Crypto Dollar Cost Averaging

Timing the market for the best returns is tricky and hard, to say the least, especially for beginners. Crypto dollar-cost averaging (DCA) is an investment strategy that solves this problem.

With DCA, you make regular, small investments in crypto, regardless of whether the market is up or down. This lowers the average cost per unit over the long term and saves you the time and effort required with other active trading and investing strategies.

But even DCA is not completely fail-proof. It has its own pitfalls and drawbacks you need to be aware of. In this guide, we’ll explain what is crypto dollar cost averaging, how to execute it and everything you need to know about it.

What is Dollar Cost Averaging?

Dollar Cost Averaging is an investment method where instead of investing all your capital at once, you make smaller, regular purchases over a longer period of time. Here, investors don’t have to worry about the many ups and downs the markets inevitably go through.

DCA is a hands-off approach to accumulating wealth over the long term and is considered relatively safer and more effective. The strategy works for any asset, be it stocks, commodities, bonds, or even cryptocurrencies.

It’s important to note that this strategy relies on the assumption that the value of the underlying asset will increase over the long term.

How Does Crypto Dollar Cost Averaging Work?

Dollar-cost averaging works with cryptocurrencies as well. The idea is the same – you invest a certain amount regularly in the crypto of your choice rather than making a lump sum investment at once.

Crypto is a highly volatile asset compared to many other traditional assets. So, there is a greater risk you might make an ill-timed investment.

For example, the all-time high Bitcoin reached in 2021 ($69,000) before crashing afterward. Many such investments are lump sum investments, which means you’ll lose a substantial amount of money if you make the wrong decision.

Dollar-cost averaging helps you avoid that. Since you’re only investing a small amount every time and playing the long-term game, you don’t have to worry about timing the market right.

There are many factors that play a crucial role in a successful DCA strategy –

The first step is to zero in on the cryptocurrencies you want to invest in. Generally, stick with the big ones, like Bitcoin and Ethereum, since they’re less volatile and have survived longer than the others. Plus, DCA is a long-term commitment, and Bitcoin and Ethereum are more likely to flourish and rise in value in the long run.

The next step is to decide the amount you’ll invest at regular intervals. Make sure you choose an amount that is not too high or low but something you can afford to invest every time without fail. The frequency of the investments can be monthly, weekly, or even daily.

You can choose to invest manually or go for automated options out there. Here’s the difference between the two.

Automated DCA

In automated DCA, you choose and set up a list of pre-set parameters, like the amount to be invested, which crypto to buy, frequency, etc., and forget about it. Once you set it up and everything is automated and passive.

There are many crypto exchanges that allow you to do this. They are similar to trading bots with slight differences. Here are some of those exchanges:

Manual DCA

The manual DCA is the opposite of automated DCA. Here, you must go to an exchange and buy a certain amount of crypto at regular intervals, all by yourself and manually. While it requires more effort and attention from the investors, it allows for more flexibility in dynamic situations.

How is it Better than Crypto Trading?

What people don’t understand with active crypto trading or day trading crypto is that it’s a real job. It requires real skills and experience and hours and hours of sitting behind a computer looking at graphs and candlesticks to make small but frequent profits to earn anything significant by the end of the day or month.

Most people already doing a job don’t have the time commitment needed for day trading crypto. Swing trading crypto is somewhat a better option, but it still requires you to learn technical analysis, which takes time, and to be honest, can be a headache.

That is why crypto dollar cost averaging is a better option in many ways.

However, while crypto DCA is generally safer, it still does not guarantee profits.

