IRS Delayed Crypto Tax Reporting Until 2026?

Not really.

The IRS has issued a new notice about how crypto taxes are to be treated during 2025, IRS Notice 2025-07.

We posted about this notice this back in 2024, and have reviewed it more.

Summary

For broker-held assets (like exchange accounts):

- If the broker offers specific lot selection, you can use that

- If the broker doesn’t have that capability, you can:

- Keep your own records identifying which lots you’re selling at the time of sale

- Set up your own standing order in your records (like “always sell highest cost basis first”)

- If you do neither, FIFO will apply within that broker account

For self-held assets (like personal wallets):

- The notice doesn’t change anything

- You must follow the regular rules from the 2024 final regulations

- This means either specific identification or FIFO within each wallet

tl:dr; you still have to do wallet-by-wallet accounting, FIFO is the default, but you can do the specific identification yourself when trading on an exchange

Background

The IRS recognizes that exchanges aren’t quite ready to deal with the change in crypto taxation treatment they imposed back in July 2024, with Notice 2024-28. The new regulations say that exchanges must treat all dispositions using FIFO (First-In First-Out) unless the taxpayer wishes to specifically identify a lot for the transaction, or has standing order with specific instructions.

Surprising no one, the crypto world wasn’t ready and exchanges did not have the capability to allow users to select cost basis lots when doing trades. This meant they would have had to use the default FIFO method, which could well be against and detrimental to a taxpayer’s position.

What has changed – Broker and taxpayer cost basis relief

Brokers have been given temporary relief from these rules for the duration of 2025, allowing them this year to add this capability into their systems. If they do have the ability to let taxpayers choose lots, then those can still be used.

Taxpayers have also been given relief from the rules, meaning they are able to make their own determination about what lot was used when trading on a broker. If you are able to identify a lot before you transfer, trade or do other activity through a broker, you can decide that in your own records and use for your 2025 taxes.

What has NOT changed – Safe harbor and accounting

This does NOT allow reverting back to universal accounting, but rather that any trade through a broker can use a lot of your choice as long as you can make that determination before the trade happens.

This is NOT relief from safe harbor that was allowed in 2024-28, and this must still be completed as before, either identifying your lots by the end of 2024 and electing to use global allocation and completing this by your first activity or your 2025 tax return.

Also, if you are using safe harbor then that must be done before you are allowed to make use of this relief.

What does this all mean?

If you trade on an exchange or broker, either a centralized or decentralized exchange, and they do not yet have the ability to let you pick the cost basis lots you want to trade, then you can do this yourself.

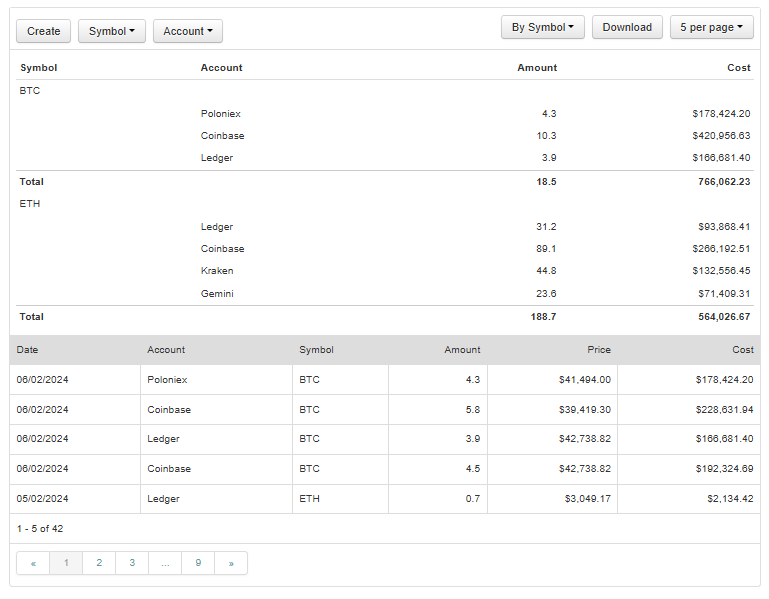

For example, let’s assume you have done the safe harbor, and know exactly what lots you now have in every wallet and exchange account.

Let’s say you have 6 ETH in CryptoExchange, with basis of

- 1 ETH from 1/1/2022 worth $1,000 ($1,000 each)

- 2 ETH from 1/1/2023 worth $4,000 ($2,000 each)

- 3 ETH from 1/1/2024 worth $9,000 ($3,000 each)

You want to sell 2 ETH at a price of $4,000, but CryptoExchange does not yet have a way for you to specify which lots you can use. You can sell your 2 ETH but in your records you can pick the lots you will use, so say your oldest ones from 2022 and 2023

SELL 1 ETH from 1/1/2022 @ $4,000 – $1,000 = $3,000 long term gains

SELL 1 ETH from 1/1/2023 @ $4,000 – $2,000 = $2,000 long-term gains

You will then update your records showing that you still own

- 1 ETH from 1/1/2023 worth $2,000 ($2,000 each)

- 3 ETH from 1/1/2024 worth $9,000 ($3,000 each)

Personal Wallets

This relief only applies to brokers and does not apply to your own wallets.

If you spend crypto directly from your wallet you still must use FIFO, or select the lot you are using BEFORE you make the purchase.

All in all, nothing much has changed, it’s just you have control over the lots you are spending both in your own wallets and on exchanges until 2026.

Bitcoin.Tax Safe Harbor Tool

If you have not yet done your safe harbor, bitcoin.tax provides a Safe Harbor tool that lets you assign your cost basis lots across all your accounts in a matter of a few clicks. We allow both specific unit allocation and global allocation and let you assign your asset balance across your wallets.

The safe Harbor tool is available for free to all subscribers for the 2024 tax year.

Sign up and do your safe harbor today.

CoinsTax LLC (dba bitcoin.tax) do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction.