Bitcoin.Tax can export your capital gains records into multiple formats, including a "TXF" file for importing into TurboTax®.

Bitcoin.Tax can export your capital gains records into multiple formats, including a "TXF" file for importing into TurboTax®.

The online/web version of TurboTax does not support file importing. You must use their downloadable or CD version.

We are going to go through the steps to import your file.

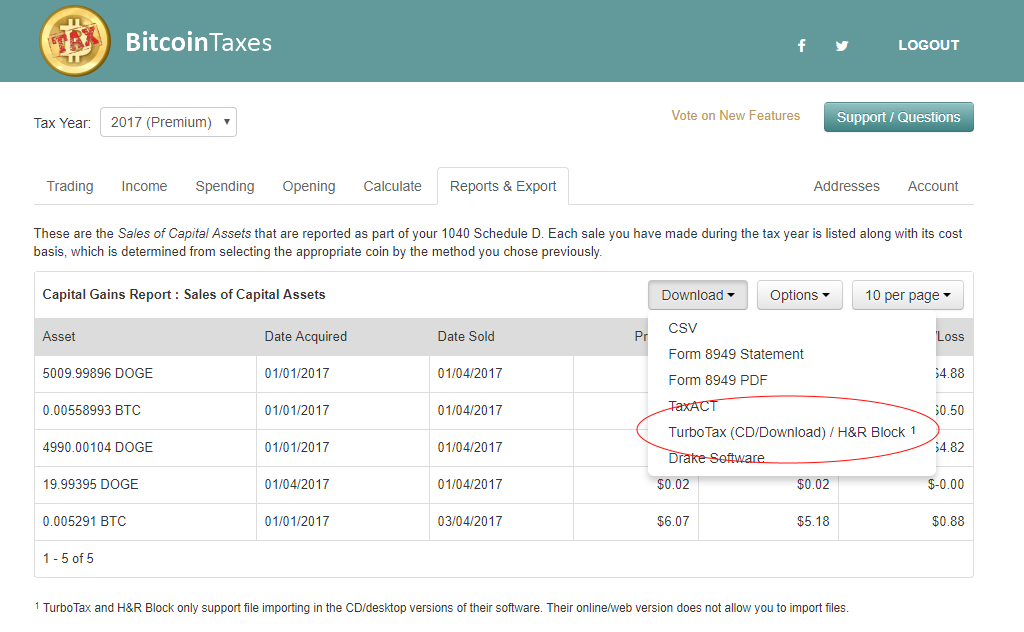

Once your have finished calculating your data, go to the "Reports & Export" tab, click the Download button and select the TurboTax option.