Limitations of Crypto Dollar Cost Averaging

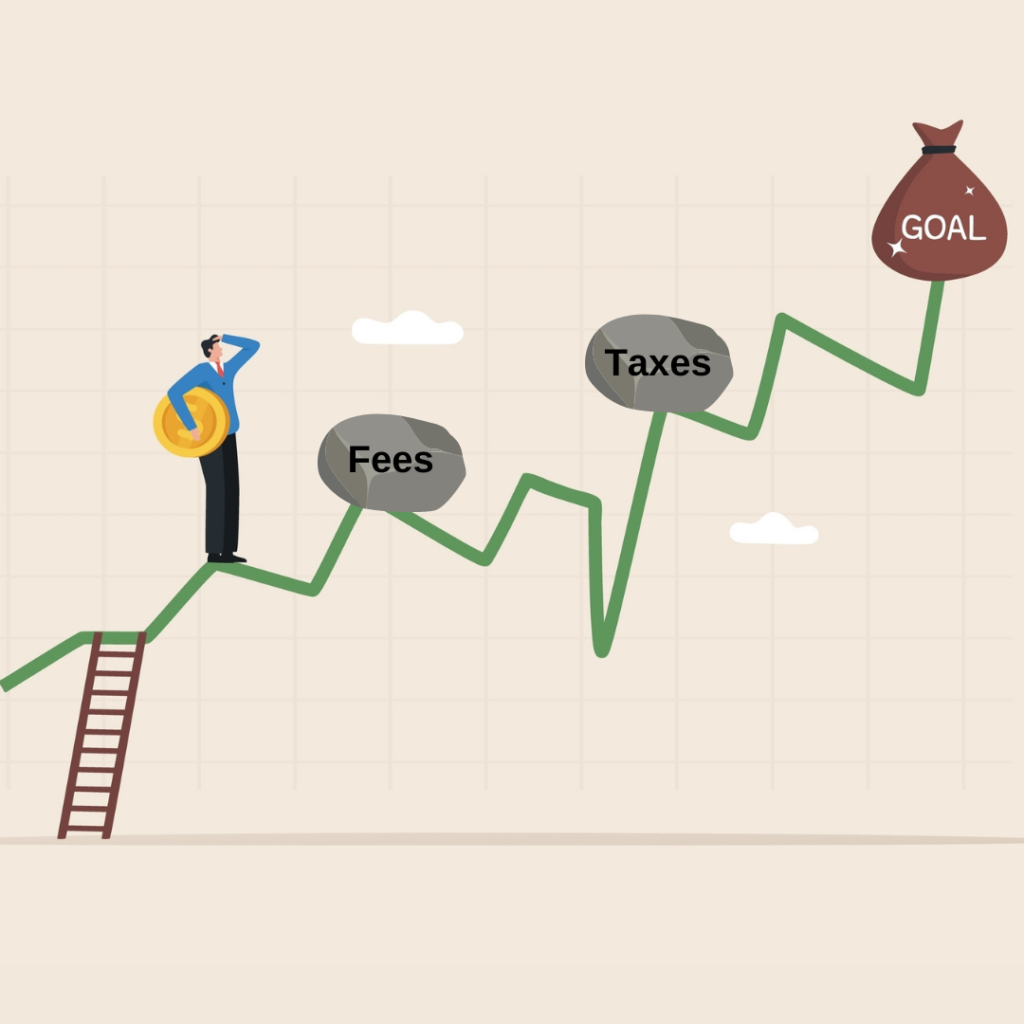

Fees – With DCA, you’re buying smaller chunks of crypto at regular intervals, meaning every time you buy, you will pay exchange fees. This fee, compounded over the years, might be a significant sum, but assuming you’ll make substantial returns, these fees shouldn’t matter much.

Reporting Taxes – As per the crypto tax laws of most countries, you must report all crypto-related transactions on your tax return, including crypto purchases. With crypto DCA, this can quickly become a concern, as you’re buying at regular intervals, and keeping track of all these transactions can get tricky.

However, this problem can be easily solved by using a crypto tax software like Bitcoin.Tax, which can be integrated with all your crypto exchanges and wallets. It automatically tracks and calculates all your crypto transactions and taxes and creates a complete tax report.

Missing Out on Sudden Price Swings – There is a large contingent of people that think of crypto as a get-rich-quick scheme, looking for the next project that will skyrocket. It does happen, but rarely, and almost always never ends well.

We saw this with Dogecoin and many other cryptocurrencies before. Even Bitcoin rose from $32,000 to $69,000 in 2021. The people who bought Bitcoin at the start of 2021 would have seen their Bitcoin gets doubled. But we all know what happened next – a crypto winter, which we’re still in.

So, while you’re avoiding the unexpected negative market swings, keep in mind, you’re also missing out on positive opportunities.

Is Dollar Cost Averaging Effective for Crypto?

Dollar Cost Averaging has historically been effective with most assets. There is no reason why crypto dollar cost averaging would be different.

People with expert insights on crypto might want to take calculated risks and take the traditional path of timing the market and investing based on their skills and experience.

But for people who don’t want to learn about investing in-depth and go through the steep learning curve of crypto and its underlying technology, dollar cost averaging is a pretty safe and effective alternative.