On 1st August 2017, a new Bitcoin fork was created called Bitcoin Cash.

Starting from block 478558, the Bitcoin blockchain split to be the Bitcoin (BTC) and the Bitcoin Cash (BCH) forks.

Anyone who held BTC before the fork are able to receive the equivalent amounts of BCH. BCH can now be traded on many exchanges, including Kraken, Bitfinex, Bittrex, ViaBTC, OKCoin and more. Coinbase initially stated they would not support the BCH fork, however, recently changed their mind and now expect to support it from 1st January 2018.

This is a similar situation that happened to the Ethereum fork in July 2016 where ETH forked to become both ETH and ETC (Ethereum Classic).

Tax Implications

There are really no similar traditional financial events for this with regard to taxes. There also has been no additional guidance from the IRS on how this should be treated, so we are left to make a reasonable decision.

What is clear, is that income has been generated. However, the question is when and how much.

The IRS, in their 2014-21 Notice, clarified that mining is to be treated as income on the date the assets are received. The price would be their fair market value, e.g. the price for which they were immediately sold or the daily price of the digital currency.

But what is the price of BCH? It isn't reasonable to say it was anything to do with the price of BTC because they are different markets. However, while there wasn't a consistent open market, it had been trading for weeks before and a price was established.

If you owned 10 BTC in your core wallet, you had access to 10 BCH since you had the private keys. However, many people were unable to access these new coins until their wallet had been updated. They could argue their date of receipt was later. And if you had BTC in Coinbase? You do not yet have access to those 10 BCH, but will do at the begining of next year.

What if you had no interest in BCH but you owned 1,000 BTC. Do you suddenly have a $277,000 income tax bill?

Yes, as discussed by Tyson Cross, tax attorney at BitcoinTaxSolutions.com. Since you have accession to wealth then this is taxable income.

The ETH/ETC split in 2016 was similar, although there was no established price, so another option was to say they had a zero cost basis. This let you record it as income, albeit nothing, but when you come to trade or sell you will take 100% gains. The taxes you pay would be treated as if it had been deferred normal income.

If you hold onto your BCH coins for more than a year, then you will have kept them for investment purposes and so should benefit from the reduced long-term capital gains rates.

FAQ

1. Woo-hoo! Free money!

Yes, BCH is essentially free money because you owned BTC. However, free money is income and income is taxable.

2. Do I need to tell the IRS about my BCH?

You should report the BCH as income for a market value, e.g. Bitcoin.Tax uses a daily price of $277. This also becomes the cost basis. You will report that as income for 2017 and pay the appropriate taxes. When you sell those BCH you can subtract the proceeds from this cost basis, which is your capital gains or losses.

If it is treated as having a zero cost basis, then for now there is nothing to report. However, when you sell or spend your BCH you will take the 100% proceeds as capital gains income that will be taxed. This would be declared as normal as part of your capital gains in 1040 Schedule D.

3. Should it be treated as a split of BTC?

That seems incorrect and complicated. If you half the value of your BTC holdings and sell them, you will incur more gains. However, could you determine how much were short-term and long-term? The BCH would also be classed as income at this point, since it now has a value, and so will incur income taxes. Unlike stocks that split, BCH and BTC are separate digital assets that have no common markets, and will have different values going forward.

4. What should I use as the date of the BCH?

The date you had control. This will often be the date of the fork, 1st August 2017. For instance if you held your coins in your own local wallet, e.g. Bitcoin core or Ledger, then you were in control of the BCH private keys on that date. If you held your BTC in an online exchange, it would be more likely the date they were available to you. With Coinbase, for instance, that will not be until 1st January 2018.

5. Will I pay taxes when I sell my BCH?

Yes, you will pay the appropriate taxes as it will be treated as capital gains income. If you use the zero cost-basis approach and you owned 1 BTC before the fork, you have 1 BTC and 1 BCH after the fork. When you sell your 1 BCH, at $300 for example, then you will need to declare $300 capital gains income. Tax rates depend on your circumstances and other income, but if sold within a year would be your normal tax rate, e.g. 25%. If you held onto the BCH for more than a year, you could claim long-term tax rates, e.g. 15%.

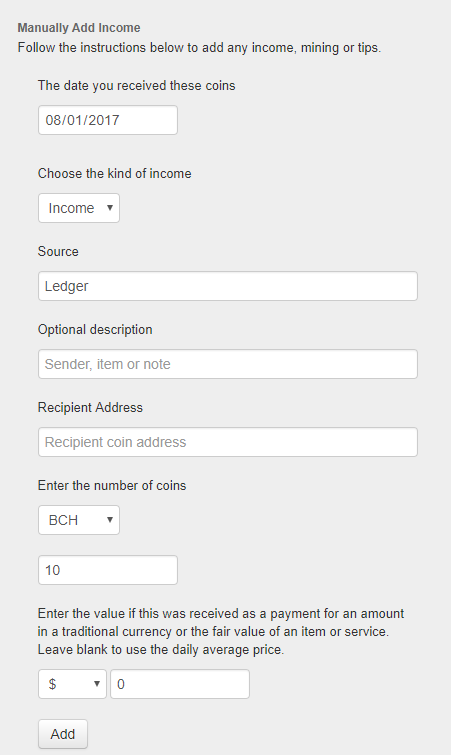

6. How should I enter this into Bitcoin.Tax?

Go to the Income tab for 2017 and manually add a new row for the amount of BCH you now own. This will often be the amount of BTC you held beforehand, but you might want to split it up by wallet or exchange. So, for example, if you had 10 BTC in your Ledger wallet at the time of the fork and checked you have access to those 10 BCH, then you would add 10 BCH income. Bitcoin.Tax will put in the daily price, or if you enter zero "0" as the total value it will set a zero cost-basis and defer the income to when they are sold, spent or traded.

Bitcoin.Tax is the leading capital gains and income tax calculator for Bitcoin and other digital currencies, calculating gains and losses for users since 2013. You can sign up for free at https://bitcoin.tax/signup.

This post is the opinion of the author and not financial or tax advice. Please speak to your own expert, CPA or tax attorney on how you should treat Bitcoin Cash. Our list of Bitcoin and digital-currency knowledgeable experts can be found at https://bitcoin.tax/cpa.