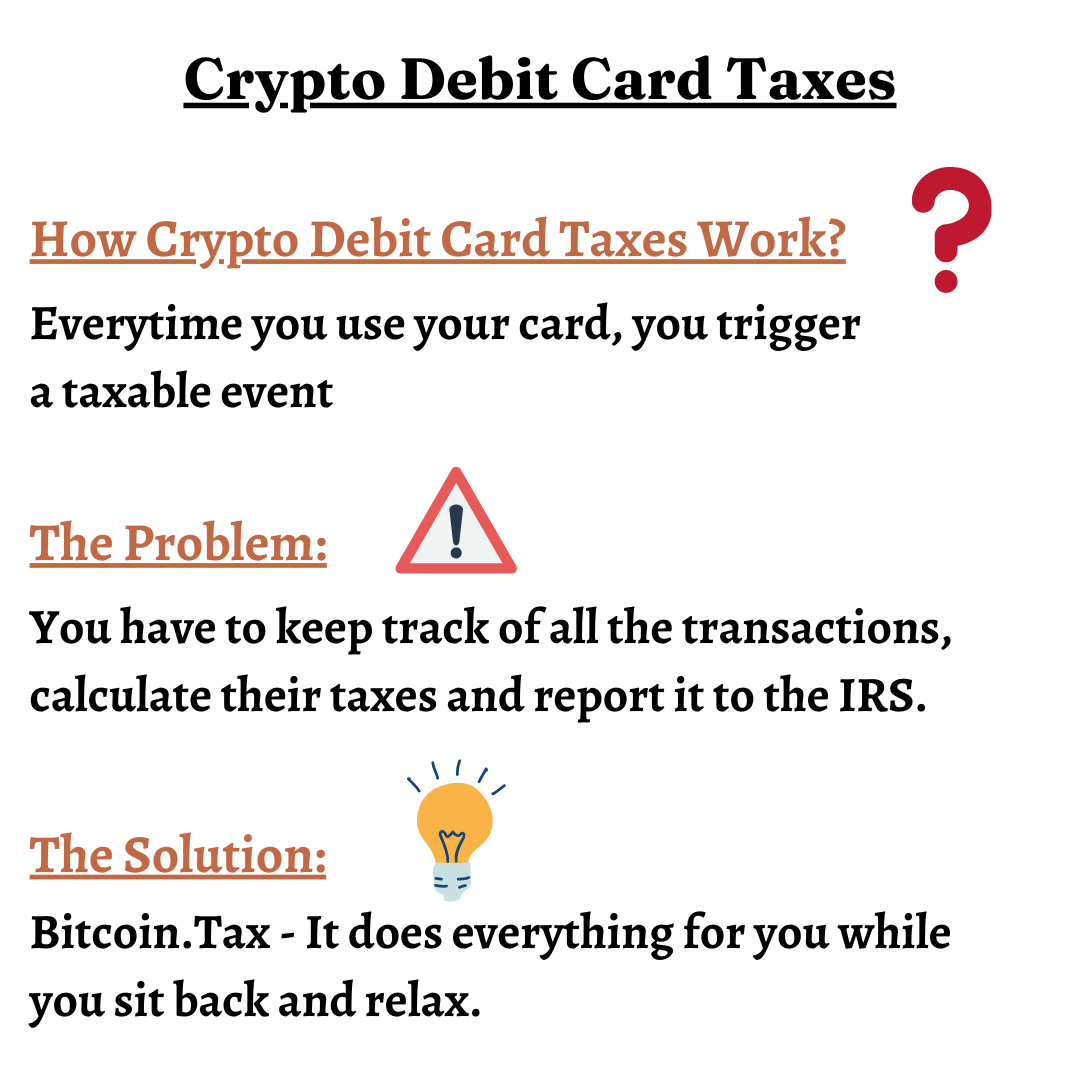

Crypto Debit Card Taxes

Before we discuss crypto debit card taxes, you should know how crypto taxes work. If you’re this far down the rabbit hole, you probably already know. If not, here’s a quick explainer –

The IRS views crypto as property. So, every time you sell (dispose of) your crypto, you incur capital gains (or losses) and will get taxed accordingly.

