In Canada, Bitcoin and cryptocurrencies are considered commodities by The Canada Revenue Agency (CRA). The CRA treats cryptocurrency trades as barter transactions, which makes them subject to the income tax.

In Canada, Bitcoin and cryptocurrencies are considered commodities by The Canada Revenue Agency (CRA). The CRA treats cryptocurrency trades as barter transactions, which makes them subject to the income tax.

The gains and losses from these trades must be reported when filing your taxes, where most individuals would report these figures on their Schedule C. If your cryptocurrency trading is considered a "business", it may be taxed as income. It's always best to confer with a tax professional to determine what your trading constitutes.

Official information about capital gains taxation can be found on the Government of Canada's Website.

The normal deadline for tax reporting in Canada is April 30.

Taxable Events

A taxable event refers to any type of cryptocurrency transaction that results in a capital gain.

Here are the primary ways in which your cryptocurrency could result in a capital gain:

- Trading crypto for crypto

- Selling crypto for dollars or other fiat

- Buying items or paying for services rendered with crypto

Variations of these events can also result in a taxable event occurring (i.e., trading with coins acquired from a fork/split or buying something with crypto that you received for services rendered).

Buying a cryptocurrency with fiat is not, in itself, a taxable event. A taxable event occurs once the crypto is disposed.

Capital Gains = Proceeds — ACB - Fees

ACB refers to "Adjusted Cost Basis", which is how much your coin cost to acquire, plus any expenses associated with it. Adjusted Cost Basis averages together all of your acquisition costs of a specific coin in order to calculate a cost basis.

For example, if you buy 1 BTC for $3,000, 1 BTC for $5,000, and 1 BTC for $10,000, your adjusted cost basis for your BTC would be $6,000. If there were fees associated with those buys, they would also be added to the cost basis.

Proceeds are determined by the value of the crypto, service, or fiat you received, at the time of the coin's disposition. Fees refers to amounts incurred to sell your coin.

Your capital gain or loss on crypto is determined by taking the proceeds from the disposed (i.e., traded or sold) coin and subtracting the coin's adjusted cost basis.

For example, if you acquired 1 BTC for $5,000, plus paid a fee of $100, the adjusted cost basis of your 1 BTC would be $5,100. If you later sold that 1 BTC for $6,000, you would realize a capital gain of $900 ($6,000 - $5,100).

If you did one or two trades throughout the year, it's not too difficult to determine how much of a capital gain has been realized. However, most people have a lot more than one or two trades, which makes manually calculating your gains extremely difficult.

Mining Crypto

The tax treatment for mining cryptocurrency is established on a case by case basis. If the mining being done constitutes a "business activity", it is taxed as income. If it constitutes a hobby, it is taxed differently. It is best to consult with a tax professional to assess whether your mining constitutes a business activity or a hobby.

Superficial Losses

If you realize a capital loss when trading or selling capital property, you can use it to offset capital gains you have elsewhere to lower your taxes. To deter abuse of this rule, the CRA enforces a superficial loss rule on capital losses. If you have a superficial loss, it cannot be used as a deduction against your taxable income.

A superficial loss occurs when you dispose of a cryptocurrency for a loss and then you (or, even someone affiliated with you, like a spouse or a dependent) buys the same cryptocurrency in the surrounding 61 day period (30 days before AND 30 days after the sale).

For example, let's say you have 2 BTC, and then you sell 1 of those BTC at a loss. If that 1 BTC was purchased 30 days prior to the sale, the loss would be superficial. Or, if after selling the 1 BTC, you bought another BTC within 30 days, the loss would also be considered superficial.

Capital Gain Rates

For individuals, the amount of capital gains tax owed is 50% of your capital gains, based off the Inclusion Rate. If your primary source of income is from trading crypto, your gains may subject to a different rate - it is best to consult with a tax professional if you are unsure.

Foreign Property Reporting

Cryptocurrency likely falls under the CRA reporting requirements for "specified foreign property". Given this, if the cost of the cryptocurrency exceeds $100,000 anytime throughout the year, it needs to be reported on form T1135.

