We're pleased to announce the release of BitcoinTaxes 2.0, to calculate capital gains and income for the 2014 tax year and into 2015.

New features:

- Moved to bitcoin.tax

- Adding income from Coinbase, BitPay, CEX.IO

- Adding income from mining addresses with price lookup

- Adding spending, donations and gift/tips from Coinbase, Core/Qt Wallets, Blockchain.info

- Address and transaction viewer

- Market prices for over 2,000 trading pairs

- Support for Kraken

- Optional like-kind treatment calculation

- Automatic calculation of opening position and cost-basis

- Income report

- Donation/Gifts cost-basis report

- Free version supporting all importing and calculation functionality for and all alt-coins up to 100 transactions1

- Unlimited Premium version2

New Bitcoin.Tax Domain

Version 2.0 has moved and is now hosted under a new domain, https://bitcoin.tax. Visitors to the previous bitcointaxes.info website will automatically be redirected to the new site.

What's New

In a previous post I talked about the mistake in trying to calculate crypto-currency gains and taxes wholly using the blockchain. Doing it this way is unfortunately both inaccurate and incorrect, and so simply can't be used as an effective method. I'll admit, it seems like it could have been perfect, and was one of my thoughts when I started BitcoinTaxes over a year ago now. But unless you go through all your data correcting all the mistakes, your figures are just going to be wrong. And with users we've already helped, some that have tens-of-thousands of trades, it just isn't going to work.

So we've continued with our more reliable approach of letting you control how to import your data. We know it works, gives the right answer and have positive testaments from users. To that end, there are now more ways to add your information.

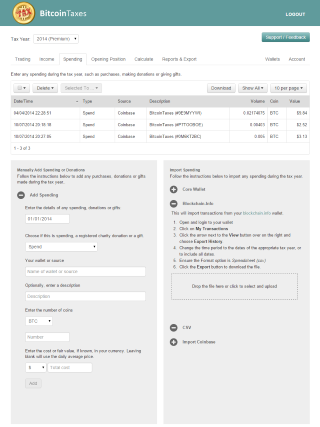

Spending Coins

The front-end interface deliberately hasn't changed too much. It is clean and easy to navigate, but now with a few additions where you can add more data.

The Spending tab gives access to a dedicated page to add any transactions where you "spent" coins for goods and services, or made donations or tips. Although this depends on local tax jurisdictions and some countries may not even have to include spending, the US, where crypto-currencies are taxed as property, must calculate gains when they are spent, as if they had been sold.

You can manually add spending, import a CSV file (if you are that organized!), and import from your Coinbase account. We've also integrated with imports from the Core wallet software (Bitcoin, Litecoin, Dogecoin, etc.) as well as a transaction history from blockchain.info.

Spending is additionally categorized with Charitable Donations and Gifts/Tips. Coins given away are not included in your tax calculations (i.e. you don't have gains) as the cost basis is transferred over to the receiver. The Reports page provides a breakdown of any donations or gifts/tips you have made with their costs basis, so you can pass this along to the recipient.

Income

Income is where you can enter any coins that were received or mined. Tax treatments for income vary per country, so please check your local laws, however there is an income report for any received coins either at their fair value or market price. From this point, they are also included in any gains calculations as they could still create gains/losses when spent or sold.

Income can be imported from a CSV, your Coinbase or BitPay accounts. We have also added mining income from CEX.IO and by entering a coin address.

Market Price

One of the great new features, and throughout v2.0, is to find the equivalent fiat price. If I received 1 BTC and enter it as income, there is no need to type in a price. It will be looked-up in our rate tables for that day. We have Bitcoin, Litecoin, Dogecoin and over 2,000 alt-coin trading pairs. Of course you can always override the estimate, but for income and mining, it gives a valuable way to quickly calculate your taxable income.

Mining

Income can also be included from any mined addresses. We support BTC, LTC and DOGE at present, but are looking to add more of the popular mined coins.

If you always use the same mining address to receive payouts, you can simply add it in and we'll find the transactions for the tax year. We then work out the price, show them to you, and finally include them in both the Income and Gains calculations. Easy.

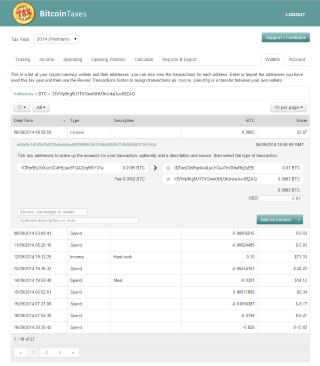

Addresses and Transactions

Tracked mining addresses is a specific example of the new address tracking. On the Addresses page is where you can choose to add any of your own addresses. This acts as a more sophisticated blockchain viewer, combining information from the blockchain along with knowledge of your other addresses and the coin prices.

