Crypto Forks & How are they Taxed

Simply put, crypto forks are upgrades made in a blockchain to either fix a bug or security issue, add new functionalities or change the fundamental nature of how it operates. These upgrades may force the blockchain to split into two, depending on whether it’s a soft or hard fork. Both have different tax consequences.

If you’re new to cryptocurrency and blockchain, all this may sound overly complex, but it’s really not. In this guide, you’ll learn all about crypto forks, the differences between soft forks and hard forks and their tax consequences.

What is a Crypto Fork?

To understand what crypto forks are, first, we must understand how blockchain technology works in relation to cryptocurrency.

Blockchain is essentially an advanced system for storing data and information, which is chronologically consistent and can’t be changed or modified. Each blockchain has its own set of rules, characteristics and consensus mechanism that it operates on.

In the context of cryptocurrency, think of it as a chain of blocks, each block containing a transaction record. If you know how crypto mining works, you would know that every time a miner validates a transaction, a new block is created in the blockchain.

Crypto forks are upgrades to the blockchain, which either modify or change the existing rules, characteristics or consensus mechanism of a blockchain.

And as mentioned before, depending on the nature of the fork, this may or may not result in a split, which brings us to…

Soft Fork Vs Hard Fork

The best way to understand how crypto works is to understand the difference between a soft and hard fork.