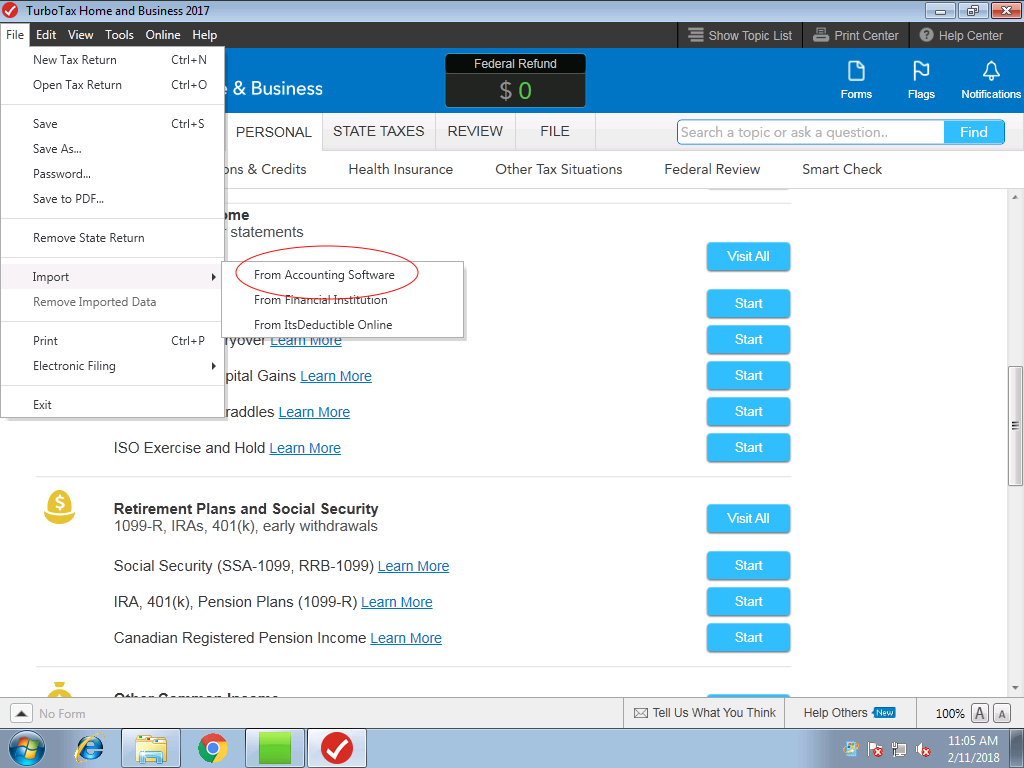

Open TurboTax for your current tax return. Although capital gains are added into the Personal Income -> Investment Income -> Stocks, Mutual Funds, Bonds, Other section, you don't actually have to be there to import your file.

Click the File menu at the top, choose Import, and then "From Accounting Software".

On the next screen, select "Other Financial Software (TXF file)" and click Continue.

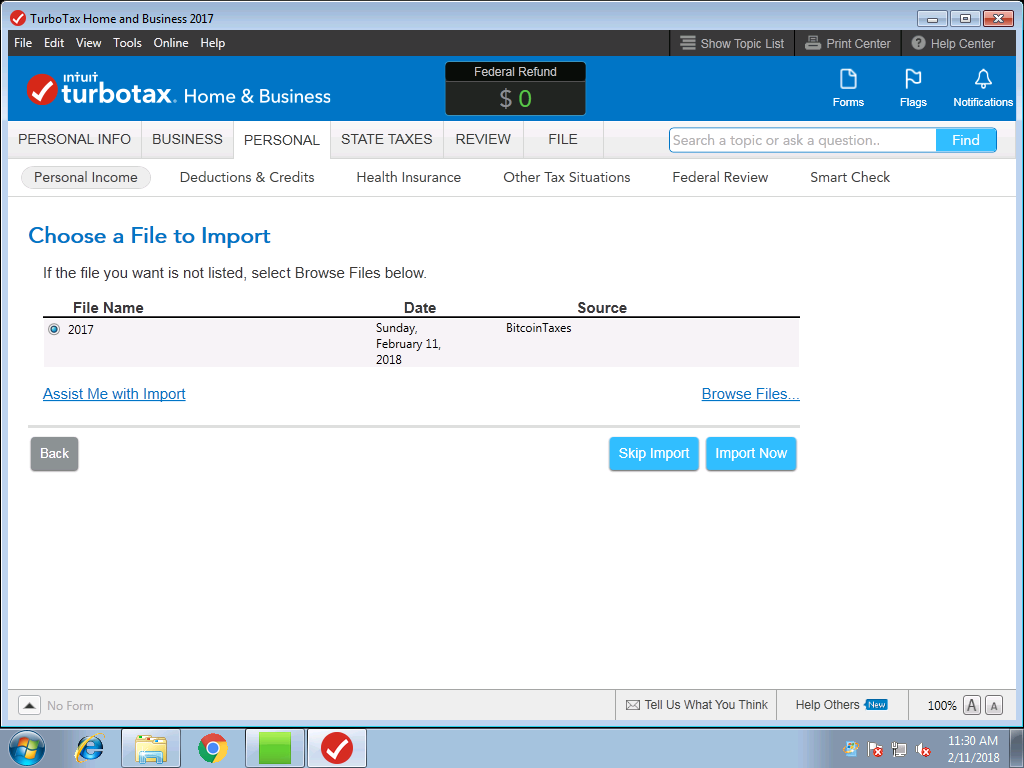

Next, click "Browse Files..." to find and choose the ".txf" file you downloaded from Bitcoin.Tax. That will be loaded into TurboTax and you can click "Import Now".

