The London Hard Fork

On Thursday, 5 August, the world’s second-biggest cryptocurrency underwent the much-awaited software upgrade that aims to solve some of the problems that have annoyed even the biggest Ethereum supporters for the longest time. What we are talking about is Ethereum’s highly unpredictable and volatile transaction fee.

The problem has only worsened after the recent upsurge in non-fungible tokens (NFTs), mostly built on Ethereum’s blockchain, and the explosion of new DeFi platforms, also known as Decentralized Finance, which mainly use Ethereum as well. The latest ETH hard fork, the 11th for those keeping count, brings new changes and fixes, mainly by “burning” ether to reduce and stabilize the transaction fee.

What is the London ETH Hard Fork?

The hard fork gets its ‘London’ moniker because one of the Devcon International Developer’s Conferences was once held in the city of London – this is typically how the hard fork names are chosen.

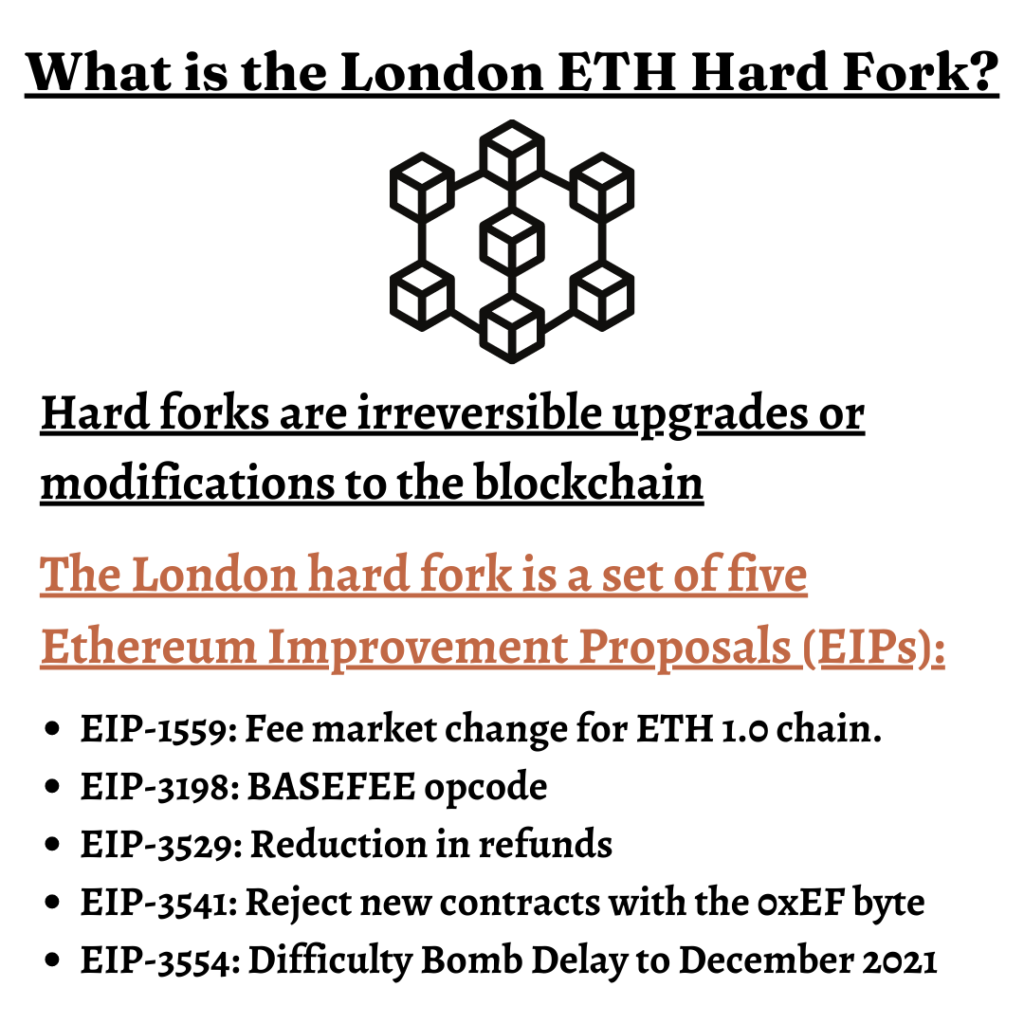

In general crypto terms, a hard fork is an irreversible upgrade or modification to the blockchain, historically representing one or more radical changes to a cryptocurrency and its network.

