Bitcoin.Tax and Intuit® have partnered again for this year's tax season and can now help users import their cryptocurrency capital gains directly into TurboTax Online®.

Bitcoin.Tax and Intuit® have partnered again for this year's tax season and can now help users import their cryptocurrency capital gains directly into TurboTax Online®.

Users of Bitcoin.Tax can also benefit by saving up to $15 on TurboTax federal products.

Users of Bitcoin.Tax can also benefit by saving up to $15 on TurboTax federal products.

Importing your capital gains

Including your cryptocurrency capital gains information into your tax forms has been quite difficult due to the basic support from the major online tax preparation services.

Also, the current IRS forms are not really designed for cryptocurrency users that have to report every tax event. The standard Form 8949 only allows for 14 lines per page, but trading on multiple exchanges can easily generate many more lines because of how lots are split and cost bases determined.

A trader could end up with a 5,000 page PDF to print!

Fortunately, IRS Form 8949 instructions do allow for printing your own condensed version, but this could still result in a 800+ page file that must be printed and mailed to the IRS.

While Intuit's desktop/CD version of TurboTax has limited import support for the TXF file format, it has not been available for users of the web-based TurboTax Online versions until now.

Importing into TurboTax Online from Bitcoin.Tax

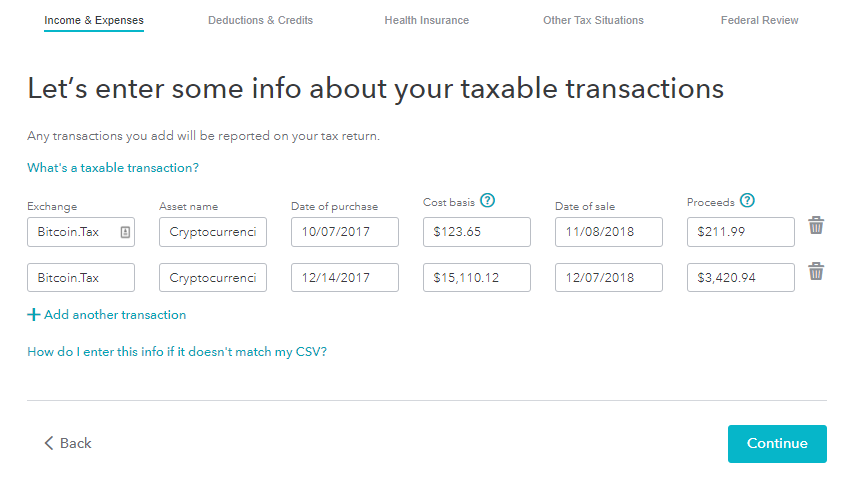

Filing your taxes has just become much easier with the addition of a new TurboTax Online download report file. Bitcoin.Tax and the TurboTax Online team have created a file format that can be exported from your Bitcoin.Tax account and imported directly into the TurboTax website.

This means you can use the power of Bitcoin.Tax to calculate your crypto capital gains along with the convenience of TurboTax to prepare and file your taxes.

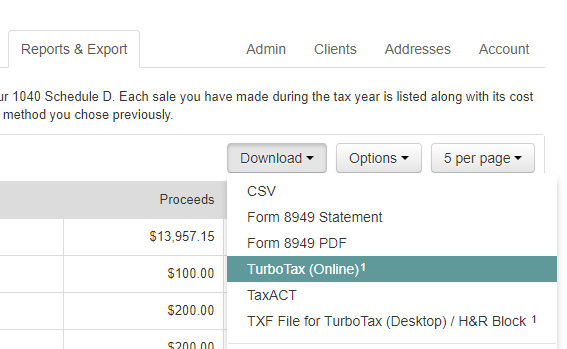

Just use Bitcoin.Tax tax as normal, go to the Reports tab and click the Download button. The new option for "TurboTax Online" will download the file you need.

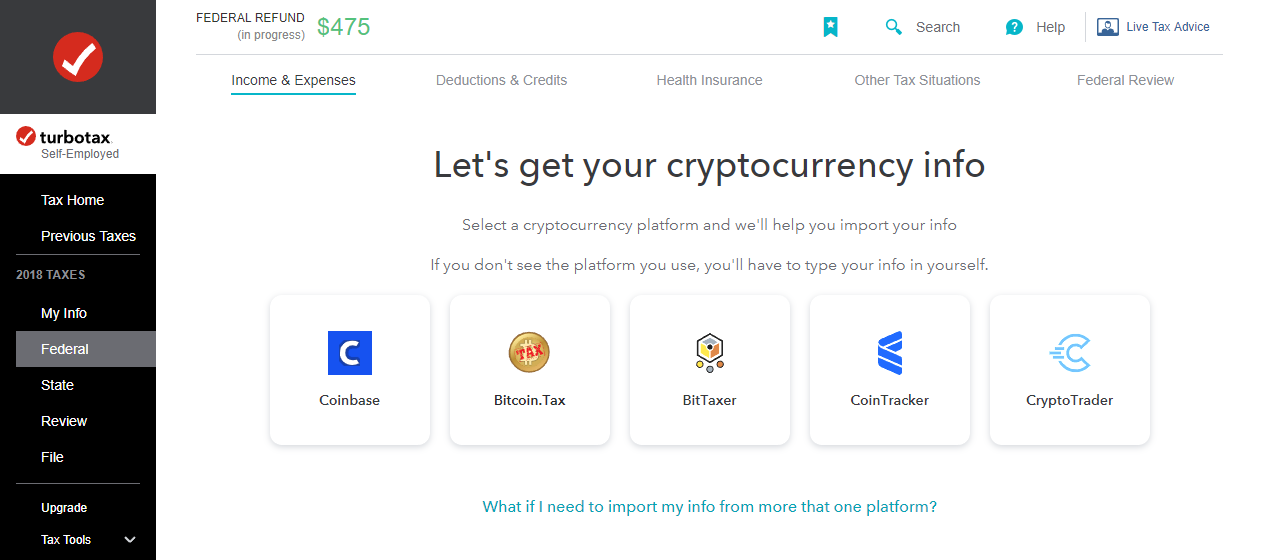

TurboTax Online has a new Cryptocurrency section:

- click Federal in the menu on the left

- choose Income & Expenses at the top

- scroll down into All Income and clicking the Investment Income section

- click the Start or Revisit button next to the new Cryptocurrency option

Importing more than 2,251 entries

TurboTax has a limit of 2,251 entries. If you have more than that in your capital gains report, you can either try and reduce the number of lines, aggregate the values or create an attachable statement.

If you click the "What do I do if I have more than 2,251 transactions?" in TurboTax Online, you are advised to use a service like Bitcoin.Tax and just enter the sum values of your short-term and long-term gains/losses.

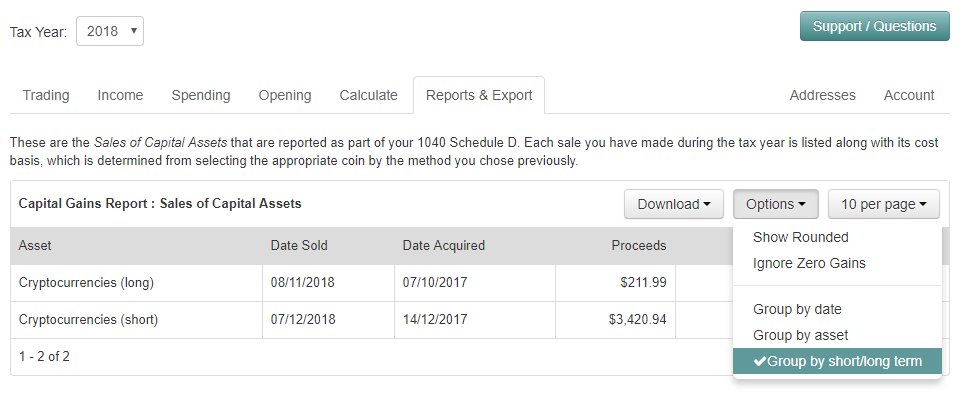

You can get these values in Bitcoin.Tax by clicking the Options buttons in the Reports tab, and choosing "group by short/long term".

This will change the table to show one or two lines, one for your total short-term gains and one for your long-term gains.

You can go back to TurboTax and click "I'll enter them myself" then enter the values manually. Or, you can use Bitcoin.Tax and download the TurboTax Online file again, which will now just be those one or two lines, then import it into TurboTax using the Bitcoin.Tax icon.

You may still need to send the IRS all your Sales of Assets entries, as you are supposed to report each and every tax event. Please check with your own tax professional if you need to do this. If so, you can continue and create an attachable statement.

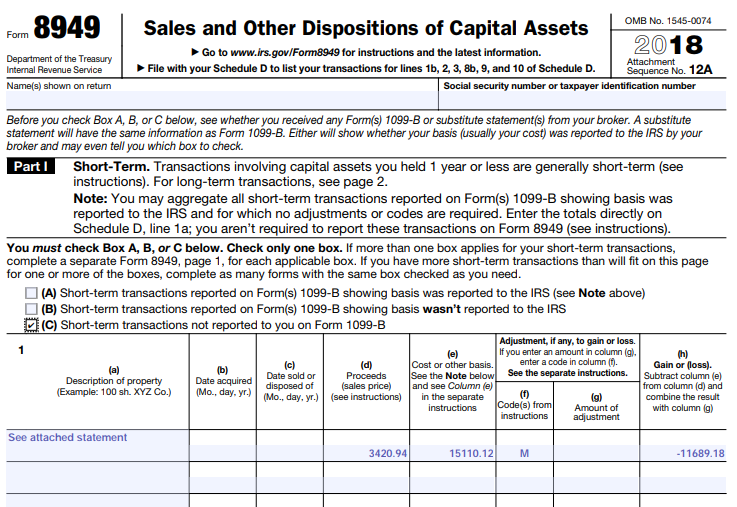

Form 8949 Attachable Statement

The IRS Form 8949 Instructions (page 3 Exception 2) provides details on how to create an attachable statement.

To do this, enter a single line on Form 8949 summarizing each of your short and long term capital gains, and then send the IRS the full details by mail.

To enter a summary line in Form 8949:

- Enter "See attached statement" for column (a)

- Leave the date columns, (b) and (c), blank

- Fill in the total proceeds, cost and gain in columns (d), (e) and (h)

- Enter "M" in column (f)

Back in Bitcoin.Tax, go to the Reports tab and click the Download button and choose "Form 8949 Statement". This will download a CSV with all your entries.

Print this off on paper and then download and complete Form 8453, ticking the entry at the bottom for "Form 8949".

Put these together and mail to the IRS at the address shown at the bottom of the form.

BitcoinTaxes gives you up to $15 off when purchasing TurboTax when clicking our link below.

Bitcoin.Tax is the leading capital gains and income tax calculator for Bitcoin and cryptocurrencies. You can sign up for free at https://bitcoin.tax/signup.

BitcoinTaxes does not provide financial, tax planning or tax advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.