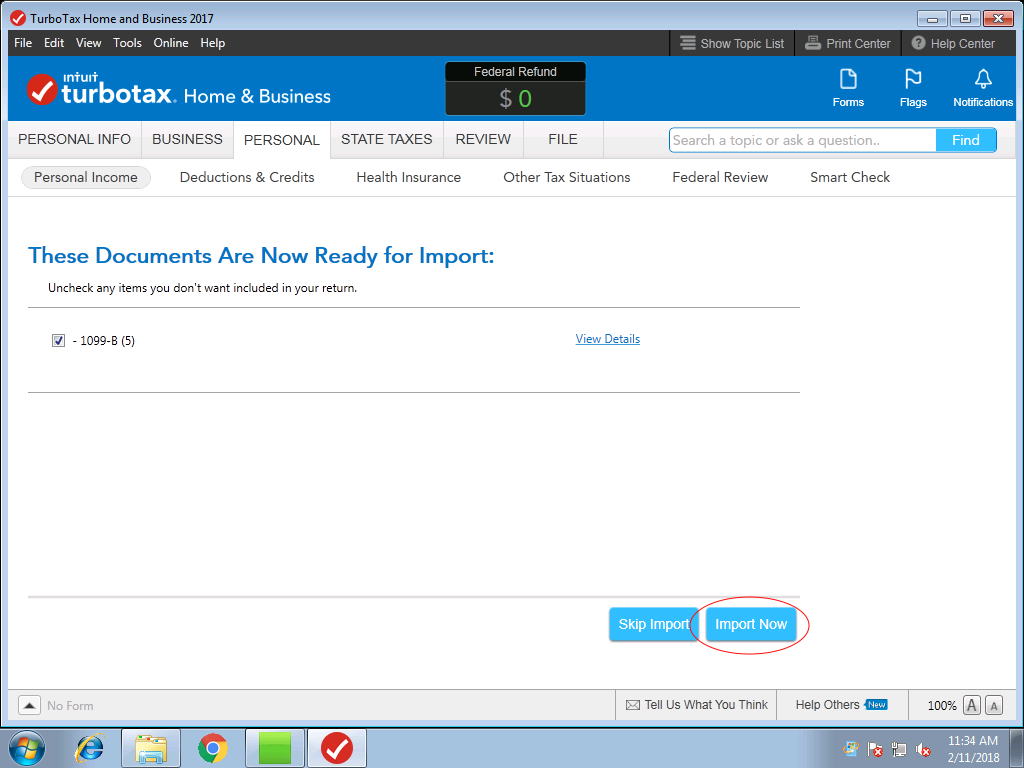

It should show as 1099-B. You can click the "view details" link to check what the file contains, otherwise, just go ahead and click "Import Now".