The London hard fork is a set of five Ethereum Improvement Proposals, or EIPs, aiming to reduce network congestion and transaction fees while improving speed.

How does it do that? Here’s how –

Lesser Transaction Fees & Less Volatility

Prior to the upgrade, ETH users would have to do a lot of guesswork before proposing a transaction fee, also known as gas prices, to secure a spot in the next block of transactions. Some people would even pay premium prices to guarantee their inclusion. This led to a lot of unpredictability and volatility in the gas price.

The new software upgrade aims to change that. After the upgrade, the protocol will algorithmically determine a transaction fee, or a uniform gas price, based on the overall demand at that particular time. This will not only prevent sudden spikes in prices but will also prevent the system from going bonkers.

Interestingly, users can still tip the miners to get ahead in queues.

Doubling of Block Size & How it will Help Stabilize the Gas Fee

Another significant change included in the EIP-1559 is the doubling of block sizes. Although doubling block sizes sounds as if twice the number of transactions can now occur in a single block, in actuality, the upgrade will allow the block to only be half full. This will help reduce overcrowding in the network and help smooth out the sudden spikes and fluctuations in demand. Hence, stabilizing the gas prices.

Historically, this issue has plagued Ethereum since the very start and this hard fork is finally the solution.

Overlooked, But Crucial Upgrade

Unlike earlier, the transaction fee after the upgrade will now be burned instead of going back to the miners, which means a portion of the cryptocurrency will be destroyed forever and will never go back to circulating again. This is really beneficial for ETH holders, as this new change could lead to inflation, boosting the value of ETH. In response to some speculations, experts assure that this wouldn’t lead ETH to go deflationary.

More than ETH holders, this change is even more significant for ETH miners, but negatively, as this new change will leave miners with lesser income streams, particularly two. One by selling their usual computing power and earning rewards for minting new coins, and two by getting extra tips from users who want to get ahead in the queue.

Although it’s true that miners would no longer be able to earn as much as they used to before the upgrade, it’s also true that miners will most probably make up for these losses, as they are inevitably linked with the overall value of ETH, which will hopefully rise thanks to this new upgrade.

However, that’s not the biggest concern for miners regarding this new ETH hard fork. An even crucial upgrade, which got overshadowed by the EIP-1559, is the EIP-3554. This new upgrade will pave the way for the long-awaited Ethereum 2.0 upgrade that will force the network to switch from a “proof of work” system where miners have to solve complicated mathematical problems to validate a transaction to a “proof of stake” system where eventually their role will become obsolete.

Ethereum enthusiasts are already staking their ETH 1.0 for the ETH 2.0 protocol on various centralized platforms and staking protocols. Once ETH2 rewards are distributed, Bitcoin.Tax users can automatically link their ETH staking accounts to pull in the reward data – and when they dispose of it, the capital gains will be automatically calculated for them.

The deadline to adapt to this new system, also known as the “difficulty time bomb,” was initially scheduled for summer 2022, but the EIP-3554 brings this deadline closer by moving it to December this year.

What it Means for Ethereum & its Future

As we discussed so far, miners will probably be the most negatively affected after this upgrade. Not only will they earn less in the short term, but they are now approaching the dead end, faster than what they expected initially.

But apart from that, ETH holders and investors will benefit the most from this new upgrade, as lesser transaction fees will attract more users, resulting in a rise in demand, ultimately boosting ETH’s value.

Ethereum is the second-largest cryptocurrency in the world, and this new upgrade solves a major pain point that has haunted users, miners, software developers, and everyone involved since the dawn of Ethereum. But now, this upgrade will finally give Ethereum the edge it always needed for it to go head-to-head with Bitcoin. It will be interesting to see how Ethereum continues to grow and compete with Bitcoin, especially with the new tax laws and Ethereum 2.0 being closer than ever before.