Soft Fork

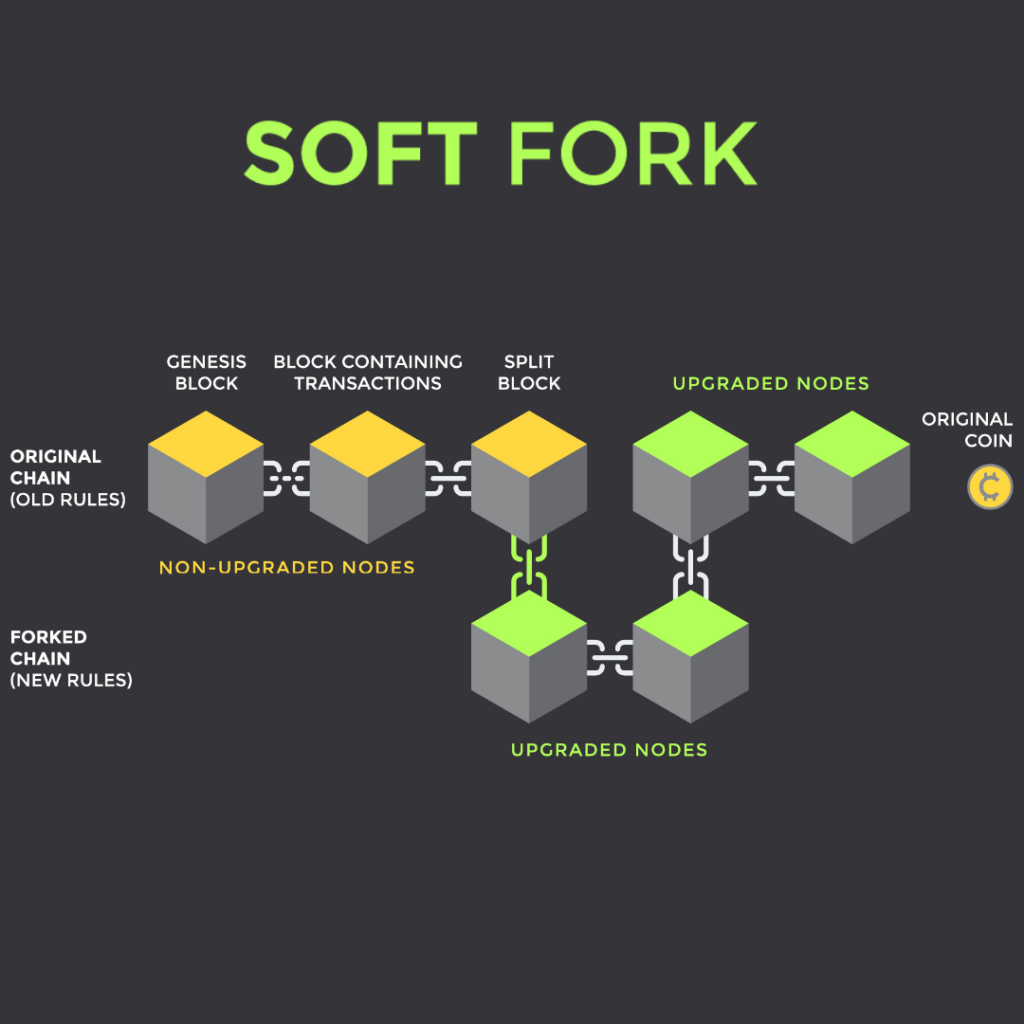

The fundamental characteristic of a soft fork is they are backward-compatible.

What do we mean by backward-compatible?

Backward compatibility means the newer version of the blockchain after the upgrade is compatible with its older version. In other words, soft forks are only modifications. They don’t involve any fundamental change in the existing rules and mechanisms of the blockchain.

A famous example of a soft fork is the Segregated Witness (SegWit) upgrade on the Bitcoin blockchain, which was developed in 2015 and implemented in 2017.

Before the upgrade, Bitcoin transactions were extremely slow due to the limited capacity for data in each block. However, increasing the block size would mean replacing the existing nodes with new ones, resulting in a backward-incompatible upgrade (hard fork).

So, instead, a group of clever developers came up with the SegWit concept. The primary idea behind it was to segregate the witness (signature) from the block, freeing up more space to store transaction data. This helped increase the transaction speed and capacity of the Bitcoin blockchain.

The upgrade didn’t require any fundamental change to the blockchain or its nodes. Instead, new rules were created around the existing framework, making it one of the most successful soft forks in crypto history.

Tax Consequences of Soft Fork

In the event of a soft fork, the blockchain continues to work as usual with no impact on its users and coins in supply. Therefore, you don’t receive any new coins. Instead, you continue to use the old ones as if nothing happened.

This is important because it means soft fork has no significance from a tax perspective. Hence, soft forks are not taxable events.

