Next Monday, April 18th, is the deadline for filing 2015 US personal tax returns. However, if you don't think you can get everything ready in time, you can always file for an extension that allows you to delay your tax return until October 15th.

File for an Extension

This is quite simple and can be done through IRS freefile website, through many other eFile services, such as TurboTax and TaxACT, or by sending in the forms by mail.

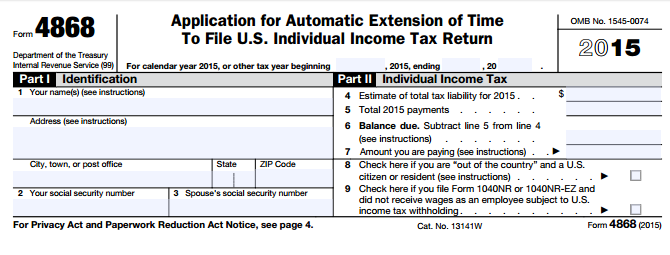

You will need to fill in Form 4868.

Be aware that while this gives you an extension for filing the paperwork, you will still need to pay any taxes you owe by April 18th. In most cases, paying 90% of any owed taxes for the year should avoid late-payment fees.

If you do not file your taxes and no not file for an extension you will incur a failure-to-file penalty, which could be 5% of your taxes per month up to 6 months, and then either $135 of 100% of your taxes.

Bitcoin Taxes

Sign up for a free account with BitcoinTaxes for the next six months so you can import your Bitcoin and other digital currency trading, spending and mining transactions. Calculating capital gains and taxable income is then straightforward and you can download files to import into TurboTax, TaxACT or even print your Schedule D 8949.