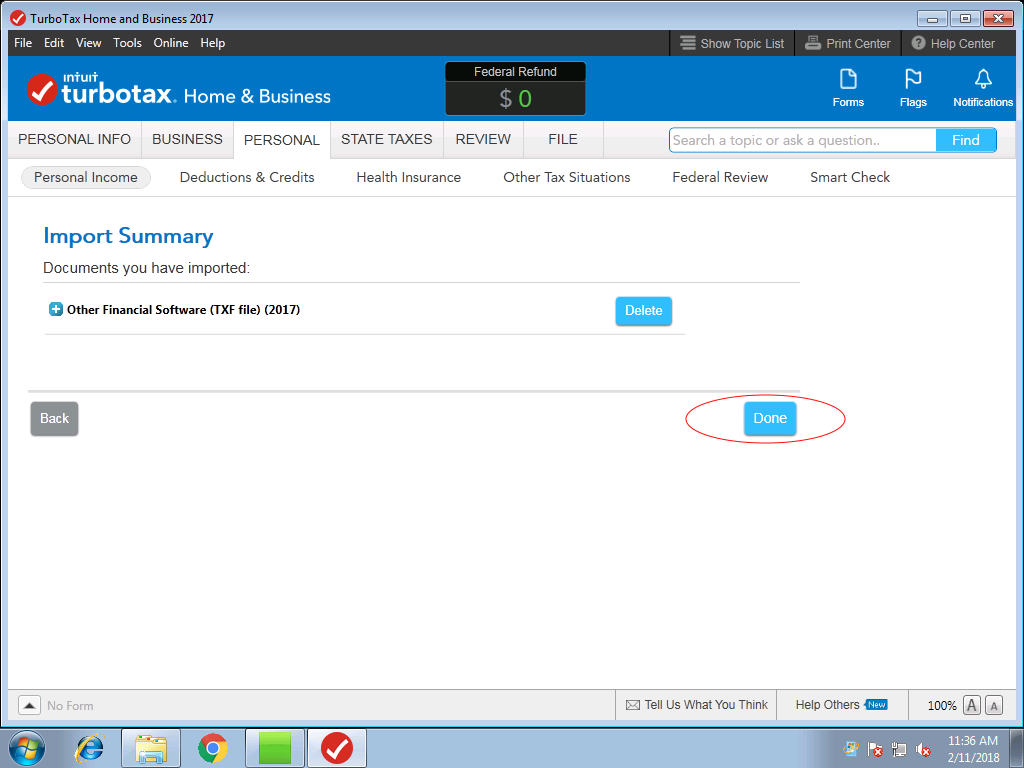

Just click Done on the next screen.

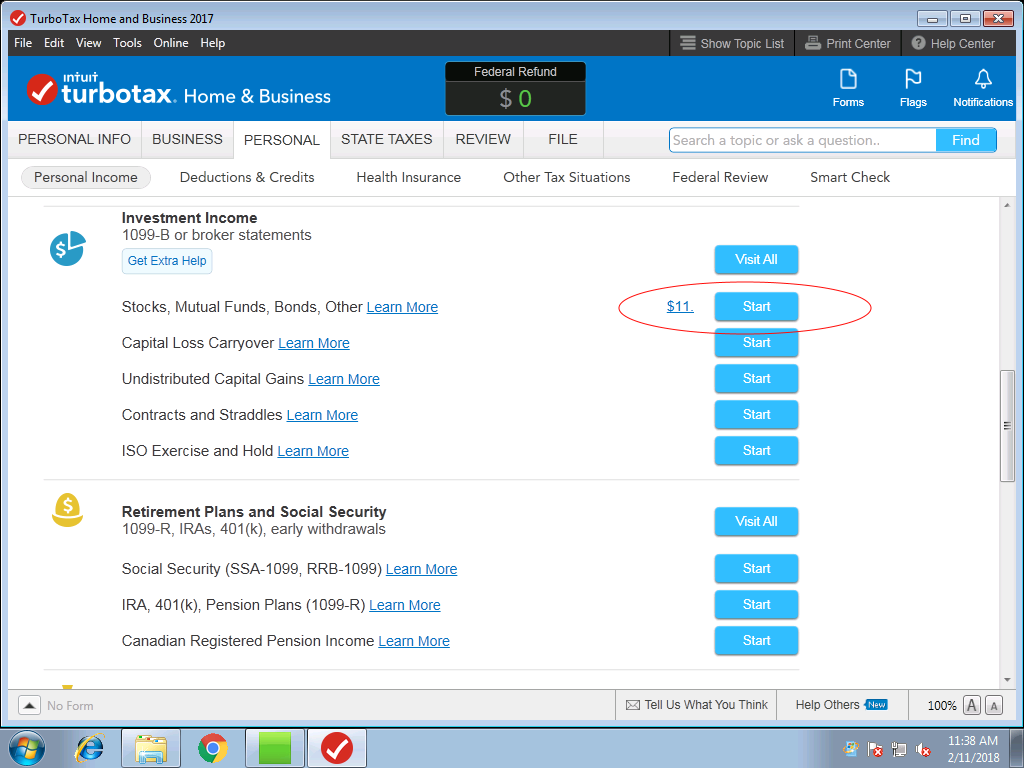

If you now go to PERSONAL at the top, then into Personal Income, and scroll down to the Investment Income, you will see the entries have been added.

You can click the Start button (or Update if you've been there already) next to the Stocks, Mutual Funds, Bonds, Other, which will show you the details.

