Safe Harbor rules from IRS Rev. Proc. 2024-28

Understanding Safe Harbor rules for 2025

Starting January 1, 2025, you’ll need to track your cryptocurrency gains and losses separately for each wallet or exchange account you use. The IRS understands this is a big change, so they’ve provided “safe harbor” rules to help you transition your existing holdings.

In their Revenue Procedure 2024-28, section 5, the IRS details the rules that give you protection from having your historical calculations questioned in an audit, as long as you follow the steps to properly allocate your existing crypto holdings to your various wallets. The key is that your records need to match your actual wallet balances as of January 1, 2025.

You have two ways to make this allocation:

Specific Unit Allocation

Think of this as manually assigning specific purchases to specific wallets. For example, you could decide that the Bitcoin you bought in March 2023 should be assigned to your Coinbase wallet, while the Bitcoin from July 2024 goes to your hardware wallet. You need to complete this before making any sales in 2025.

Global Allocation

With this method, you create a rule for how you’ll assign your crypto to different wallets. For instance, your rule might be “assign my oldest purchases to Wallet A, then Wallet B.” You need to document your rule before January 1, 2025, but you have until your 2025 tax return is due to complete the allocation.

Important Points to Understand:

- You can use different approaches for different cryptocurrencies

- Your allocations must match your actual wallet balances

- Once made, these allocations can’t be changed without losing safe harbor protection

- The allocations must be reasonable (you can’t just assign all your lowest-cost crypto to one wallet and highest-cost to another without justification)

What You Need to Do Now:

- Review your current holdings across all wallets

- Make sure your records accurately show which crypto is in which wallet

- Plan how you want to allocate your existing cost basis

- Document your decisions and keep records of your allocations

Safe Harbor Tool for 2025 Transition

Bitcoin.Tax has introduced a new Safe Harbor tool to help you prepare for the 2025 IRS regulations requiring wallet-by-wallet tracking of cryptocurrency gains and losses. This tool helps you properly allocate your existing crypto holdings across your wallets while maintaining compliance with IRS safe harbor provisions.

How it works

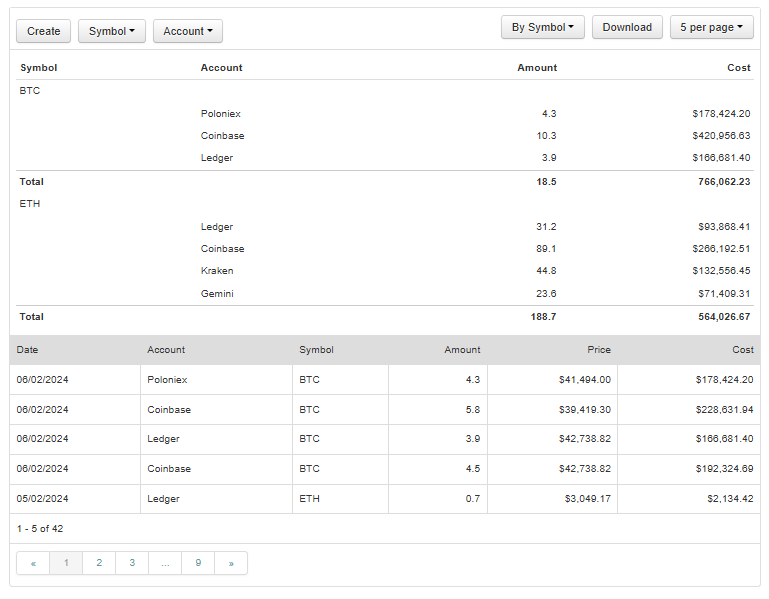

The tool starts with your 2024 Closing Report, which contains all your cryptocurrency lots with their original purchase dates, costs, and locations. You can then reallocate these lots between wallets to ensure your records match your actual wallet balances as of January 1, 2025.

Key Features:

- Direct lot editing: Move entire lots or split portions between wallets

- Wallet view: See total holdings and basis for each wallet

- Asset view: Review holdings organized by cryptocurrency

- Multiple reallocation strategies: Choose FIFO, LIFO, highest-cost, or lowest-cost when moving assets

- CSV export: Download your final allocations for your records

Making Adjustments

You can adjust your allocations in several ways:

- Edit individual lots to move them between wallets

- Split lots to move partial amounts to different wallets

- Use bulk reallocation strategies to move multiple lots at once

- View and adjust holdings by wallet or by cryptocurrency

The tool maintains the original purchase dates and costs while allowing you to properly align your records with your actual wallet holdings. All changes are separate from your transaction history, preserving your original records while creating the necessary documentation for 2025.

Important Considerations

- Compare your final allocations with the original Closing Report to ensure accuracy

- Verify that your allocated balances match your actual wallet holdings

- Keep the exported Safe Harbor report for your records

- Your allocations will serve as your opening balances for 2025

Using this tool helps ensure you meet the IRS safe harbor requirements while maintaining accurate records of your cost basis across all wallets. The tool will be available through the end of 2025 to help you prepare for the 2025 transition.