As we mentioned before, this means that every time you’re using your crypto debit card, you’re triggering a taxable event. Whether you realize any significant gains or not, you’ll still have to report all your transactions to the IRS.

As you can imagine, keeping track of all these transactions, calculating the taxes on them and reporting it to the IRS can quickly turn into a horrifying tax nightmare.

But there’s a solution – Bitcoin.Tax

Bitcoin.Tax is a crypto tax calculator that does all of what we just talked about while you can sit back and relax. All you have to do is connect your exchange and wallets with the software, and it’ll handle the rest.

If you intend to use a crypto debit card for daily use, consider investing in Bitcoin.Tax. It can save you a lot of time, effort and headache.

Back to crypto debit card taxes, the only time this tax situation may work in your favor is if you’re sitting on a lot of losses. In that case, it’s a great way to use crypto in daily transactions while harvesting losses.

But if you’re sitting on a lot of gains, especially short-term gains, it’s an equally terrible tax strategy.

Crypto Debit Cards vs Crypto Wallets

You’re probably wondering – What’s the difference between crypto debit cards and crypto hard wallets, then?

Well, it’s simple. In order to send crypto from your hard wallet to another person, the other person must also accept cryptocurrency and have a wallet, and as we discussed, most shop owners don’t.

And this is exactly the problem crypto debit cards solve.

Crypto debit cards allow you to spend your crypto anywhere.