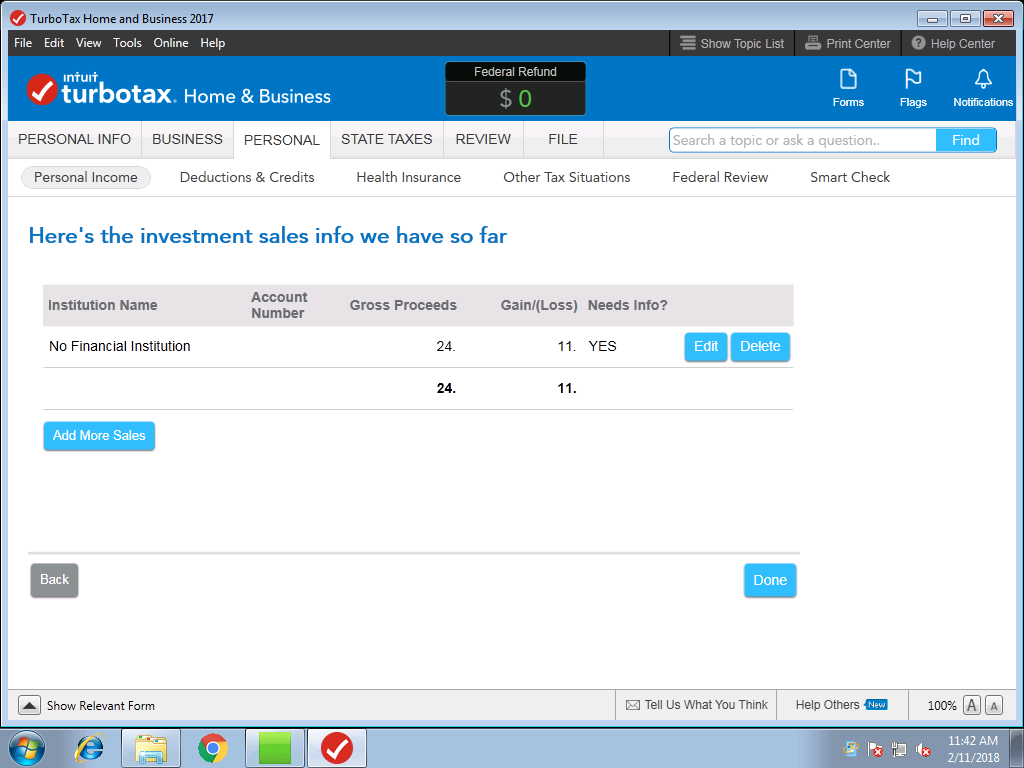

You will notice that "Needs info?" says YES. This is because there is no Institution Name set for the data, which is expected. You can ignore this.