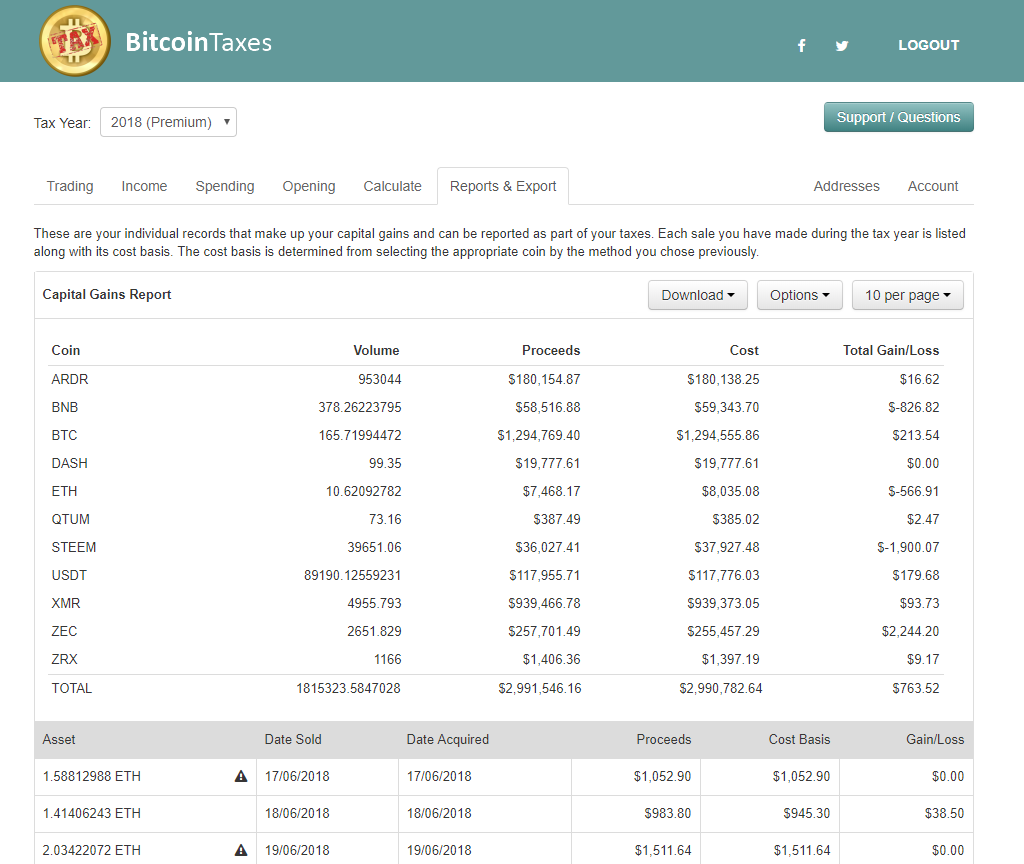

Using Bitcoin.Tax

Bitcoin.Tax has supported Canadian users since 2014 and supports adjusted cost basis as a method for all users. Our standard features allow you to import your trading, income and spending activity from exchanges and wallets and calculate any capital gains or losses you have incurred.

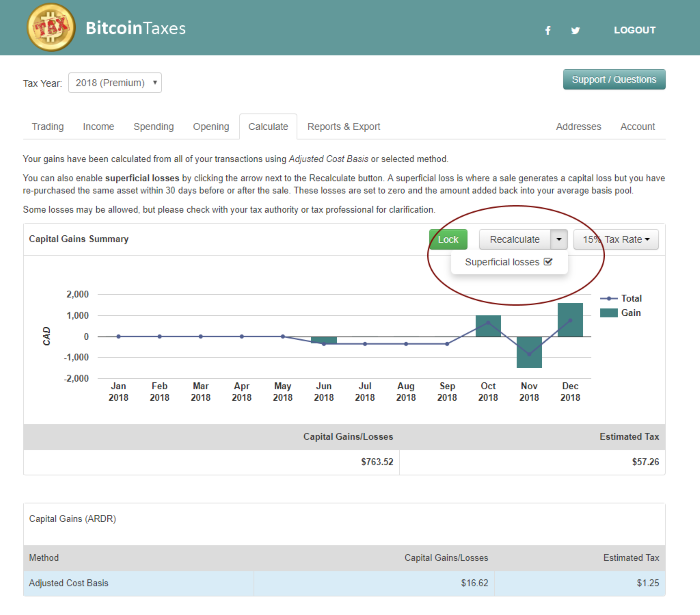

Enabling Superficial Losses

Superficial losses, where you cannot claim a capital loss under certain circumstances, can be enabled in Bitcoin.Tax using the option under the Recalculate button on the Calculate tab.

This will check for any purchases (or crypto-crypto trades) where an acquisition of the same crypto is made within the 61 day period, 30 days before or after the disposition. In that case, the capital loss is disallowed and reported as zero and the loss amount is added back onto the adjusted cost basis.

Your capital gains results can be downloaded as a plain CSV or TXF for importing into TurboTax. See our guide for importing into TurboTax.

Bitcoin.Tax is free to try for up to 20 transactions. We offer tiered plans based on the number of transactions per tax year, starting at USD 29.95 up to 1,000 transactions and increasing up to 1 million transactions.

Sign up with Bitcoin.Tax to Calculate your Crypto Taxes

This post is for informational purposes only and not intended as tax or financial advice. Please speak with your own tax professional on how you should treat the taxation of your own cryptocurrencies given your own circumstances.