In December 2018, Her Majesty's Revenue & Customs (HMRC) in the UK issued an update to their policy on how to treat cryptoassets (cryptocurrencies) for individuals.

In December 2018, Her Majesty's Revenue & Customs (HMRC) in the UK issued an update to their policy on how to treat cryptoassets (cryptocurrencies) for individuals.

The latest release of BitcoinTaxes now supports this policy and is available to our UK users.

Capital Gains Tax (CGT)

HMRC does not consider cryptocurrencies to be money and they are still subject to capital gains. While they are split into three types of tokens: exchange, utility and security, the tax treatment depends more on their use rather than the type.

In the vast majority of cases, individuals hold cryptoassets as a personal investment, usually for capital appreciation in its value or to make particular purchases. They will be liable to pay Capital Gains Tax when they dispose of their cryptoassets.

Most users will calculate the capital gains or losses from their trading.

Only in exceptional circumstances, with an individual with high volume trading, would it be considered subject to Income Tax rather than CGT. This might well be the case for businesses that operate a trading system and HMRC says they will come out with guidance for business in due course.

HMRC also considers cryptocurrencies to be intangible since they are digital. This means that one Bitcoin, for example, is treated no different than another, and therefore costs can be pooled together to create an average cost.

When the crypto is disposed, i.e. when you no longer own it, a tax event is seen to have occurred. This could be from

- selling it for GBP, or other fiat currency

- trading one crypto for another

- spending crypto for goods and services

- donating to charity

- giving your crypto to another person

A tax event from a disposal will trigger a capital gains calculation, where you need to work out if the event had a profit or loss.

In the case of giving away crypto, it must be considered a disposal at fair market value in GBP. While no rules are in place for how to work out the value, using a common and consistent method would likely be the best approach.

Donations to charity are not subject to CGT, unless the donation is tainted or if the disposal to charity is valued higher than the cost of acquisition, resulting in a realised gain.

Costs, such as the acquisition cost or fees, can be used to reduce the amount of gains received. However, costs used as part of Income profits or expenses, such as mining equipment, cannot be deducted.

Cost Basis Calculations - Pooling

Since crypto assets are intangible, pooling is used to calculate the cost basis of an asset when it is disposed. This is essentially averaging your crypto with their acquisition costs.

As an example,

Buy 1 BTC for £3,000

The average cost for each BTC is (£15,000 + £3,000) / 2 = £9,000

Same-Day and 30-Day Rules

Much with traditional shares, crypto has the same rules to prevent bed and breakfasting, with the same-day and 30-day rules.

The same day rule says that when disposing, the cost basis will be taken from any other crypto of that same asset type that was acquired that day, even if occurred after the disposal.

Likewise, any of the same crypto acquired within 30 days will also be used as the basis before any pooled value.

This means you cannot sell your holdings at the end of the tax year to create losses and then buy them back. You would have to wait at least 30 days in order to make use of your pooled assets.

For example,

Sell 40 XYZ and receive £1,600.

If nothing else happened, there would be a gain of

= £1600 - (40 / 140 * £2000)

= $1600 - £571.43

= £1,028.57

A few days later, 5 more XYZ are purchased for $175. These fall under the 30-day rule and so must be included as some of the crypto sold.

So now the gain is:

= (proceeds of 5 XYZ less cost of their acquisition under 30-day rule) + (proceeds of remaining 35 XYZ less their cost from the average pool)

= (5 / 40 * £1600) - £175 + (35 / 40 * £1600) - (35 / 40 * £2000)

= (£200 - £175) + (£1400 - £500)

= £25 + £900

= £925

Pooling with Bitcoin.Tax

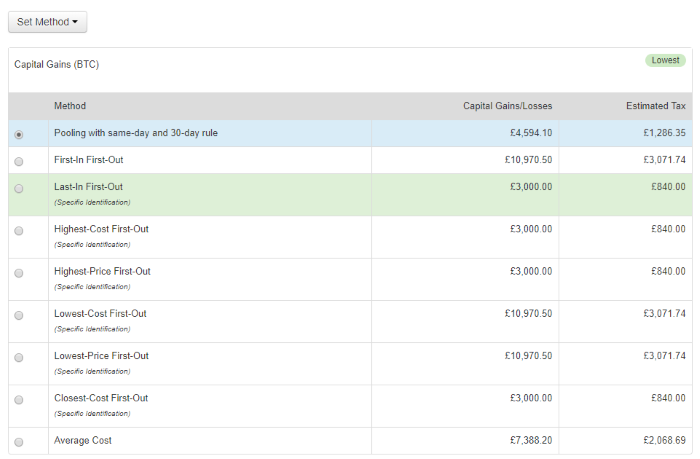

Bitcoin.Tax has updated all tax years with these new UK rules. The old calculation methods, such as FIFO, LIFO, averaging, etc., are still in place but we recommend you update your calculation methods selections where appropriate.

To calculate using the Pooling method, go to the Calculate tab in Bitcoin.Tax and select the new "Pooling with same-day and 30-day rule" option. You can select each crypto asset individually or click the Set Method button and choose the option for all your crypto assets.

Changing the option will start a new calculation. Or, if you see "recalculate" next to the Pooling option, please click the Recalculate button.

Once this is updated you should not need to change it again.

Bitcoin.Tax will now calculate using average pooling.

The same-day rule means that any acquisitions made on the same day of a disposal will be pooled separately and used first.

If the same-day rule is not used, then the 30-day rule means that any acquisitions made in the 30 days following a disposal will be used instead of the average pool.

Please be aware that this means we could incorporate income and purchases of cryptocurrencies from the following tax year into your calculations. Therefore, it is important that you navigate to the following year and import any relevant trading and income data before calculating your capital gains - at least the first 30 days worth of data from the following year. You can then go back to the previous year and recalculate.

If there are 30-day acquisitions used from the following year, they will be carried forward and displayed in the Opening tab of that year so they are not reused.

When you are finished, you can see the total capital gains amount shown in the table at the top of the Calculate tab.

When you are finished, you can see the total capital gains amount shown in the table at the top of the Calculate tab.

We display the capital gains amount and the estimated taxes on that amount.

Please note that we do not take away the standard deduction (£11,300 for 2017/2018) as we do not know what other gains you might have. If crypto is your only source of capital gains, and you are under this allowance, then you may not need to report this information. However, we strongly recommend you still go to the Reports tab and download the CSV of your data in case you need to show this is the future.

Bitcoin.Tax is the leading capital gains and income tax calculator for Bitcoin and cryptocurrencies. You can sign up for free at https://bitcoin.tax/signup.

BitcoinTaxes does not provide financial, tax planning or tax advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.