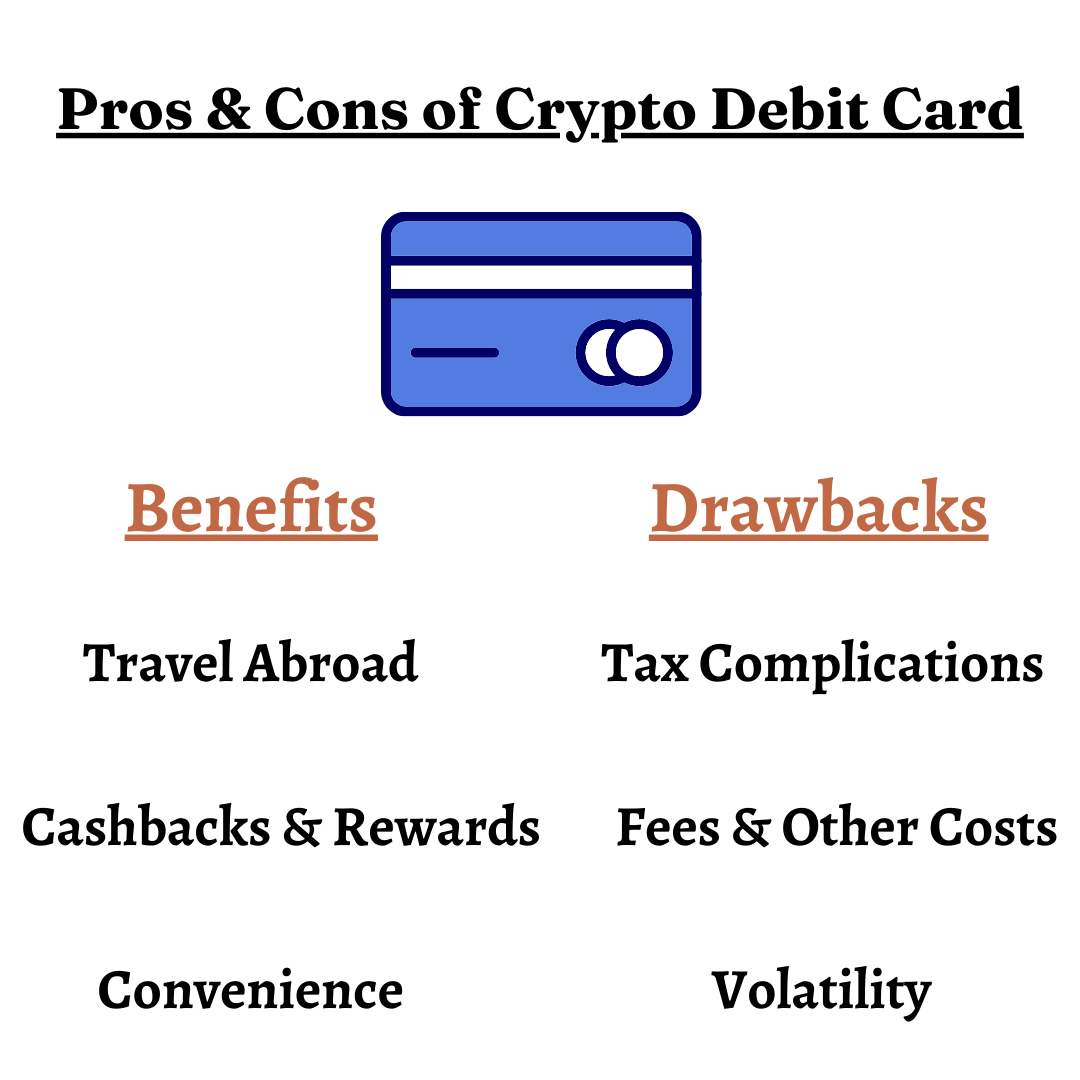

Pros and Cons of Crypto Debit Cards

Pros

Avoid Exchange Rates – By using crypto debit cards, you can avoid many complications and expensive exchange rates when traveling abroad. Some people use it for the sole purpose of traveling abroad.

Cashbacks and Rewards – Crypto debit cards are known for offering huge cashbacks and rewards to their users. While some cards offer more than others, you’ll get them on almost all cards regardless.

Convenience – Lastly, as we discussed multiple times in this article, it allows you to spend your crypto virtually anywhere that accepts Visa or Mastercard. It’s a win-win for both parties – the payer and the receiver.

Cons

Tax Reporting – Crypto debit card taxes are the biggest hurdle stopping many people from using it. Tracking all transactions, calculating the taxes, and reporting is too much hassle, which some people understandably don’t think is worth it.

Price Volatility – Cryptocurrency is notoriously volatile. The volatile nature of crypto may force you to lose money every time you use your card.

Fees and Other Costs – Some cards charge a transaction fee every time you use your card. This can make it extremely inconvenient and costly to use for daily use.

5 Best Crypto Debit Cards

The following are some of the best companies to get a crypto debit card from –

Coinbase offers the overall best crypto debit card with lots of features, affordable fees, nine cryptocurrencies and robust security. It supports Visa.

You can also connect multiple crypto wallets with your Coinbase Card.

Binance offers huge cashbacks of up to 8%, though there are some requirements to qualify for cashbacks. It doesn’t have any monthly fee but a fee of 0.9% on every transaction.

The downside to Binance Card is it’s only available in Europe.

BlockCard offers an affordable flat monthly fee, which is one of the cheapest in the market. It also offers cashbacks.

The only downside, you’ve to buy Ternio tokens to make transactions.

Most crypto debit cards are limited to Europe only, but not BitPay. BitPay is available in all 50 states of the United States. It supports Mastercard.

BlockFi doesn’t offer a debit card but a crypto credit card with attractive cashback rates – 1.5% (3.5% for the first three months).

There are a couple of downsides, though – it only supports Bitcoin, and it isn’t available for US citizens.

Are Crypto Debit Cards Worth it?

Though crypto debit cards are a great innovation in the crypto and finance space, the drawbacks – crypto debit card taxes, fees and volatility, may outweigh the benefits for some people.

Nonetheless, it’s up to you to decide if it’s worth it for you or not.