Hard Fork

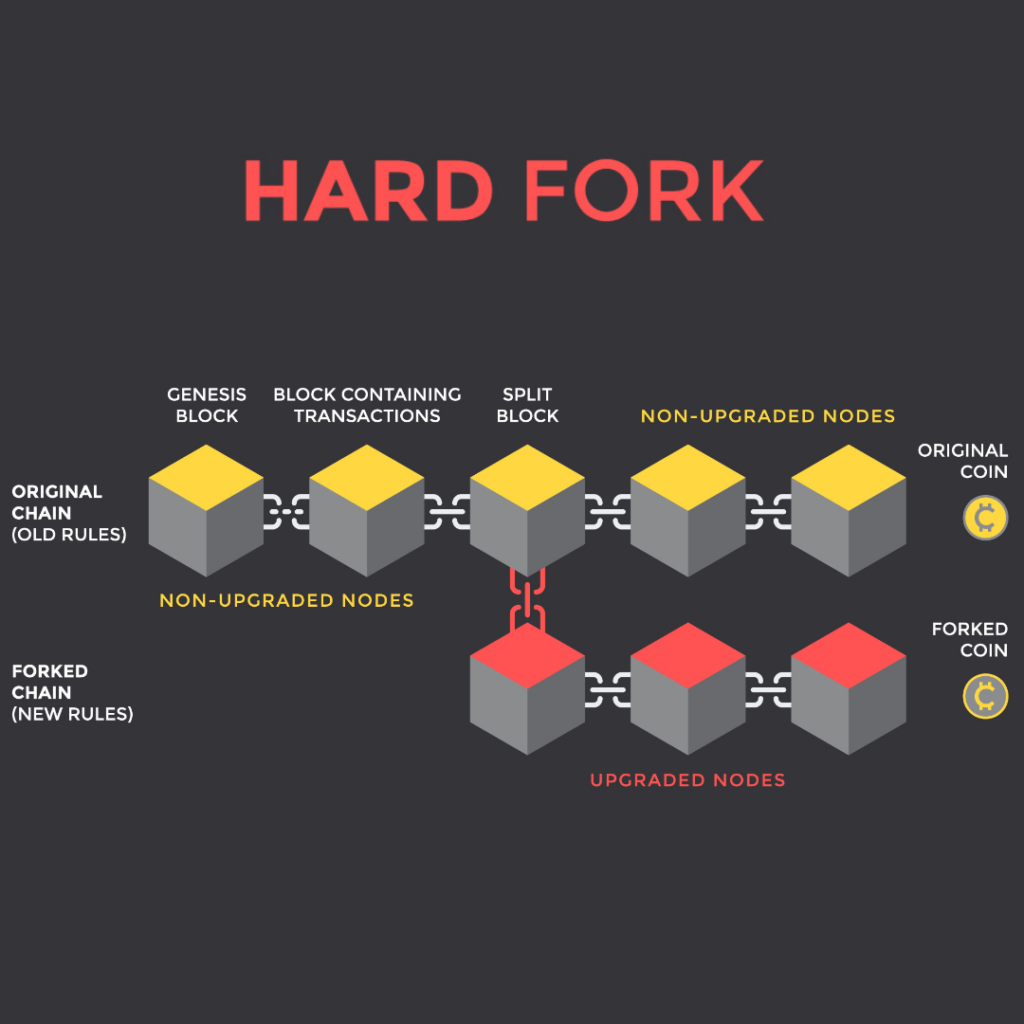

Opposite to soft forks, hard forks are upgrades that are backward-incompatible. This means the new nodes after the upgrades are not compatible with the old ones, forcing the blockchain to split and create a new branch and essentially a new blockchain altogether.

The old blockchain will continue to function as before, while the new one goes on its own different path. However, both the blockchain will share the same transaction data and history up until the point of the fork.

Usually, these hard forks occur due to disagreements within a community, where one group prefers the new upgrades and the other doesn’t. A great example of this is the Bitcoin and Bitcoin Cash hard fork.

In 2017, a new upgrade was proposed to increase the block size of the Bitcoin blockchain to increase transaction speed and store more data in a single block. This created a disagreement within the community, ultimately resulting in a hard fork.

What we call Bitcoin Cash today was a result of this hard fork. Technically, both Bitcoin and Bitcoin Cash are essentially the same on paper, except for the block size, but with two different blockchains.

Tax Consequences of Hard Fork

Whether hard forks are taxable depends on which country you live in and how crypto is classified and taxed in your country.

In some countries, including the US, hard forks are taxable.

Why?

When a hard fork occurs, and as a result, you receive new coins, it will be treated as taxable income, the same as mining or staking rewards and airdrops. Hence, you’ll pay income tax rates on the fair market value of the new coins at the time of acquisition.

So, for example, suppose in August 2017, before the Bitcoin hard fork, you owned 10 Bitcoin. As a result of the hard fork, you would now receive 10 Bitcoin Cash coins, separate from the 10 Bitcoins you already have. Therefore, you must report the 10 Bitcoin Cash coins as taxable income and pay appropriate taxes.

Crypto hard forks are tax-free in the following countries –

- Brazil

- Sweden

- United Kingdom

- Denmark

- Austria

- Australia

- Germany

Crypto Hard forks are taxable in the following countries –

- United States

- Japan

- The Netherlands

- Spain

- Switzerland

- India

For all the countries we didn’t mention, they either don’t have clear guidelines on crypto hard fork taxes or have different tax treatments based on your trading activities. Check out our Crypto Tax Guides section to learn how crypto taxes work in your country.