From here you can view those transactions you might have made and add them as a new trade, income or spending. We already automatically detect any transfers between your wallets, so they are easily ignored.

The point here is to catch the exceptions rather than the rule. 99% of your trading, spending and income should already be captured from imports, but here is a nice way to include any missing or off-the-books transactions.

Addresses can add any new transactions as they appear, so your view is always kept up to date. A coming feature will also notify you of a new transaction and you can quickly add any notes or prices, so it can be included in your income or tax calculations as-you-go.

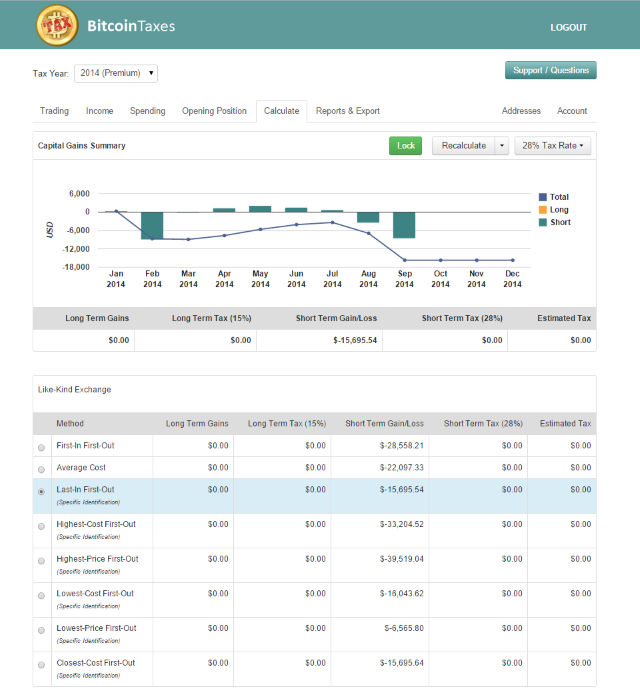

Like-Kind Treatment

Our default calculation has always been to treat any alt-coin trading as a tax event, but now we provide like-kind or cost-basis transfers. It is currently uncertain if this could potentially be allowed in the US3 and other countries should check their local tax laws to check their viability.

So for example, a BTC/DOGE trade has been treated as a SELL of BTC into fiat, and then a purchase of DOGE with that fiat amount. This triggers a tax event and potential gain or loss on the BTC. But when calculated as like-kind, the cost-basis value and date of the original BTC are transferred over to the DOGE. There is no tax event, no gains/losses and the DOGE takes on the purchase cost of the BTC.

Switching, or comparing, is just a matter of selecting the calculation option on the Calculate page.

Other Changes and Additions

We switched the source of our fiat exchange rates from oanda.com to openexchangerates.org, effective from 1st July 2014. This ensures any past calculations are not affected.

Bitcoin/USD prices for 2013 had always been quoted from MtGox. Since 1st Jan 2014 it has been Bitstamp. However, we now support most major fiat/crypto exchange rates, which are determined based on their best match and volume. So for example, a DOGE/USD rate before a direct USD market existed would pick up a Cryptsy BTC rate, and then a USD/BTC rate. However, we plan to allow you to pick your preferred source as well as an option to ignore any coin-coin values. Meaning if there is no direct coin-fiat market, it effectively has a zero value.

Kraken has been added as a supported exchange. We have been in contact with Circle, but unfortunately they don't yet provide an export facility and have no timescale.

Feedback

The Feedback button is still the quickest way to make contact with any questions or comments, but otherwise you can still contact our Support team directly.

1. Free version is limited to 100 transactions per tax-year for 2014 and later and has no access to the address/transaction viewer.

2. Premium prices for new subscriptions are $19.95 per tax year.

3. The IRS has not specifically accepted or rejected the use of like-kind treatment when calculating capital gains. Please consult with your tax professional.

About Us

Denebrook Software, established in 2006 and based near Seattle, are the developers of BitcoinTaxes and have provided tax solutions to crypto-currency users since January 2013. With their own scalable and feature-rich platform, users from over the globe have been able to import their Bitcoin transactions and calculate tax liabilities. BitcoinTaxes supports all crypto-currencies, major currencies, and is integrated with multiple trading platforms.