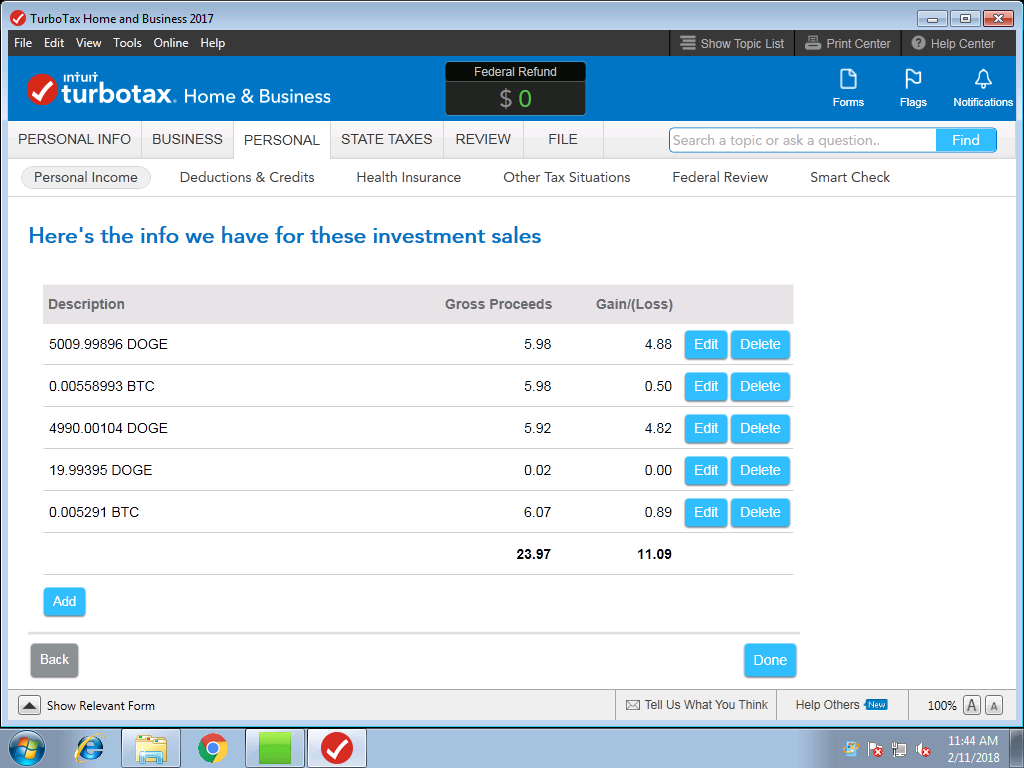

You can click the Edit button next to the line and see all the records.

Click Done to get back.

You are finished and your data has been imported.

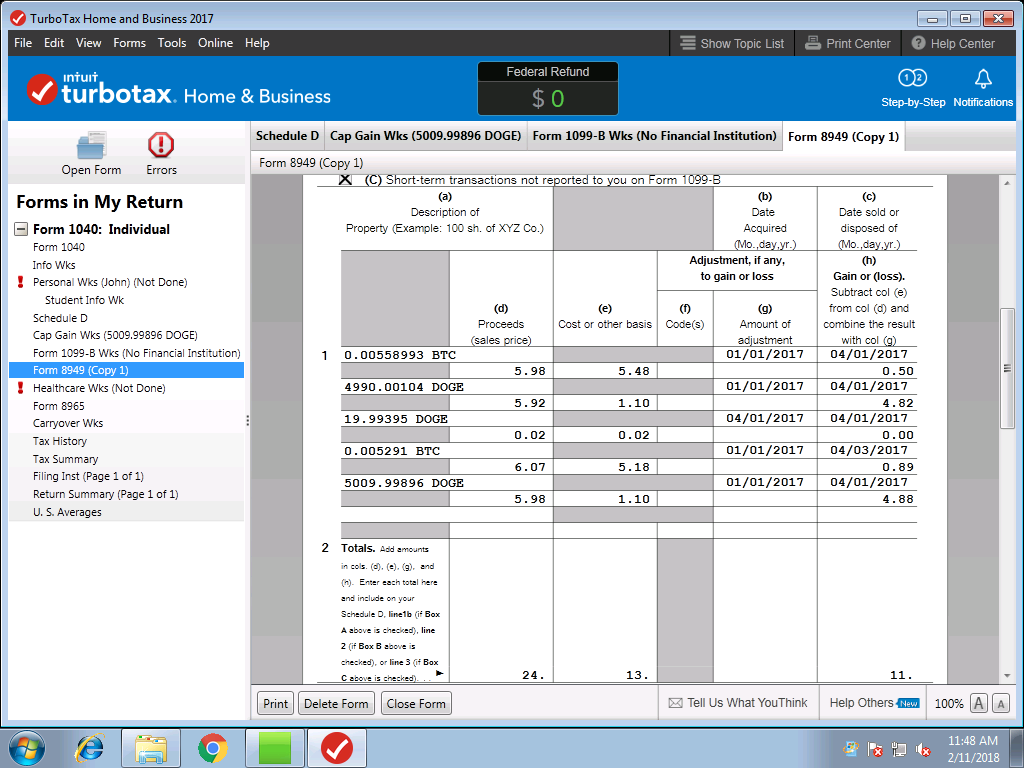

If you want to verify the information has been included in your Schedule D, click on the "Forms" at the top right of TurboTax. You will then see both the Schedule D and 8949 forms. Select each to check the details have been included.

Images are reprinted with permission © Intuit Inc. All rights reserved.

Bitcoin.Tax is leading capital gains calculator for digital currencies for US and worldwide users, traders and investors. You can try Bitcoin.Tax at https://bitcoin.tax/signup.

This post is the opinion of the author and not financial or tax advice. Please speak to your own expert, CPA or tax attorney on how you should treat taxation of digital currencies. A list of Bitcoin and digital-currency knowledgeable accountants can be found at https://bitcoin.tax/cpa.