Once your capital gains have all been calculated you will need to include them in your taxes.

How to do this depends on how you are filing this year.

How to do this depends on how you are filing this year.

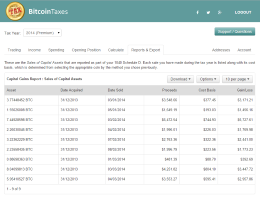

Go to our Reports & Export tab to the Sales of Assets section.

Do you file yourself and mail in your 1040?

Click the Download button and choose "Form 8949 PDF".

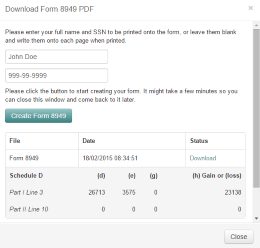

A window will open. If you enter your name and SSN, we will print them onto the form with all your other information. Or you can leave them blank, but you will then need to write them in yourself onto the printed forms.

A window will open. If you enter your name and SSN, we will print them onto the form with all your other information. Or you can leave them blank, but you will then need to write them in yourself onto the printed forms.

Click Create Form 8949. Your file will start being created. It can take a few minutes so you can close window and come back to it later.

The Status will change to Download once it is complete. Clicking this link will download the multi-page Form 8949 PDF ready to print.

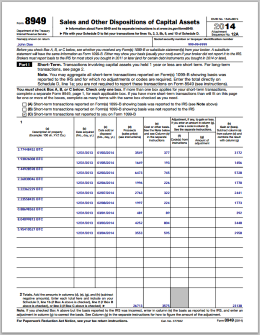

Fill in your name and SSN if you left them blank.

Fill in your name and SSN if you left them blank.

You will also need to include the totals from 8949 in your Schedule D. The values are shown underneath the download link. Click the row if they are not visible.

Write these values (add, if you have other Form 8949s) into the appropriate boxes on your Schedule D form.

Your PDF will be deleted after 72 hours, or you can click the delete icon to remove it immediately.

Do you use a CPA or other tax professional?

Click the Download button and choose either "CSV" or "Form 8949 Statement".

This will download a file you can email over to your tax professional. Choose the CSV if they want the raw data, or the 8949 statement so they can attach it to your Schedule D.

Do you use TurboTax?

Click the Download button and choose "TurboTax TXF".

This will download a file you can import directly into TurboTax. Unfortunately, TurboTax only supports importing from their CD or downloadable versions of their software, and then it is limited to 500 lines.

Open TurboTax and go to Personal Income section, then under Investment Income click Start or Update next to "Stocks, Mutual Fund, Bonds, Other".

Say Yes to "Did you sell Any Investments in 2014?"

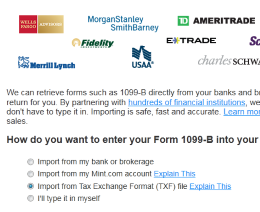

Select "Import from Tax Exchange Format (TXF) file" and click Continue.

Select "Import from Tax Exchange Format (TXF) file" and click Continue.

Select the appropriate category, such as Income and Continue.

Click Browse Files and choose the file you previously downloaded and click Import Now.

That's it. Everything is now included.

TurboTax Online

If you are using TurboTax online, you will need to enter summary information and mail in a statement. Download the "Form 8949 Statement" from BitcoinTaxes and follow TurboTax's instructions to mail an attached statement.

Do you use TaxACT?

TaxACT can import up to 2,000 lines through their website. If you have more, you will need to attach a statement instead.

Less than 2,000 transactions

Click the Download button and choose "TaxACT".

This will download a file you can import directly into TaxACT.

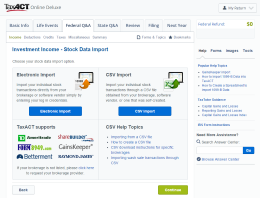

Click Federal Q&A. Under Investment Income, expand "Gain or loss on the sale of investments" and choose "Stock data import".

Click Federal Q&A. Under Investment Income, expand "Gain or loss on the sale of investments" and choose "Stock data import".

Click the CSV Import button and choose the file you previously downloaded, then click Continue.

At the next screen, click Next.

Tick the box next to "Import" at the top and then OK to the messages that appear. Click Next and finally Import.

More than 2,000 transactions

Click the Download button and choose "Form 8949 Statement".

This will download a file that can be printed and sent to the IRS via mail. You will also need to download and print Form 8453 to send in with your statement.

Click Federal Q&A at the top. Under Investment Income, expand "Gain or loss on the sale of investments" and choose "Enter totals from a statement of transactions you will attach to your return".

Click the Add icon next to New Copy of Federal Form 8949 Attachment.

Check the box to elect to attach a statement, and Continue.

Enter "BitcoinTaxes", or anything, into the name of brokerage.

You will need to select and enter your totals for report category C and F. C is for short-term capital gains and F is long-term capital gains. Open the file you have downloaded and you will see two sections, Part 1 (C) and Part 2 (F). At the bottom of each of these are the totals you require.

Click Add for a New Copy of Federal Form 8949 Attachment.

Select category C and enter the first three values from the TOTAL line in Part 1 of your downloaded file (the "Total adjustment value" is always zero).

Click Add for a New Copy of Federal Form 8949 Attachment a second time.

Select category F and enter the first three values from the TOTAL line in Part 2 of your downloaded file (the "Total adjustment value" is always zero).

Click Continue.

Important: You must print and mail your downloaded Form 8949 statement along with Form 8453 within 3 business days from the date you e-file return was accepted by the IRS. See TaxACT instructions.